- Polygon (POL) has recorded a significant surge in whale activities as the collective holdings of large investors increased to 852.14 million.

- An analyst has predicted that POL could hit $0.89 in the near term if retail investors join to accumulate.

Polygon’s (POL) surge by 18% on the monthly price chart has been met with aggressive accumulation by whales, forcing investors to take a cautious stand in the market. According to data, large investors (those with between 10 million and 100 million POL in their wallets) collectively accumulated about 695.38 million tokens as of November 11. Fascinatingly, an additional 113 million tokens ($65 million) were accumulated in the past seven days, taking the total amount to 852.14 million in the week ending November 18.

Explaining this situation, our analysts highlighted that an increase in whale accumulation encourages retail investors to create a “buying position”, signaling a bullish outlook. However, a massive liquidation by whales disrupts the momentum of the asset and forces a nosedive.

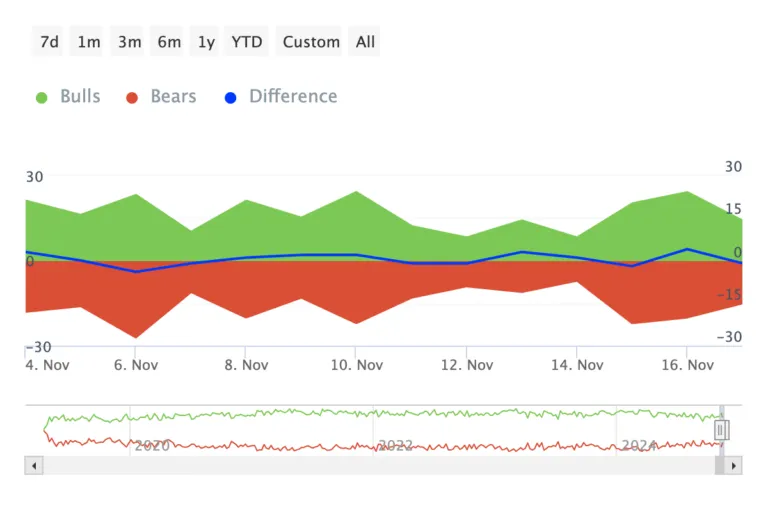

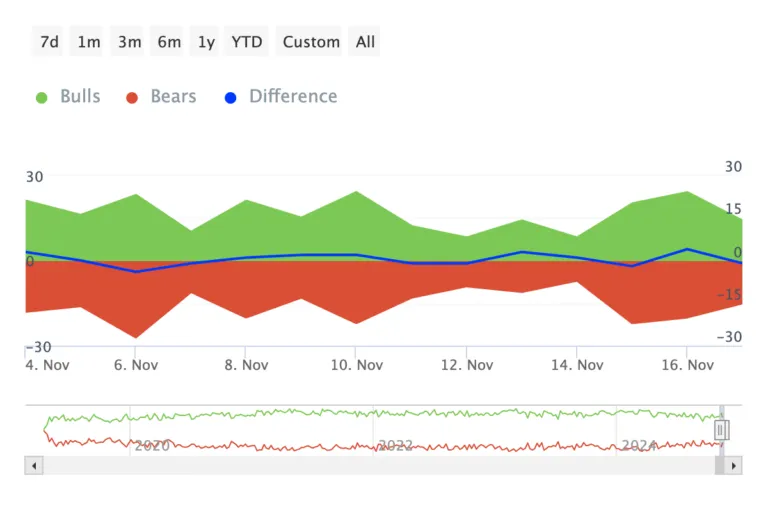

One notable observation is that the increase in whale activities coincides with IntoTheBlock’s Bulls and Bears indicator, which tracks the activities of investors who purchase at least 1% of the total trading volume as well as those who sell at a similar margin.

Polygon (POL) Price Analysis

Looking at a 4-hour price chart, we discovered the formation of an inverse head-and-shoulders pattern. Technically, this pattern indicates a bullish reversal.

According to the chart below, the deepest trough is narrower than the troughs at the left and right shoulders. Meanwhile, the third and the last troughs look similar to the “shoulder in-depth “but higher than the head. This implies that the asset could embark on a bullish run to $0.69 after breaching a short-term target of $0.45.

For crypto analyst Ali Martinez, POL has the potential to hit $0.89 in a 167% run. Analyzing his thesis, we discovered that Martinez used the Polygon logarithmic chart where he identified a long-term resistance level that has been strongly opposing a bullish run. According to our research, this price point has been in position since the asset declined from the $2.92 level in December 2021.

Meanwhile, the asset’s current behavior aligns with the 61.80% Fibonacci retracement level. Applying this analysis, we discovered that the nearest resistance level for the Polygon appears at 78.60%. A break out above this level could send Polygon to an unimaginable height.

At press time, POL was trading at $0.427 after surging by 9% in the last seven days. However, a sudden liquidation by whales could force a nosedive to $0.38.

Outside its market behavior, Polygon recently sealed a strategic partnership with leading financial technology firm Xalts to streamline blockchain adoption and enhance Real World Assets (RWA) tokenization. Commenting on this, the COO of Xalts, Supreet Kaur, disclosed that the collaboration will help to develop applications that fall in line with its requirements.

We are very excited to onboard Polygon. Deeper collaboration and integrations with blockchain partners enable regulated financial institutions to build their enterprise use cases seamlessly. We look forward to accelerating the adoption of RWA tokenization by enterprises.