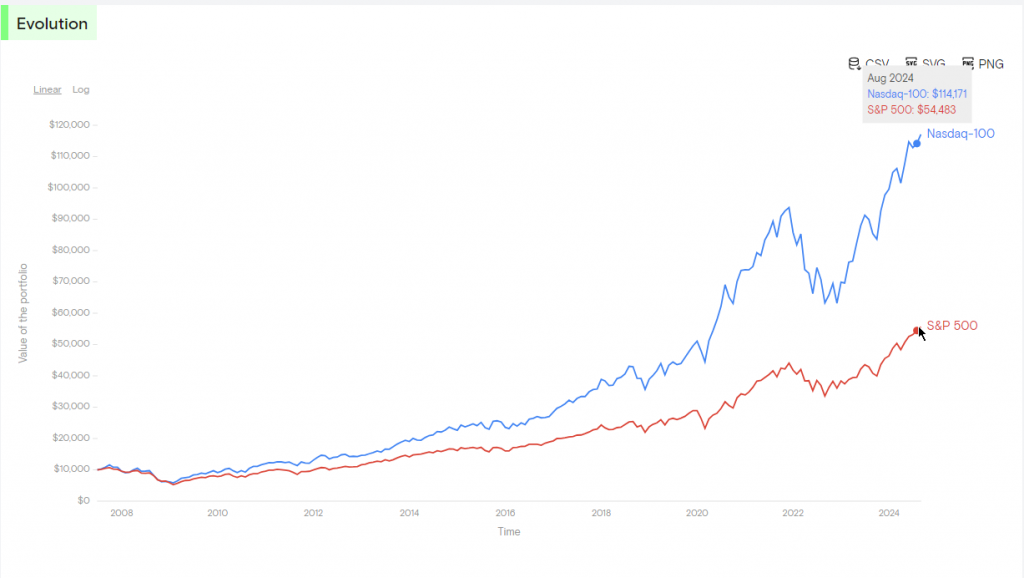

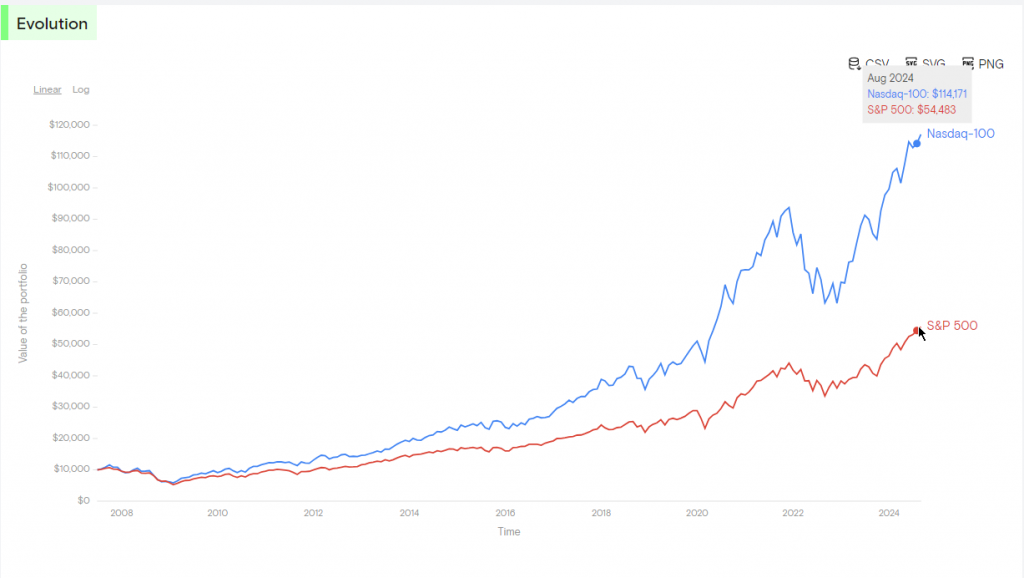

Markets saw a big push higher on Wednesday. The S&P 500 surge lifted the Nasdaq Composite past 20,000 points for the first time ever. Markets stayed calm after inflation numbers came in as expected. Crypto concerns remained present. The S&P 500 surge showed investors feel more confident about where markets are heading.

