Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

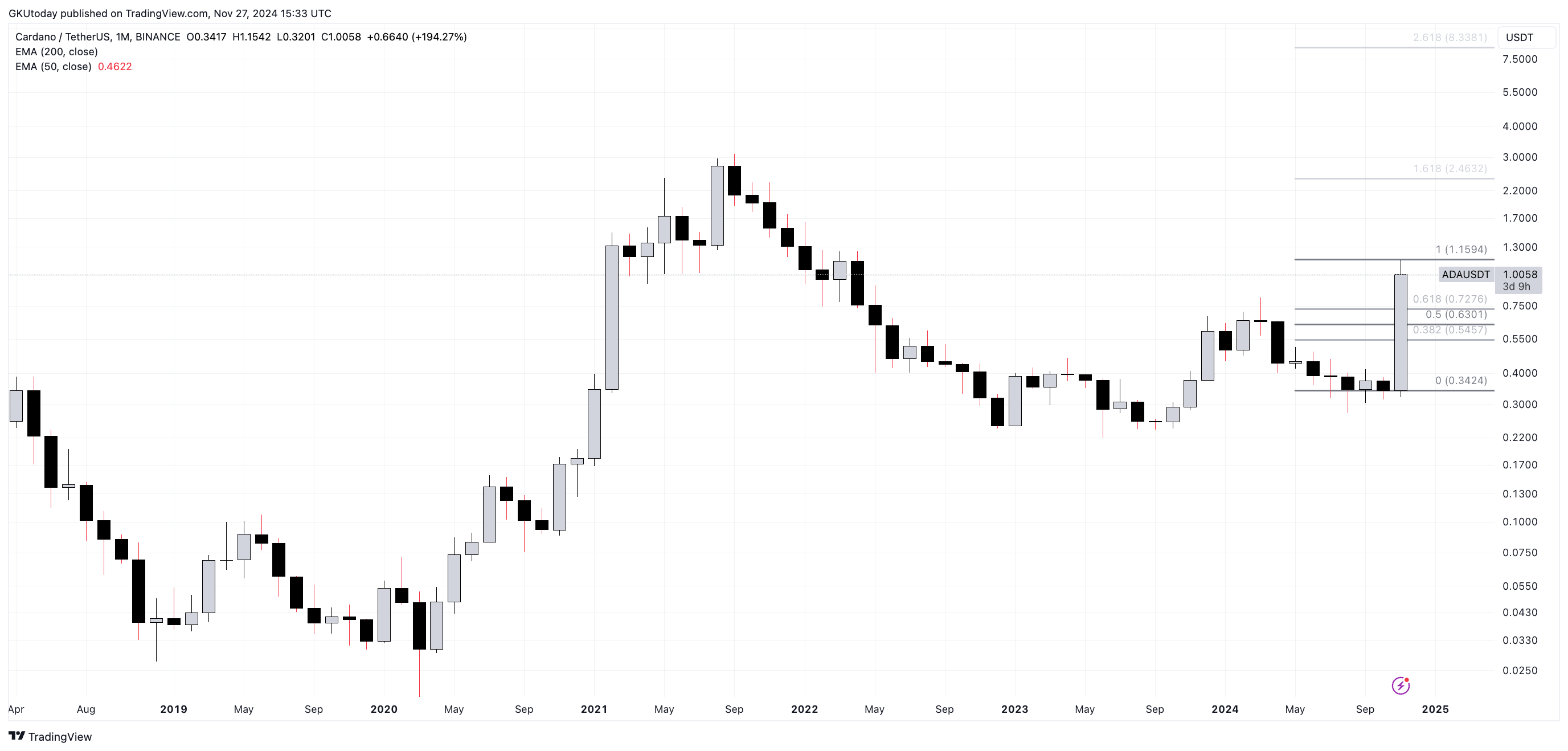

During today’s trading session on the crypto market, the price of the popular cryptocurrency, Cardano (ADA), has regained the important psychological mark of $1. In total, since the beginning of this month, the price of ADA has grown by 193%, and at its peak it tripled in value compared to what we could see in early November. The Cardano token is quite popular; it is on the ninth line on the list of the largest cryptocurrencies by capitalization, and its daily trading volume, according to CoinMarketCap, is currently more than $2.5 billion.

This leaves many crypto market participants wondering what to expect next for ADA.

Despite the fact that the crypto market does not love predictions, some indicators can help to at least give an idea of the direction of the instrument’s price movement. One of these is the Fibonacci sequence.

While the crypto market is notoriously unpredictable, certain indicators, such as the Fibonacci sequence, can provide insight into potential price movements.

Using the Fibonacci indicator, analysts suggest that if Cardano maintains its bullish momentum, the next major target could be $2.453, which corresponds to the 1.618 Fibonacci level. If this level is breached, the 2.618 Fibonacci level at $8.30 will be the next key target. These levels are considered important because they often coincide with areas where the most buying or selling activity is taking place, making them defiant in shaping price movements.

It is all just speculation for now, but it looks like Cardano is seeing some renewed interest and optimism, with $1 reclaimed. If conditions stay favorable, there could be further gains on the horizon.