The recent upside momentum in Ethereum (ETH) has gained significant attention from crypto enthusiasts. Amid this rally, today, November 28, 2024, Ethereum co-founder Jeffrey Wilcke was found dumping a significant amount of ETH on a cryptocurrency exchange.

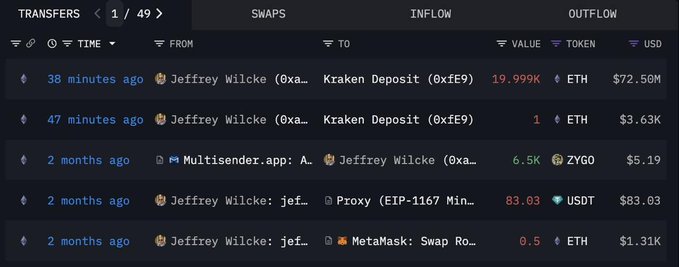

Ethereum Co-Founder Dumps $72.5 Million of ETH

According to blockchain intelligence firm Arkham, Wilcke dumped 20,000 ETH worth $72.50 million to Kraken. This significant transaction was spotted just before the opening bell of the US market. Despite this substantial sell-off, the co-founder still holds a massive 106,000 ETH worth $384 million, as reported by Arkham.

Whales and Traders’ Recent Activity

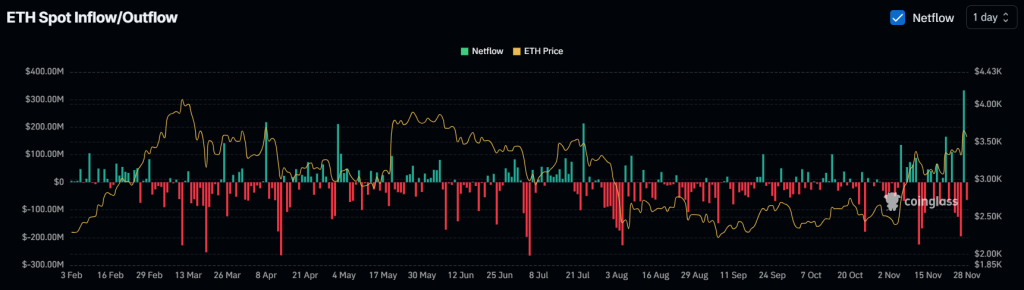

Additionally, on November 27, 2024, whales and investors deposited $333.04 million worth of ETH, according to Coinglass’s ETH spot inflow/outflow metrics. This significant positive net flow suggests that whales transferred ETH from wallets to cryptocurrency exchanges, a move that often creates selling pressure and leads to a price decline.

In addition to long-term holders, traders appear optimistic and have shown strong interest and confidence in the altcoin. Coinglass’s ETH futures open interest has soared by 7.9% over the past 24 hours, indicating that traders have been increasing their positions or new traders are entering the market.

The combination of on-chain metrics suggests mixed sentiment among traders. Long-term holders appear to be dumping, while short-term traders are actively participating with the token.

Ethereum (ETH) Technical Analysis and Upcoming Levels

According to expert technical analysis, ETH appears to be retesting the breakout level at the $3,550 mark after closing a daily candle above $3,685. However, the altcoin remains bullish, and its daily chart does not indicate any bearish signs.

With a bullish outlook, there is a strong possibility that ETH’s price could soar by 15% to reach the $4,100 mark in the coming days. On a positive note, Ether’s Relative Strength Index (RSI) suggests that the altcoin still has room for growth. Currently, ETH’s RSI stands at 65, below the overbought point.

ETH’s bullish thesis will remain valid only as long as it trades above the $3,300 level, otherwise, it may fail.

Current Price Momentum

At press time, ETH is trading near $3,570 and has registered a price gain of over 1.85% in the past 24 hours. During the same period, its trading volume surged by 9.5%, indicating increased participation from traders and investors amid a bullish outlook.