Also Read: Trump’s NATO Exit Plan: How It Could Accelerate De-Dollarization & Aid Russia

S&P 500 Surge Drives Nasdaq to 20,000 as Inflation Eases and Crypto Concerns Grow

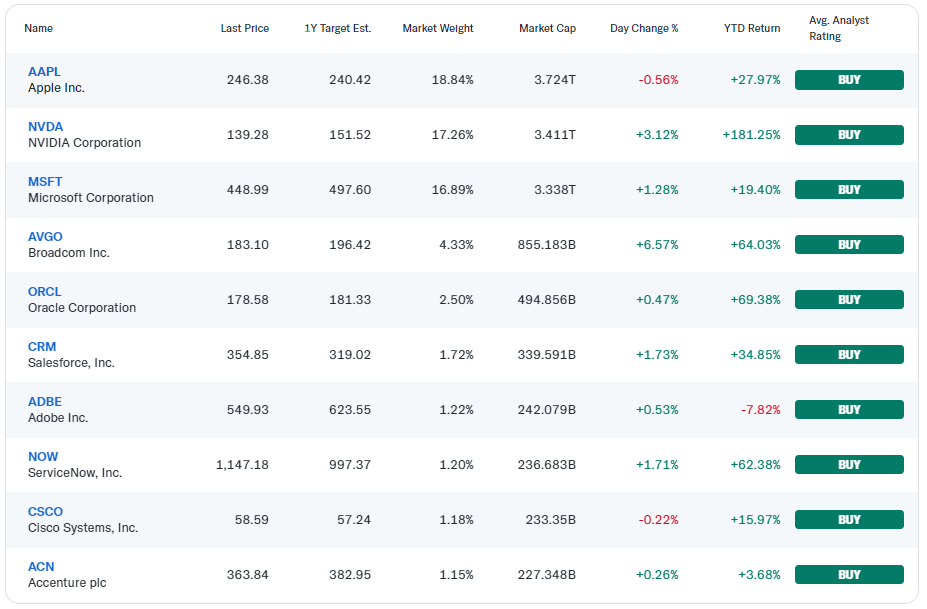

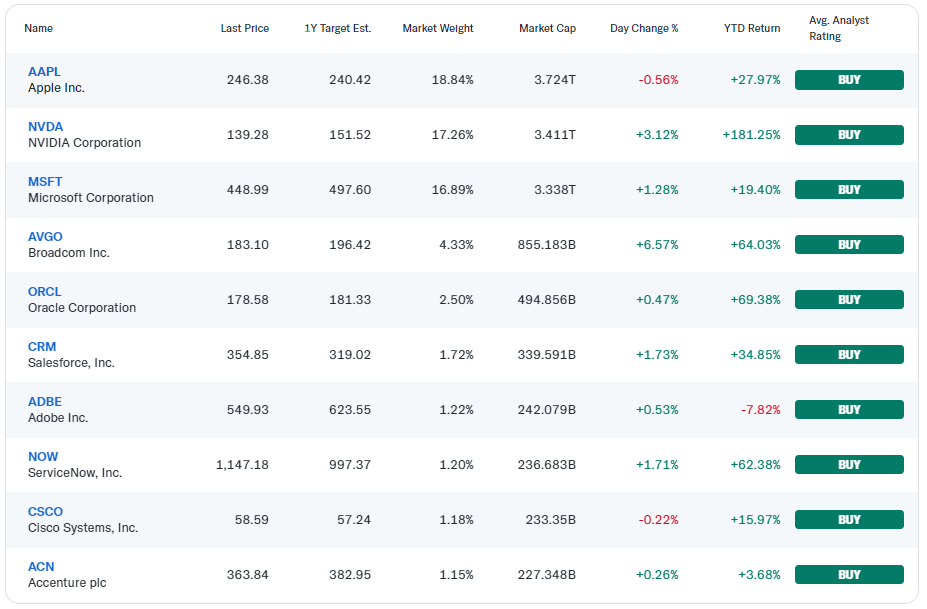

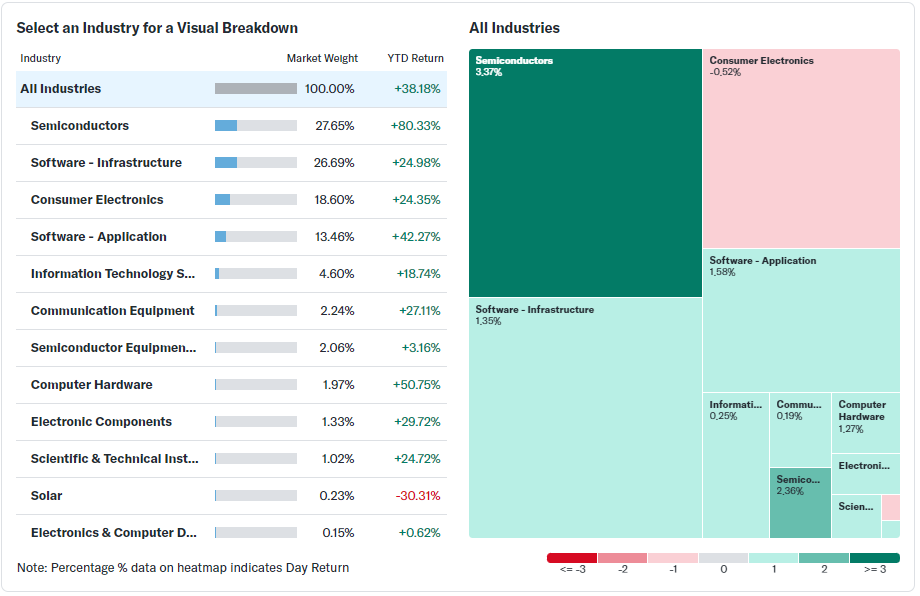

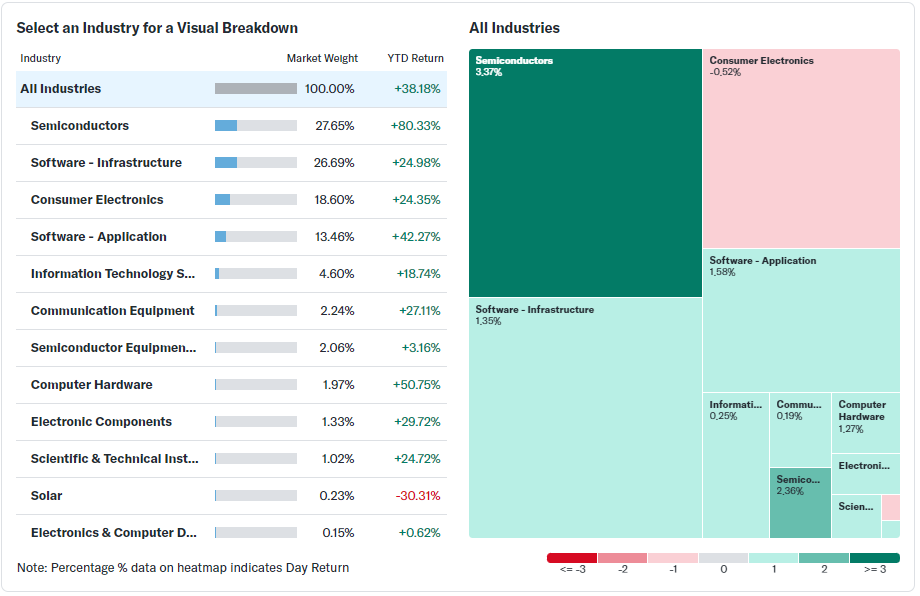

Tech Leaders Drive Market Rally

The S&P 500 surge pushed the index up by 49.28 points. It rose 0.82% to 6,084.19. Tech, communication, and consumer stocks led the gains. Tesla’s stock hit a new high, jumping 6%. Other tech leaders did well, too. Nvidia, Alphabet, and Amazon went up between 1.2% and 5.5%. The S&P 500 surge got its biggest boost from tech companies.

Inflation Data Fuels Rate Cut Expectations

November brought the biggest rise in consumer prices in seven months. Markets liked this news because it matched what experts predicted. “The equity market seems to be breathing a sigh of relief that this is another steady-as-she-goes report,” said Wasif Latif from Sarmaya Partners. As inflation eases, more investors think the Federal Reserve will cut rates.

Also Read: Top U.S. Stocks To Buy Before Trump’s Inauguration

Market Sectors Show Mixed Performance

The S&P 500 surge helped most areas. But health insurance stocks struggled. Companies like Cigna, CVS Health, and UnitedHealth Group fell after new laws about pharmacy businesses came up. The Dow Jones dropped 99.27 points to 44,148.56. This showed market volatility affects different sectors differently.

Trading Activity and Market Breadth

Market volatility stayed low. More stocks went up than down on the NYSE, with a ratio of 1.27-to-1. Traders bought and sold 14.25 billion shares. This matched the usual amount over the past 20 days. The steady S&P 500 surge brought in more market activity.

Also Read: Nvidia Faces Class-Action Over $1 Billion in Crypto Mining Sales

Market Outlook and Future Implications

The S&P 500 surge keeps showing strong investor trust. Markets now think there’s a 96% chance of a Fed rate cut next week. This is up from 86% before the inflation report. As inflation eases and crypto concerns stay around, tech stocks keep leading the way. Nvidia’s results and Broadcom’s work with Apple on AI chips suggest tech stocks will stay strong. These companies have driven recent market gains.