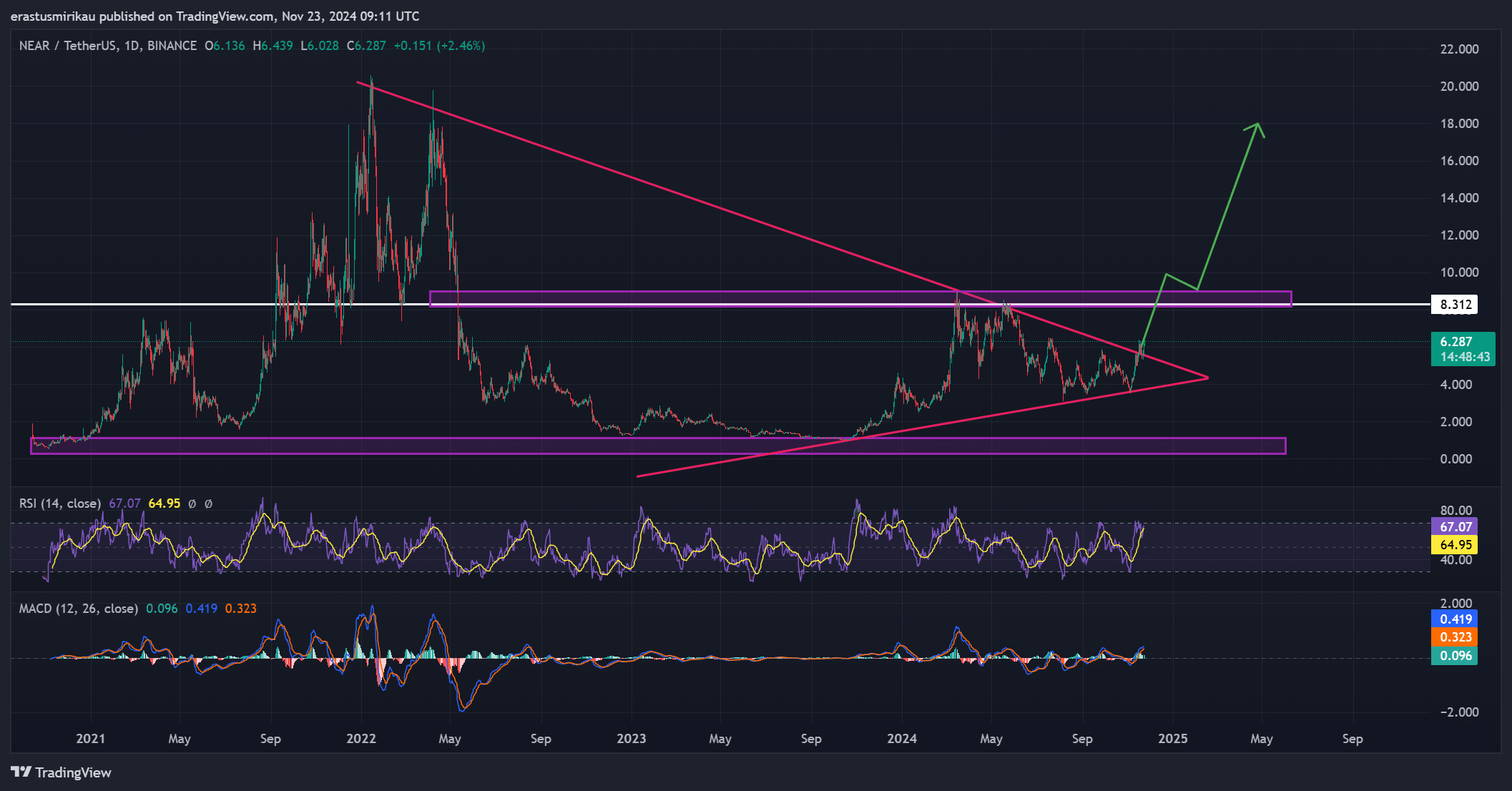

- The breakout from a symmetrical triangle and bullish RSI/MACD signaled sustained upward momentum.

