- Stellar’s golden cross and $0.33 support suggest potential recovery to $0.45 and beyond.

- Historical 3,162% XLM gains fuel $2.19 price target as investors withdraw $3.37 million from exchanges.

Stellar [XLM] has retraced some of its previous gains, trading at $0.4255 at press time. This represents a 0.96% drop over the past 24 hours and a 9.09% decline over the past week.

With a circulating supply of 30 billion XLM, the crypto holds a market capitalization of $12.79 billion.

Despite the short-term pullback, analysts point to historical data and recent technical indicators as reasons to monitor the asset closely.

Technical indicators point to potential upside

Recent technical analysis shows that Stellar experienced a “golden cross,” where its 13-day moving average (red) moved above the 49-day moving average (yellow).

This pattern is widely seen as a bullish signal, indicating potential for upward momentum. However, XLM’s price has retreated from its November high of $0.60, consolidating around $0.42.

Support is evident in the $0.33 range, near the 49-day moving average, where buyers may step in if the price continues to pull back. The Relative Strength Index (RSI) was at 52.40, suggesting neutral momentum.

Buyers remain active after the RSI cooled from overbought levels in November. Analysts suggest that if XLM remains above $0.33 to $0.42, a potential recovery toward $0.45 or higher could unfold.

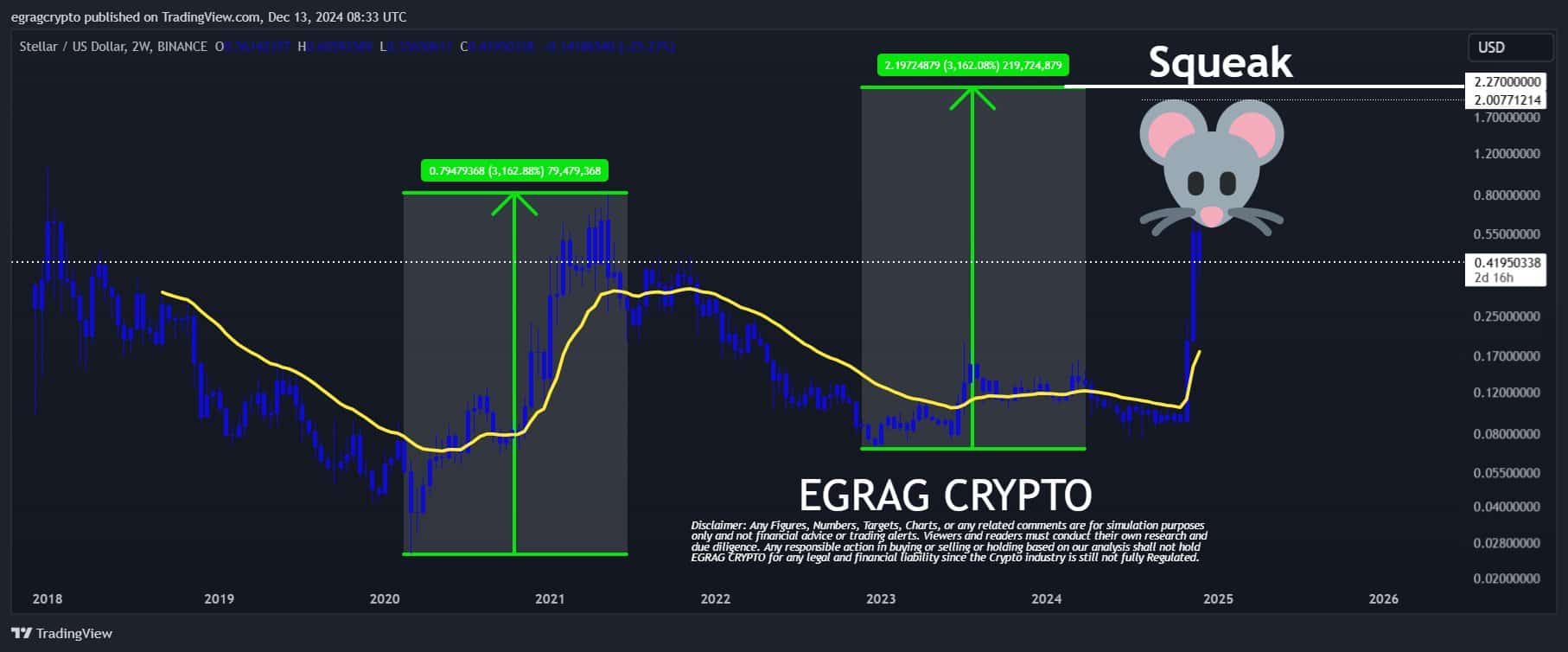

Historical data fuels optimism for future growth

Historical performance provides insight into XLM’s potential price trajectory. During the 2020–2021 bull run, Stellar rose from approximately $0.025 to $0.79, representing a 3,162.88% gain.

