Key Points

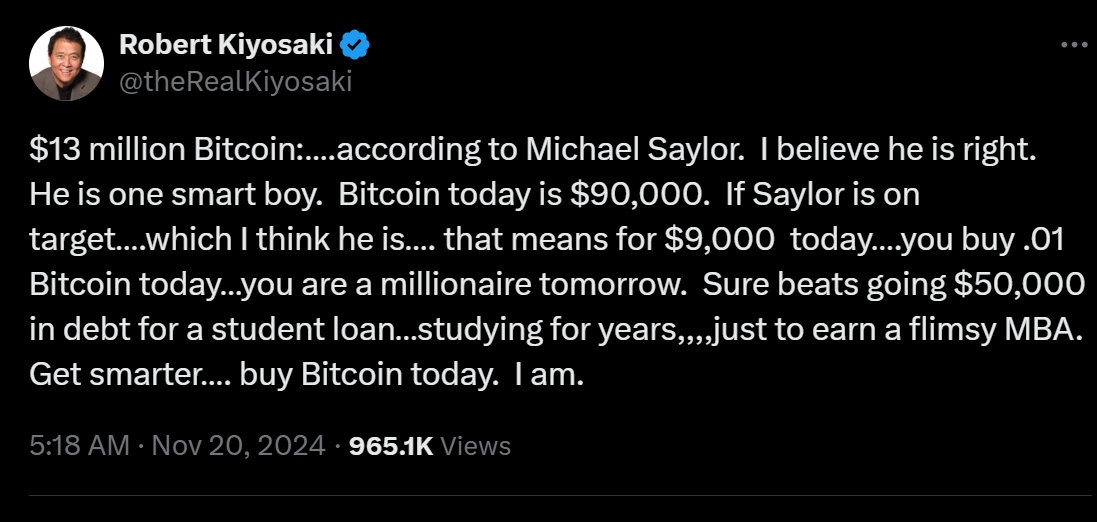

- IBIT’s day 1 of options trading was close to $1.9 billion in notional exposure traded via 354,000 contracts.

- Grayscale will roll out options trading for BTC ETFs, amidst significant investor appetite for the products.

Yesterday’s debut of Bitcoin ETF options was the latest boost for BTC, sending the digital asset to a new ATH above $93,900. Following BlackRock’s IBIT options’ success, today, Grayscale will launch options for its BTC ETFs.

IBIT Achieved Record-Breaking Activity on Day 1 of Options Trading

Bloomberg’s analyst, James Seyffart shared an announcement via X on November 14, highlighting the success of BlackRock’s IBIT options trading, following the launch of the crypto products.

The final tally of IBIT’s first day of options was close to $1.9 billion in notional exposure traded via 354,000 contracts.

He noted that 289,000 were Calls and 65,000 were Puts, and this translates into a ratio of 4,4:1.

Following IBIT’s huge success which mirrors increased interest from investors, today, Grayscale will launch options trading for its BTC ETFs.

Grayscale to Roll Out Options Trading on BTC ETFs

Today, November 20, Grayscale will launch options trading on GBTC (Grayscale Bitcoin Trust) and BTC (Bitcoin Mini Trust) to further develop the ecosystem around their US-listed Bitcoin ETPs, according to an announcement shared by the company via X.

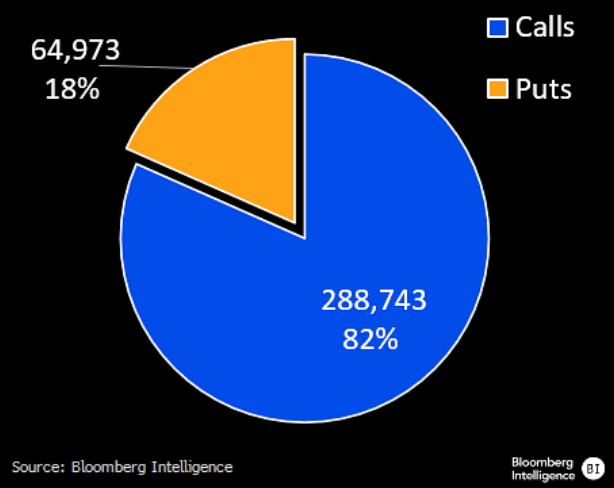

Following the Options Clearing Corporation’s (OCC) approval of Bitcoin ETF options, Grayscale filed an updated prospectus for its Bitcoin Covered Call ETF on January 11.

The tooling targets income generation by employing a call strategy which means writing and buying options contracts on Bitcoin ETPs while holding BTC or GBTC as collateral, as noted by Seyffart via X.

Amidst continued optimism in the crypto industry, the first day of Bitcoin ETF options trading and IBIT’s significant success pushed BTC to a new ATH.

Bitcoin Hit a New ATH at $93,900

Yesterday, BTC hit a new ATH at $93,000, after a significant surge from $91,000 levels. At the moment of writing this article, BTC is trading close to $93,000, up by 1.3% in the last 24 hours.

With a market cap of over $1.84 trillion, BTC is positioned in the 7th spot in the Top Assets by Market Cap list, below Amazon.

BTC ETFs also recorded two inflow days this week totaling over $1 billion, according to SoSoValue data.

The total net assets locked in the crypto products as of November 19 were over $98 billion, and the cumulative flows in the crypto products since their debut surpassed $28.5 billion.

Considering the favorable framework in the crypto industry due to the upcoming changes in Washington in 2025 and the prospect of a Strategic Bitcoin Reserve in more states in the US and other countries, Bitcoin is well-positioned to hit $100,000 even before Trump’s inauguration in January 2025.