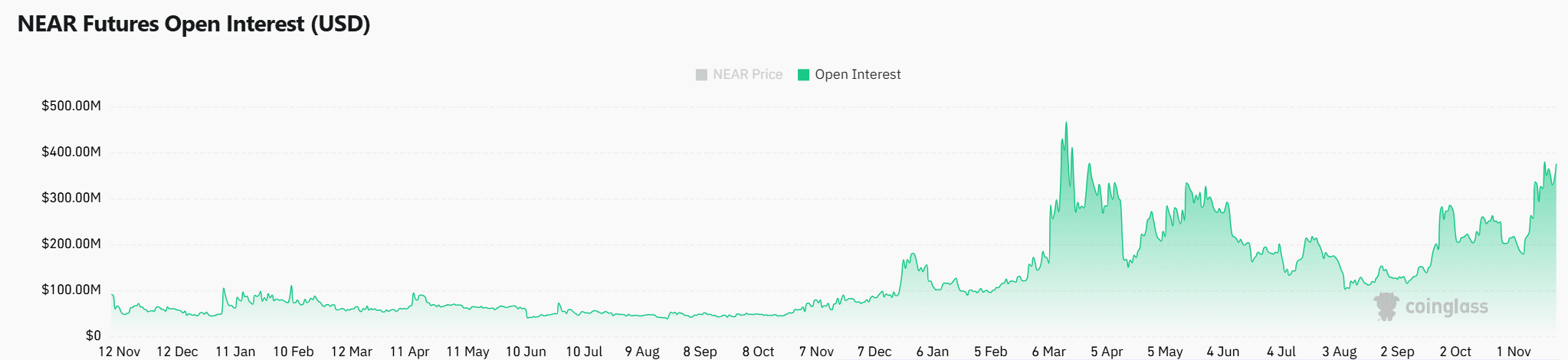

- Open Interest surged 19.02%, while steady development activity reinforced long-term ecosystem growth.

NEAR Protocol [NEAR] has surged to a new milestone, hitting $244M in Total Value Locked (TVL) for the first time since July.

This achievement comes alongside a significant price jump of 10.82%, with NEAR trading at $6.35, at press time.

These metrics underscored growing confidence in NEAR’s ecosystem, but is this rally sustainable, or will it fizzle out?

NEAR’s breakout signals renewed momentum

The daily chart revealed an exciting breakout from a symmetrical triangle, a pattern often associated with strong directional moves.

This breakout has paved the way for a potential rally toward $8.31, a critical resistance zone.

Notably, the $4.00 level remains a strong support, ensuring a safety net for the bulls.

The technical indicators aligned with this bullish outlook. The Relative Strength Index (RSI) stands near 65, indicating there’s still room for upward movement before reaching overbought conditions.

Simultaneously, the MACD has confirmed a bullish crossover, with the histogram reinforcing a growing positive trend. Consequently, the breakout appears to have both technical and market momentum behind it.

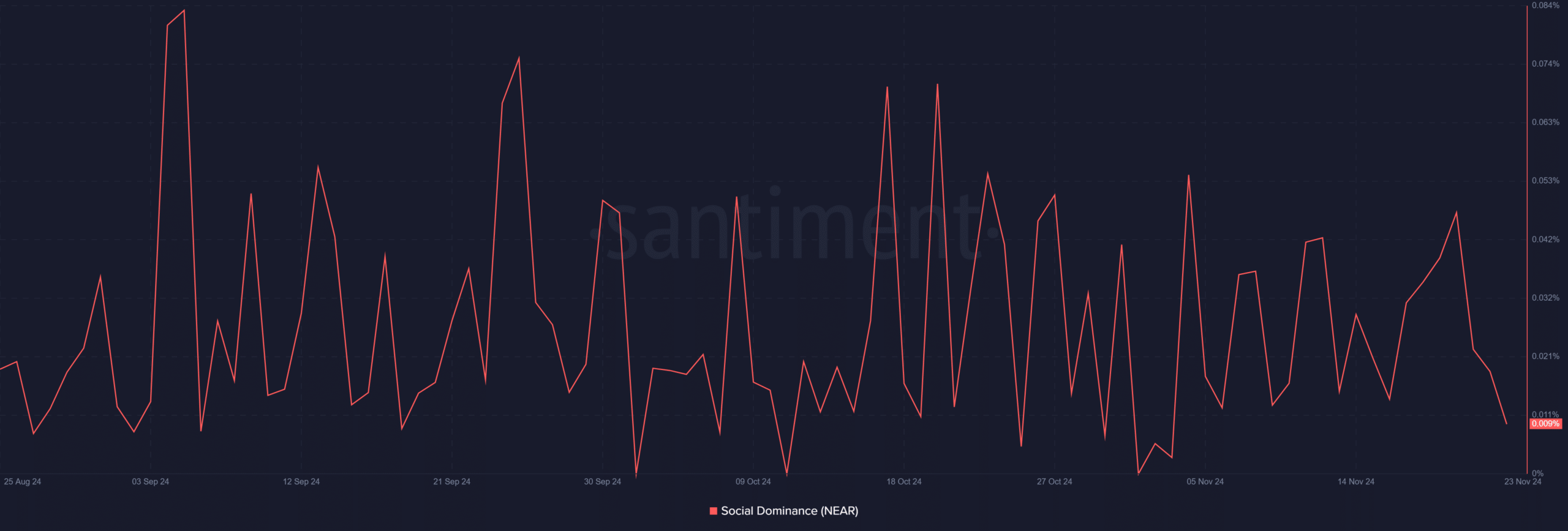

Why social dominance hasn’t caught up?

