Notcoin saw a slump in buying pressure on the lower timeframes, but the momentum and trend continued to favor NOT bulls. With $0.0072 and $0.0066 as important support levels, it is unlikely that NOT will test them anytime soon.

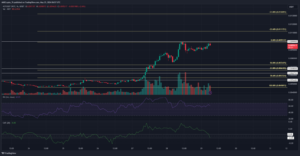

Notcoin (NOT) experienced a 115% rally from May 24th to May 28th. Since then, it has faced strong resistance at $0.0099, just below the significant $0.01 level. Analysts pointed out that $0.0066 and $0.0068 were key resistance levels, but the bulls broke through these barriers, showing their strength this week.

Notcoin (NOT) Price Analysis: Consolidation and Potential for Further Rally

The $0.0072-$0.0075 region, which acted as resistance earlier this week, was flipped to support in the past 24 hours. Following this shift, NOT prices surged to the $0.0099 level, which had previously rebuffed buyers on the listing day.

Source: NOT/USDT on TradingView

A short-term range has been observed between $0.0088 and $0.0099, suggesting a consolidation phase that could provide the foundation for another rally. Despite a weakening in buying pressure over the past 12 hours, indicated by the CMF’s dip to -0.05, the RSI remains above neutral 50, signaling ongoing bullish momentum.

Fibonacci retracement levels identify $0.0072 and $0.0066 as key support levels, though it is unlikely that NOT will drop toward these levels in the coming weeks. Instead, a rally toward the extension levels at $0.0112 and $0.0132 appears more likely. However, a drop in Bitcoin [BTC] below $67k could negatively impact the Notcoin uptrend.

Notcoin [NOT] Rally: Short Liquidations and Market Sentiment

During the past two days’ upward rally, short liquidations saw abnormally large spikes. This indicated that many participants were betting against further gains and were subsequently liquidated. Their forced market buy orders propelled prices even higher.

Open Interest trended higher alongside the price, demonstrating a bullish sentiment behind the token. The majority of the market believed that the rally might extend further, raising concerns that a liquidity hunt could follow.

Additionally, the spot CVD (Cumulative Volume Delta) showed a strong upward move, which was encouraging. This suggested that the recent rally was not solely driven by the derivatives markets, indicating that more gains were possible.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News