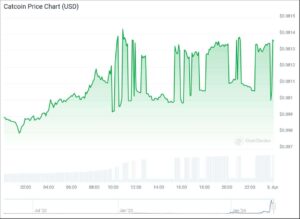

In the last day, Catcoin, one of the popular memecoins, has seen a big jump of 40%. This comes at a time when many other cryptocurrencies are facing losses. It’s making waves as one of the top performers among meme-inspired digital currencies.

In the past day, Catcoin (CAT) has been on the rise, even though the overall cryptocurrency market has taken a hit, dropping by 5.2%. Despite this, Catcoin has surged by 40.1% today alone. This significant increase has helped Catcoin recover most of the losses it faced earlier in the week when many meme-inspired digital currencies experienced a wave of sell-offs.

Catcoin Community Celebrates Surge in Trading Volume

Catcoin (CAT) has witnessed a staggering 197% increase in daily trading volume, reaching $18.2 million. This surge comes as the community rallies around the cat-themed memecoin. Last month, Catcoin experienced an astonishing surge of over 1,100%, reflecting a renewed interest in memecoins fueled by market frenzy and buzz.

Despite fluctuations in the market, Catcoin continues to dominate the trending charts, buoyed by recent gains. The overall performance of cat-themed memecoins shows a decline of 7.1%, with a total market capitalization of $1.9 billion and trading volumes reaching $337 million. MEW and Leia have also recorded significant inflows of 35% and 19.6%, respectively.

MEW Emerges as Top Performer Among Cat-Themed Memecoins

MEW has emerged as the top performer in the cat-themed memecoin category, witnessing a remarkable 284% increase in the past week. Its community remains enthusiastic, rallying for further inflows. However, WEN and MOG experienced losses in line with other crypto assets, recording exits of 5.2% and 0.9%, respectively. POPCAT and LMEOW faced significant declines of 29% and 33%, indicating substantial outflows within a 24-hour period.

Solana memecoins have also taken a hit, with an 11% decline, as larger assets within the network register outflows. Notably, Dogwifhat saw a 7.4% decrease in the last 24 hours, although it maintained a 22.2% gain over the past week. SLERF, a popular coin, joined the downward trend with 11% daily losses and 35% weekly losses.

Bitcoin and Altcoins Experience Outflows Ahead of Halving Event

As the halving event approaches, both Bitcoin and altcoins have witnessed outflows, signaling a cautious sentiment among investors. The decline in asset prices is attributed to macroeconomic factors and a minor downturn in the stock market. This indicates the ongoing correlation between cryptocurrency and traditional markets, reflecting investor sentiment across both domains.

The recent highs in the crypto market are closely tied to renewed institutional investment. Beginning in Q4 of 2023, increased traditional investment activity in the market was fueled by anticipation surrounding the potential approval of a spot Bitcoin Exchange-Traded Fund (ETF) by the United States Securities and Exchange Commission (SEC). This anticipation propelled the price of Bitcoin to $44,000 and eventually led to an all-time high last month.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News