Key Points

- Goldman Sachs’ latest reports show holdings of $710 million across various BTC ETFs.

- The bank’s largest exposure is in BlackRock’s IBIT, at 12.7 million shares worth $461 million.

Goldman Sachs’ latest filings with the US SEC reveal a significant expansion of the bank’s Bitcoin ETF holdings, with the most significant exposure being in BlackRock’s Bitcoin ETF, IBIT.

Goldman Sachs Holds $710 million in Various BTC ETFs

The Wall Street giant’s 13F filing for the 3rd quarter of 2024 with the US SEC revealed that the bank holds around $710 million in Bitcoin ETFs. 13F filings are quarterly reports the SEC asks for from institutional investment managers that have over $100 million in assets under management.

Goldman Sachs’ Top Holdings are in BlackRock’s IBIT

According to the official notes, the bank’s largest holdings are in BlackRock’s Bitcoin ETF, IBIT. Goldman Sachs reportedly holds 12.7 million shares in the fund, worth around $461 million at the time when the 13F filing was created.

Back in August, the Wall Street bank’s filing showed 6.9 million shares in IBIT, valued at $281 million at the time, which means that since then, the bank’s holdings in BlackRock’s product have increased by 83%.

The bank is now the second largest holder of IBIT, the first spot being taken by hedge fund Millenium Management, which has holdings worth $844 million in the crypto product.

The Bank Boosted Positions in Other BTC ETFs

Goldman Sachs also holds shares in the following BTC ETFs:

- Over 1.7 million shares in Fidellity’s FBTC, worth $95.5 million, marking a 13% rise since August

- Over 1.4 million shares in Grayscale’s GBTC, worth $71.8 million, marking a 116% surge since August

- Almost 651,000 shares in Bitwise’s BITB, worth over $22 million, marking a 156% surge since August

The bank also has shares in BTC ETFs from Invesco Galaxy, WisdomTree, 21 Shares, and ARK.

Goldman Sachs’ expanding exposure to Bitcoin via ETFs is an important sign of increased institutional interest in the crypto products.

Institutional Interest in BTC ETFs on the Rise

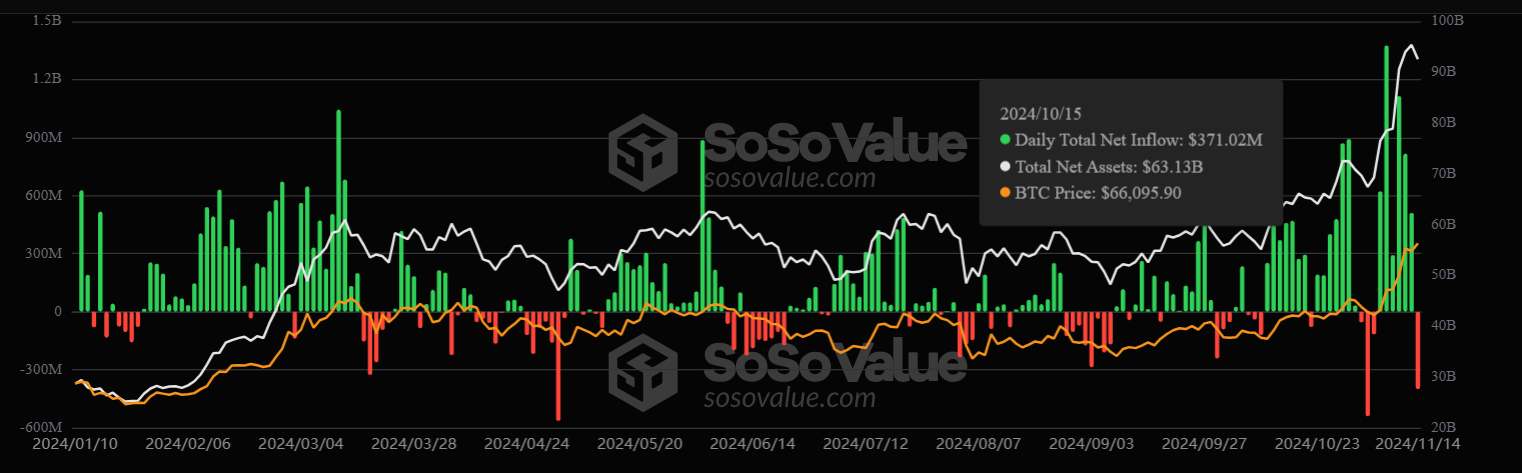

The recent disclosure of Goldman Sachs’s holdings in various BTC ETFs comes amidst a surging interest in the US-based crypto products which were launched back in January 2024.

Since then, BTC ETFs surpassed $92.5 billion in total locked assets as of November 14. Also, they are nearing $28 billion in total flows since launch, managing to surpass the essential $20 billion mark much faster compared to gold.

Lately, the crypto products recorded impressive flows with the most significant ones being on November 7, at almost $1,4 billion, and on November 11, at $1.11 billion, SoSoValue data shows.

The recent consistent inflows in BTC ETFs came following the US election results amidst a bullish crypto market that saw Bitcoin hitting one ATH after another.

BTC hit its historical high above $93,000 on November 13, fueled by market optimism at the prospect of a future Strategic Bitcoin Reserve in the US, and following CPI October data.

The most optimistic predictions foresee Bitcoin hitting $100,000 shortly, even before the January presidential inauguration of Trump.