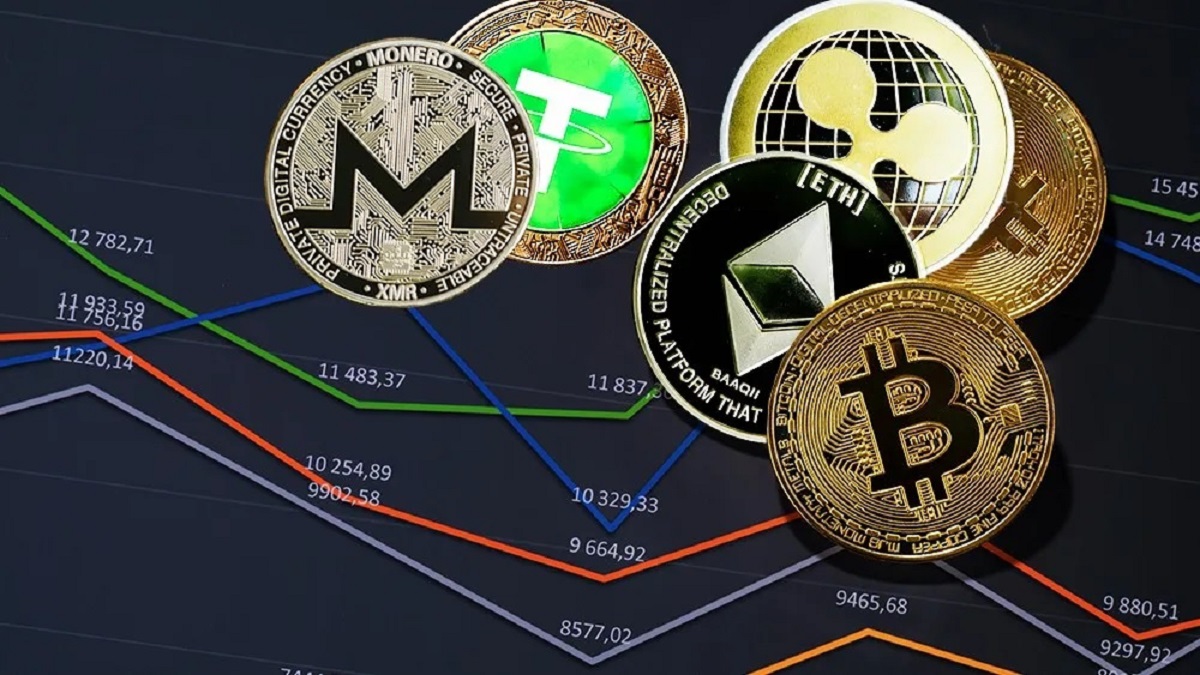

Bitcoin (BTC) has recently captured the market’s attention with significant price surges over the past month. According to renowned analyst Rekt Capital, BTC is in the early stages of a parabolic phase, which he believes could last for an extensive duration. Historical data analysis provides traders with vital insights as they navigate this market shift.

How Long Will Bitcoin’s Current Phase Last?

Rekt Capital highlighted that Bitcoin typically undergoes a parabolic phase that spans approximately 300 days within each cycle. Currently, Bitcoin’s price has reached $97,465, reflecting a remarkable 45% rise over the previous month. The analyst assured that we are just on the 16th day of this promising trend.

What’s Next for Ethereum?

Ethereum (ETH), the second-largest cryptocurrency, is also showing strong bullish signals. Rekt Capital reported that Ethereum has recently broken out of a short-term bull flag, with potential to hit the $3,700 resistance level. As of now, ETH is priced at $3,346, having increased by 28% in the last month.

Key takeaways from Rekt Capital’s analysis include:

- Bitcoin’s parabolic phase may sustain for around 300 days.

- Bitcoin’s current price is significantly up from previous months.

- Ethereum is showing bullish momentum, with a potential target of $3,700.

- Market fluctuations necessitate careful monitoring for traders.

The ongoing trends in Bitcoin and Ethereum underscore the critical role digital assets play in today’s investment landscape. As traders engage with these volatile markets, the importance of data analysis becomes paramount for crafting effective long-term strategies.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.