A Wall Street veteran predicts Bitcoin will sharply rise, driven by a unique mathematical pattern and growing ETF investments. They suggest Bitcoin could hit $400,000 by year-end and $600,000 by 2025, depending on market conditions.

This bullish outlook is underpinned by the rising influx of funds into ETFs and is substantiated by a power law model, indicating substantial upward momentum for Bitcoin in the foreseeable future.

Fred Krueger’s Bitcoin Insights

Fred Krueger, drawing on his Wall Street experience and mathematical expertise, is bullish on Bitcoin. He identifies a rare statistical pattern known as a power law, which he believes is guiding Bitcoin’s trajectory. Krueger asserts that this pattern, coupled with substantial investments flowing into Bitcoin ETFs, could lead to a significant price surge.

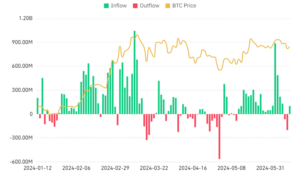

Analysis of Bitcoin spot ETF net inflows illustrates compelling trends. At the beginning of 2024, average inflows stood at approximately $190 million, coinciding with Bitcoin’s price around $40,000. By mid-March, inflows skyrocketed to $1.04 billion, propelling Bitcoin’s price to around $73,000. Recently, inflows totaled $886.6 million, aligning with Bitcoin’s price at approximately $70,580 earlier this month.

Fred Krueger’s Bitcoin Price Predictions

Fred Krueger bases his projections on Bitcoin ETF inflows and a power law model. He suggests that if current trends persist, Bitcoin could achieve $400,000 by the end of 2022 and potentially reach $600,000 by the end of 2025.

Krueger’s forecasts are bold, reflecting his confidence in his analysis. With a background in Wall Street and mathematics, Krueger’s insights carry substantial weight in the financial community.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News