Chainlink’s price has surged by 20% over the past week, driven by increased accumulation. Recently, Chainlink (LINK) has gained significant attention and its price has risen substantially.

LINK’s network activity rose alongside its price, showing promising metrics for continued price growth, although a few indicators suggested caution.

Chainlink’s Recent Developments

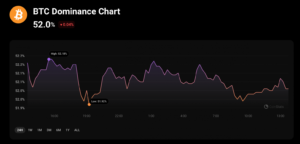

Chainlink (LINK) has seen a surge in popularity while Bitcoin (BTC) dominance has slightly declined recently. IntoTheBlock highlighted several noteworthy developments related to Chainlink in a recent tweet.

Source: CoinStats

The tweet first noted a significant increase in LINK search trends, indicating growing interest in the token. This rise in popularity has positively influenced the blockchain’s network activity, with the number of transactions spiking. Specifically, LINK recorded 5.82 thousand transactions in the last day, nearing its monthly peak.

Interestingly, despite the increase in transactions, there hasn’t been a major change in the number of new addresses, suggesting stable user growth.

Investor Accumulation in Chainlink (LINK)

Net Withdrawals from Exchanges: Accumulation of Chainlink (LINK) tokens by investors has been notable recently. According to the tweet, there have been consistent net withdrawals from exchanges. This behavior suggests that investors are increasingly holding onto their LINK rather than selling, reflecting confidence in the token’s future performance.

Whale Accumulation: Furthermore, whales—addresses holding over 0.1% of the LINK supply—have been actively accumulating the token. Over the past month, these addresses collectively accumulated a net total of 25 million LINK. This significant accumulation by large investors highlights robust confidence and strong interest in the potential growth of Chainlink.

Chainlink: Recent Developments Highlighted by IntoTheBlock

IntoTheBlock recently shared significant developments regarding Chainlink (LINK) in a tweet.

The tweet highlighted a notable increase in LINK search trends, indicating growing interest in the token among investors and enthusiasts. This surge in popularity positively impacted the blockchain’s network activity, leading to a spike in the number of transactions. On the last day alone, LINK recorded 5.82 thousand transactions, nearing its monthly peak.

Interestingly, despite the rise in transactions, there wasn’t a substantial change in the number of new addresses created, suggesting stable user growth.

On the investor front, accumulation of LINK tokens showed promising signs. The tweet noted a trend of net withdrawals from exchanges, signaling that investors are increasingly holding onto their LINK rather than selling. Additionally, whales have been actively accumulating LINK, with addresses holding over 0.1% of the supply accumulating a net total of 25 million LINK over the past month. This behavior underscores strong confidence and investment in Chainlink’s future prospects.

Chainlink’s Recent Performance and Market Analysis

Bull Rally and Market Capitalization: The rise in accumulation of Chainlink (LINK) tokens has initiated a bullish trend. According to CoinMarketCap, LINK surged by over 20% in the past week, reaching $16.22 with a market capitalization exceeding $9.5 billion.

As a result of this rally, LINK’s MVRV ratio, indicating the profit status of investors, saw a significant increase. Open Interest also rose alongside its price, suggesting potential for continued upward movement.

ChainLink-on-Ethereum-LINK: Source – Santiment

Bullish Sentiment and Price Fluctuations: Santiment recently highlighted a surge in bullish sentiment around Chainlink, the highest seen in over a year. Despite these positive indicators, LINK’s price dropped by nearly 2% in the last 24 hours.

However, the Chaikin Money Flow (CMF) indicated a notable uptick, suggesting that the recent price correction might be short-lived and that LINK could resume its upward trajectory soon.

Concerns and Technical Analysis: Nevertheless, Chainlink’s price touched the upper limit of the Bollinger Bands, which raises concerns about potential overbought conditions. Investors are watching closely to see if LINK can sustain its recent gains or if further adjustments are needed in the short term.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News