Key Points

- Over 98% of Bitcoin addresses were in profit due to the cryptocurrency’s bullish price trend.

- Despite high accumulation, indicators suggested that Bitcoin was becoming overvalued.

Bitcoin [BTC] saw a significant price increase last week, meeting investors’ expectations. The cryptocurrency began to consolidate in recent days, however, as it neared the $100k mark.

A key BTC metric has turned bearish, suggesting a potential pullback.

Bitcoin Investors Showing Signs of Greed

Bitcoin’s price rose by 8% last week, flipping its $96k resistance into a new support and indicating a potential rise above $100k. This price increase resulted in 53.24 million BTC addresses profiting, which represents 98% of all Bitcoin addresses.

Despite this, the cryptocurrency began to consolidate as its daily chart turned red. Crypto analyst Ali Martrinez noted in a tweet that long-term BTC holders were showing signs of increasing greed. This behavior historically suggests that it could take 8-11 months for BTC to reach a market top.

Assessing Bitcoin’s Metrics

To determine whether the increasing greed in the market will lead to a correction, Glassnode’s data was analyzed. After a sharp decline, Bitcoin’s NVT ratio began to rise again, indicating that BTC was becoming overvalued and a price drop may be imminent.

Despite this, the market remained optimistic about BTC, as evidenced by the coin’s high accumulation trend score. A value closer to 1 indicates high buying pressure, which can result in continued price increases.

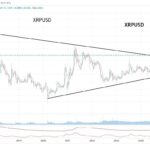

Bitcoin’s Open Interest (OI) also remained high, suggesting that the current price trend may continue. However, the daily chart showed that the coin was testing a trendline resistance. The MACD indicated a potential bearish crossover, and the Relative Strength Index (RSI) was in the overbought zone, which could trigger a sell-off and prevent BTC from breaking above the resistance in the near term.