Tether has announced plans to invest an undisclosed amount in Quantoz, a Dutch fintech company, to assist with the introduction of two new stablecoins — EURQ and USDQ, according to a Nov. 18 statement.

Quantoz, which operates under a license from the Dutch Central Bank (DNB), plans to issue these stablecoins using Tether’s new Hadron tokenization platform. These tokens are designed to comply with the EU’s Markets in Crypto-Assets Regulation (MiCA), ensuring alignment with stringent regulatory standards.

EURQ and USDQ will be backed by fiat reserves and classified as e-money tokens under DNB rules. Their primary goal is to provide a secure and regulated digital payment solution across the European Economic Area (EEA). Leading crypto exchanges Kraken and Bitfinex are set to list these stablecoins on Nov. 21.

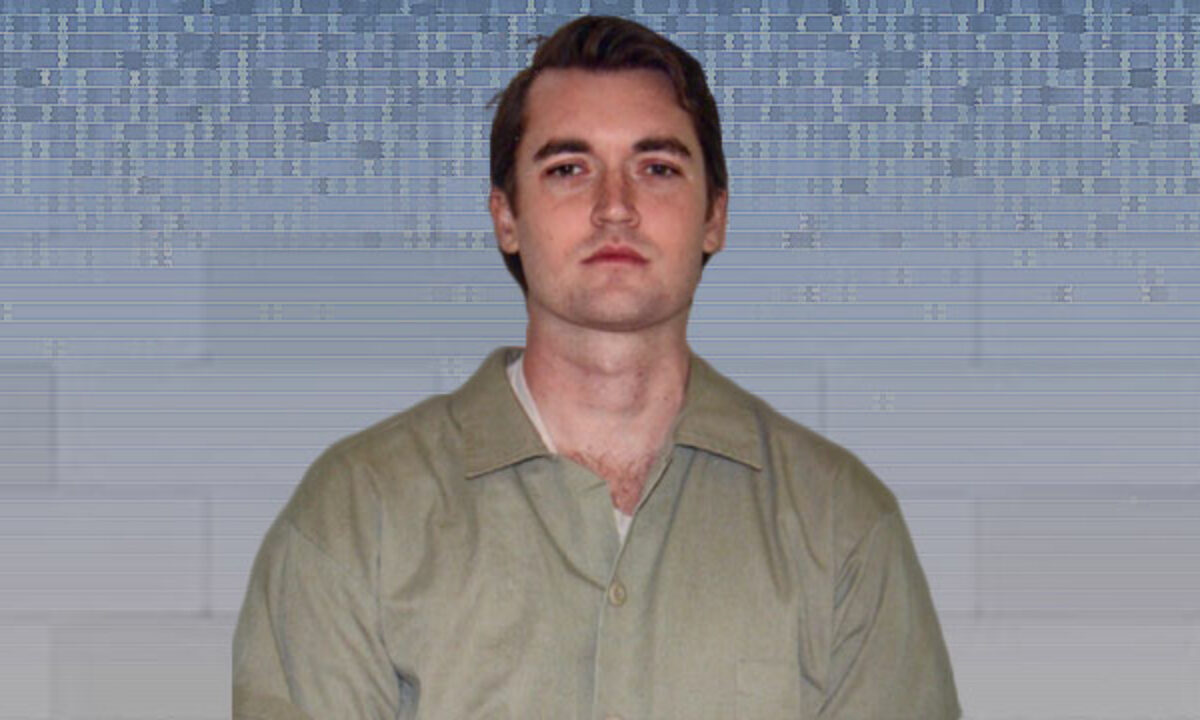

Tether’s involvement highlights its strategic focus on advancing regulated financial solutions in Europe. Paolo Ardoino, the stablecoin issuer CEO, stated:

“By supporting Quantoz and bringing technology solutions like Hadron by Tether, we reinforce our dedication to expanding reliable, compliant financial tools that empower users and build trust across the digital ecosystem.”

Hadron is designed to provide advanced capabilities for token issuance, compliance, risk management, and ecosystem monitoring across blockchain networks and centralized exchanges.

Response to competitive pressure?

Tether’s move comes as it faces regulatory challenges with USDT in Europe. USDT is the largest stablecoin by market cap and has faced delisting threats in Europe due to its non-compliance with MiCA

MiCA’s strict reserve requirements have created significant hurdles, which Ardoino claims could present systemic risks to banks and digital assets.

So, Tether’s investment in Quantoz could be a calculated effort to adapt to this regulation. The step positions the company to compete in a market primarily dominated by Circle’s EURC and Sociéte Générale’s EURCV, which collectively account for over 60% of the euro-backed stablecoin sector.

Tether did not respond to CryptoSlate’s request for additional comment as of press time.