Pennsylvania lawmakers have proposed the Strategic Bitcoin Reserve Act, a bill that would allow the state treasurer to invest in Bitcoin, digital assets, and crypto-based exchange-traded products.

Sponsored by Republican Representatives Mike Cabell and Aaron Kaufer, the bill aims to use Bitcoin as a hedge against inflation, offering a tool to protect state finances from economic uncertainty.

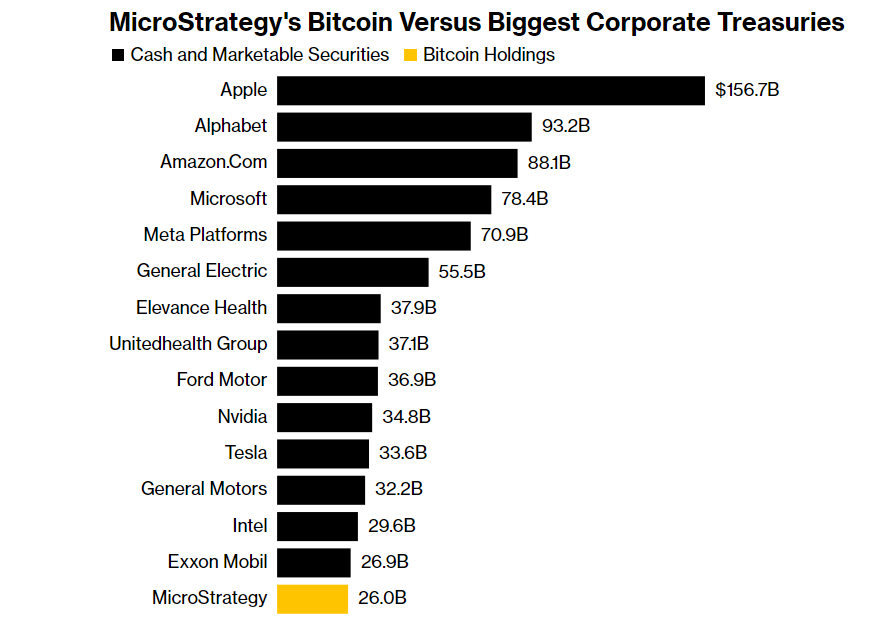

Rep. Cabell emphasized that institutions and governments, including the U.S., have already adopted Bitcoin to strengthen their portfolios. With major investment firms like BlackRock and Fidelity providing Bitcoin options, and states like Wisconsin beginning digital asset investments, Pennsylvania’s proposal seeks to create a more diversified and resilient portfolio.

The bill mirrors federal efforts like the BITCOIN Act, introduced by Sen. Cynthia Lummis of Wyoming, which advocates for U.S. states and federal agencies to invest in Bitcoin.

Senator Lummis, a vocal Bitcoin proponent, believes her bill could pass under the incoming Trump administration, aligning with its pro-crypto stance. She has called for public support, arguing the legislation could bolster America’s financial stability.

Pennsylvania’s Strategic Bitcoin Reserve Act reflects a growing trend of government interest in cryptocurrencies, positioning the state to join others leveraging digital assets as a safeguard against economic volatility.