Analysts have noted the possibility of a similar increase from current levels. Projections estimate a move to $2.19, with an extended target of $2.27, though achieving such gains would depend on broader market conditions and investor sentiment.

Source: X

Crypto analyst EGRAG CRYPTO has compared this potential rally to past price movements, stating,

“We’ve just touched the Mouse’s Moustache, and now it’s time to build momentum!”

EGRAG further highlighted the importance of retesting key exponential moving averages (EMAs) as XLM attempts to close above higher resistance levels.

Market sentiment shows mixed signals

Recent Coinglass data reflects a 30.20% drop in trading volume, now at $614.82 million, and a 4.89% decrease in open interest, indicating reduced market activity.

Despite this, long/short ratios on Binance (2.2258) and OKX (1.77) show a bullish bias among traders, with Binance’s top traders favoring long positions at a 2.3378 ratio.

Liquidation data reveals $621.13K was liquidated in the past 24 hours, with longs dominating ($552.63K), signaling risks of over-leveraging.

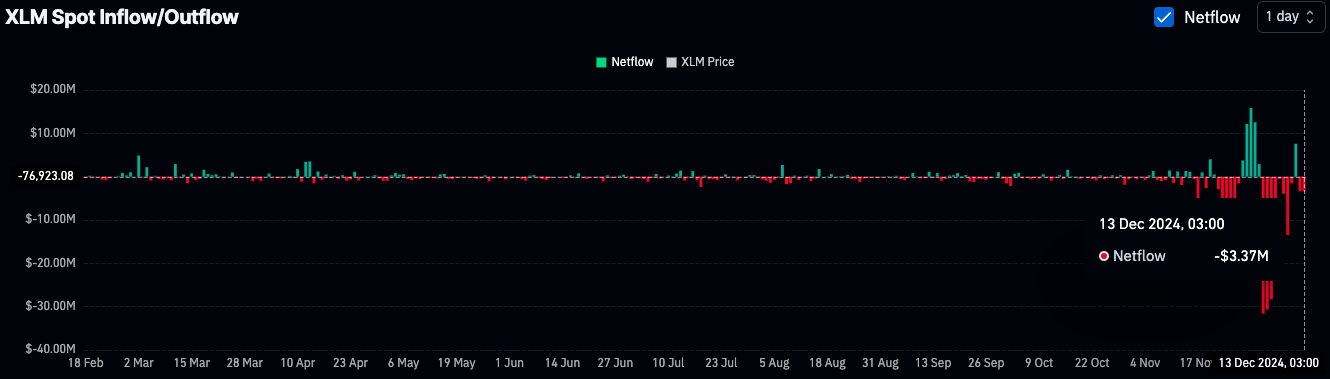

Meanwhile, spot market data shows $3.37 million in net outflows on 13th December, as funds continue to leave exchanges.

Source: Coinglass

Read Stellar’s [XLM] Price Prediction 2024–2025

Such outflows often suggest accumulation by investors, potentially reducing sell pressure on XLM.

While XLM has seen recent price declines, historical data, technical indicators, and ongoing accumulation trends suggest potential for renewed momentum.