- Bitcoin surges post-Trump’s election, hitting $102K with potential to reach $150K.

- Trump administration plans crypto-friendly regulations and leadership in AI and emerging tech.

Since Donald Trump’s election as the 47th President of the United States, Bitcoin [BTC] has grown significantly, rising from $68,000 to over $102,000.

According to a recent report from Axios, Trump has expressed support for cryptocurrency, envisioning a continued surge beyond $150,000.

With his focus on boosting market metrics, including cryptocurrencies, the broader digital asset market has been surging, reflecting renewed optimism and interest in the sector.

Following the recent surge in Bitcoin’s price, former President Trump has taken credit, jokingly claiming,

“You’re welcome.”

Trump’s pro-crypto moves post-election victory

Sources suggest that Trump’s administration is preparing to introduce crypto-friendly regulations. Paul Atkins, a well-known advocate for the cryptocurrency industry, is likely to lead the Securities and Exchange Commission.

The transition team is working on establishing a comprehensive legal framework for the crypto industry. This aims to provide the clarity the industry has been asking for.

Trump’s administration is also set to focus on advancing America’s technological leadership. This includes AI, cryptocurrency, and libertarian values, positioning the country ahead of China in the tech race.

David Sacks has been appointed as AI and “crypto czar” to solidify leadership in emerging technologies.

Elon Musk and Vivek Ramaswamy will co-lead the newly formed Department of Government Efficiency (D.O.G.E.). This department aims to modernize federal operations.

Analysts at JPMorgan attribute the historic growth in the crypto market to political developments and increased investor confidence. The market saw a 45% surge in total market capitalization, reaching $3.3 trillion.

What’s next for Bitcoin?

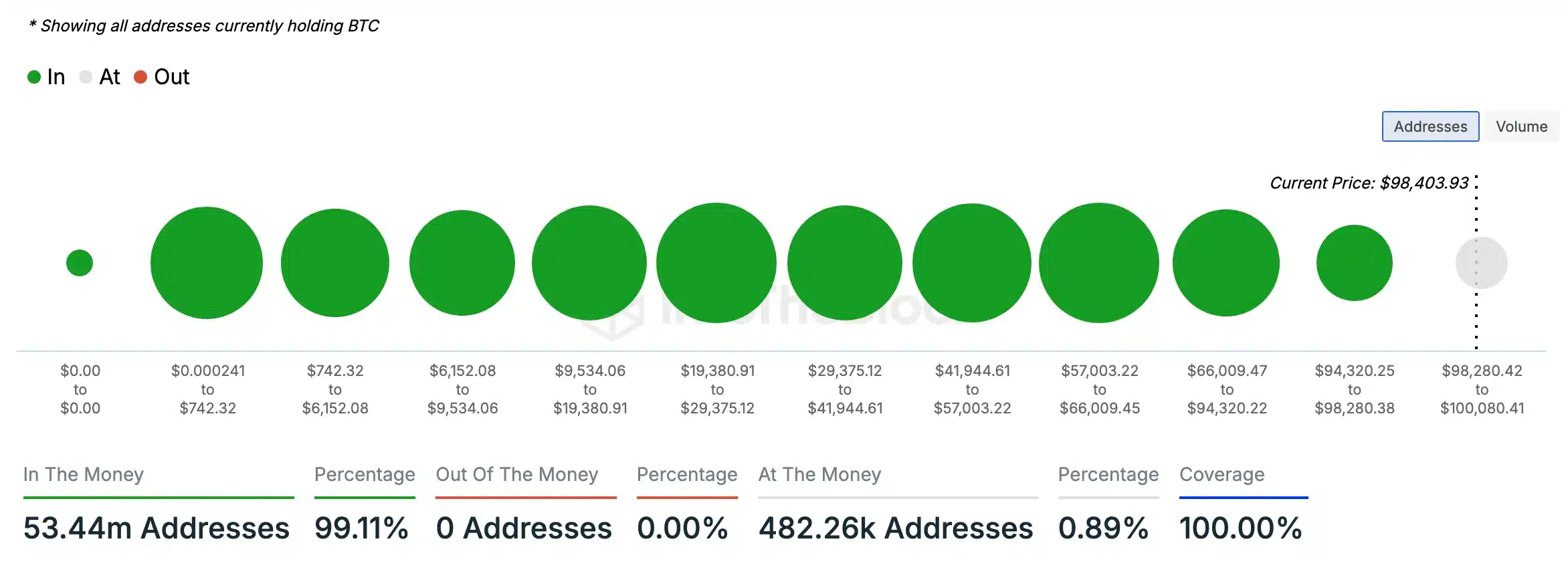

At press time, Bitcoin was trading at $98,334.63 after a 0.65% drop in the past 24 hours, according to CoinMarketCap.

The Relative Strength Index (RSI) and Chaikin Money Flow (CMF) indicators suggest that bulls are still outpacing bears.

Additionally, data from IntoTheBlock reveals that 99.11% of BTC holders are holding tokens valued higher than their purchase price. This signifies a bullish sentiment, with no holders “out of the money.”

This indicates a strong possibility of a forthcoming price surge for Bitcoin as the market continues to lean in favor of the bulls.