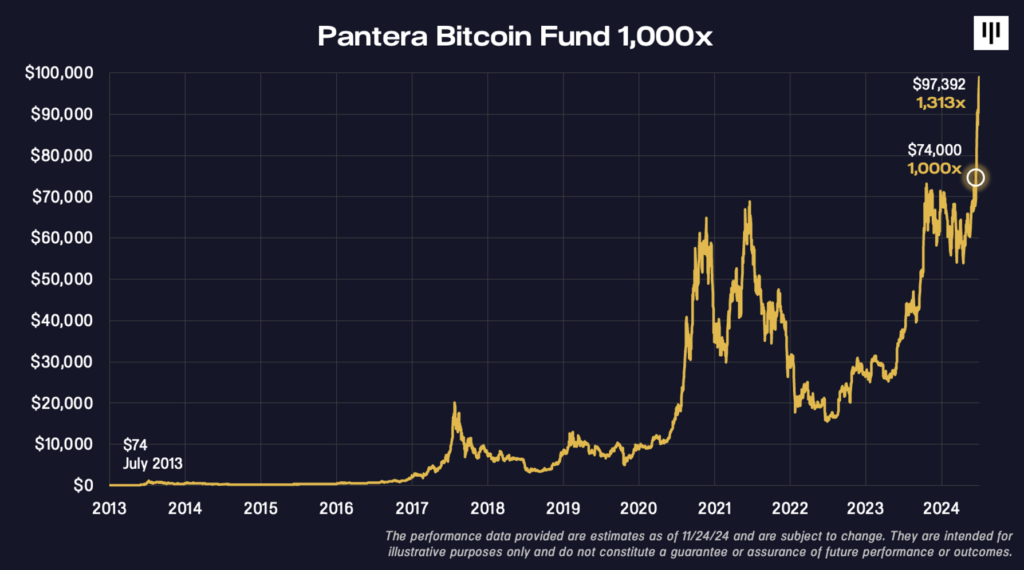

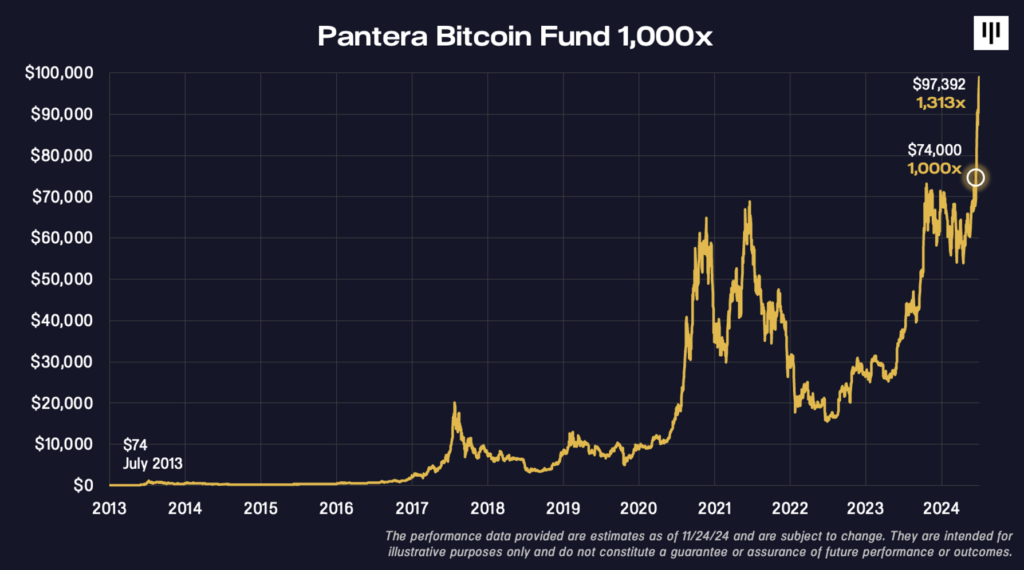

- Pantera Bitcoin Fund achieved 1,000x lifetime returns, showcasing the impact of early strategic investments in crypto.

- Pantera predicts Bitcoin’s growth driven by adoption and its potential as a borderless payment system.

Pantera Capital announced a spectacular feat for their Bitcoin Fund, which has achieved a lifetime return of 1,000x, or an astounding 131,165% net of fees and expenses.

Originally started in 2013, the fund was an early mover in the crypto market, purchasing 2% of the world’s supply between 2013 and 2015. Given Bitcoin’s explosive rise over the past ten years, this audacious approach has paid off magnificently.

Pantera Vision for Bitcoin’s Global Role

Looking ahead, Dan Morehead, Pantera’s CEO, has made ambitious forecasts. By April 2028, he expects Bitcoin’s price to be $740,000, therefore driving its market cap to around $15 trillion.

Morehead has underlined how Bitcoin might become the first really borderless and decentralized cross-border payment system, therefore confirming its importance as a fundamental part of the global financial system.

Pantera’s past goes beyond Bitcoin. The company has deliberately made investments in a wide blockchain and crypto initiatives, including early stakes in startups like Alchemy and Coinbase.

From decentralized finance to blockchain infrastructure, this broad approach has helped the company to seize value from several angles of the changing crypto space.

Though there is hope, Pantera’s high estimates should be taken under close inspection. The market for cryptocurrencies is still quite erratic, and investors have to take the natural risks of such investments into account.

Although Bitcoin has shown promise and resilience, macroeconomic events, legislative changes, and technological breakthroughs can cause rapid changes in market dynamics. The success of Pantera emphasizes the need for wise decision-making, even though it is evidence of the possible benefits of early and strategic investments.

On the other hand, CNF previously reported that the Solana blockchain’s overall architecture was commended in Pantera Capital research.

The paper distinguished Solana from rivals like Ethereum by stressing its capacity to maximize innovation, security, and user experience. Solana’s coherent architecture avoids the difficulties of linking several chains by simplifying development and user interactions.