Despite the price surge, its social dominance has surprisingly dropped, sitting at 0.0089%. This decline indicated that while whales and institutions may be fueling the rally, retail traders remained cautious.

However, this reduced chatter could work in NEAR’s favor if it signals the untapped potential for greater retail participation. Increased adoption and higher social activity would likely amplify this rally further.

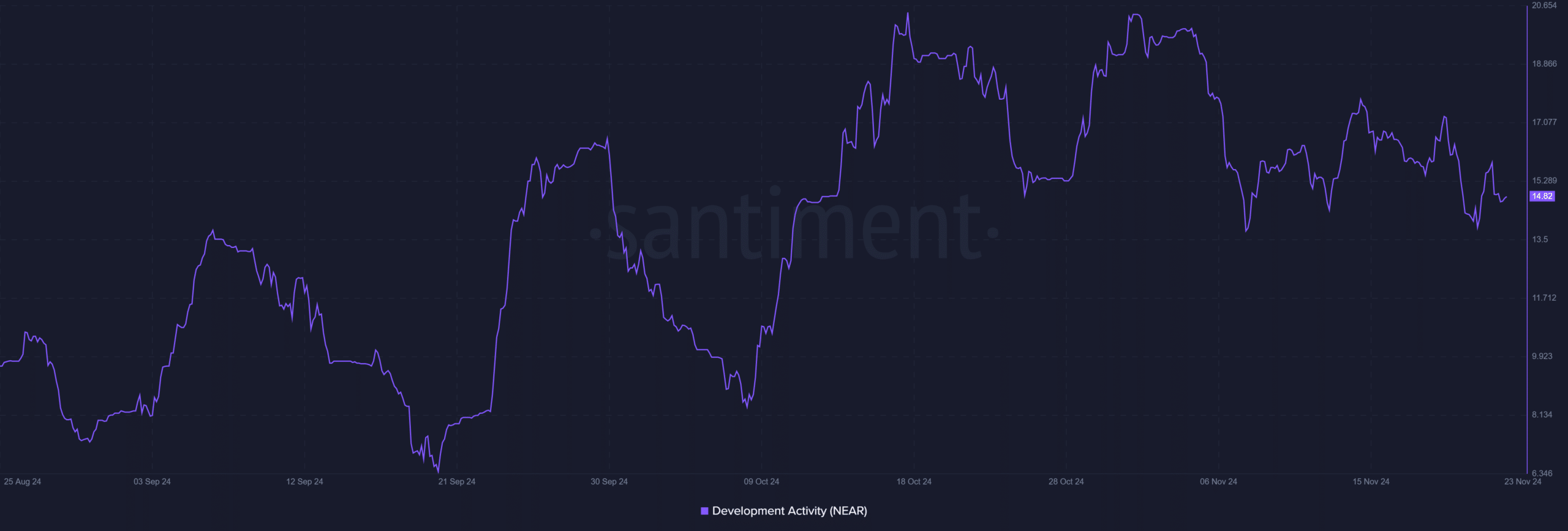

Development activity provides a solid foundation

Another crucial factor is the development activity, which currently stands at a moderate 14.82. While not exceptionally high, this level reflects steady progress within the ecosystem.

Historically, ecosystems with consistent development tend to attract long-term investors. Therefore, the ongoing activity reinforces the token’s long-term credibility, even if it doesn’t currently drive short-term price spikes.

Market sentiment spikes

In contrast to social metrics, the Open Interest(OI) has surged by 19.02%, reaching $404.88M. This sharp increase indicates heightened interest from institutional players and leveraged traders.

Such an uptick often signals optimism for continued price growth. Consequently, NEAR’s market sentiment appears to be shifting in favor of bullish momentum.

Read Near Protocol’s [NEAR] Price Prediction 2024–2025

Is NEAR poised for a bigger move?

NEAR Protocol’s $244M TVL milestone, combined with its technical breakout and growing OI, positions it for further growth. However, subdued social dominance suggests there’s room for greater retail participation.

If NEAR sustains this momentum and breaches the $8.31 resistance, it could trigger a broader bullish rally in the ecosystem. Therefore, all signs point to NEAR being ready for its next big move.