After a 26% decline over the past month, LUNC’s price has stabilized above $0.000080. The upcoming LUNC burn by Binance has sparked optimism in the market, even though trading volume has dipped.

Meanwhile, Terra Luna Classic’s staking ratio has increased to 14.83%, with over 1 trillion LUNC tokens now staked.

Terra Classic’s LUNC Token Faces Volatility Amid Upcoming Binance Burn

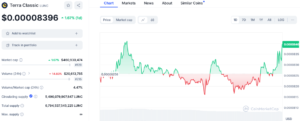

Terra Classic’s LUNC token has faced a significant downturn over the past month, dropping more than 26%. Data from CoinMarketCap shows that LUNC peaked at $0.0001253 before falling sharply to a low of $0.00007334. Despite this drop, the token has stabilized, holding above the $0.000080 support level. Recent trading activity indicates a slight recovery, with LUNC showing a modest increase of 1.67%. At press time, LUNC was trading at $0.00008396, and its intraday market cap had risen to $460,930,474, ranking it 128th in the market.

Source: Coinmarketcap

This recovery is occurring just before a significant LUNC burn event scheduled by Binance next week, which has generated some market optimism. However, the token’s 24-hour trading volume has decreased by 14.83% to $20,613,785, reflecting a decrease in investor interest. In contrast, the USTC token has seen a slight increase of 1.51%, reaching $0.01829, despite a 31% drop in trading volumes over the past day. The price of USTC fluctuated between $0.01803 and $0.01842 during this period.

Terra Luna Classic Anticipates Key Binance Burn and Staking Boost

The Terra Luna Classic community is eagerly awaiting the Binance LUNC burn mechanism, which is expected to play a pivotal role in reducing the total LUNC supply. Recent data indicates that LUNC’s total supply has dropped to 6.79 trillion following significant trading volumes and burn events.

At the same time, there is a growing enthusiasm for staking with Terra Luna Classic validators. Over 1 trillion LUNC have been staked, pushing the staking ratio up to 14.83%. This increased staking activity highlights the community’s commitment to the token’s long-term success.

The community pool reserve has also seen a significant increase, now holding 6.22 billion LUNC and 12.37 million USTC. This ample reserve is set to support upcoming development projects and further bolster the ecosystem.

Source: Tradingview

Analyzing the 4-hour chart, the LUNC/USD pair has recently rebounded from a support level around $0.000071462 observed on Monday. The token is now approaching the $0.00008411 mark, which acts as an intraday resistance level. This rebound follows a substantial downward channel that LUNC has been navigating since its May high of $0.00013, representing a 45.50% decline.

Looking ahead, the scheduled burn events in the coming month could inject significant momentum into the trading volume, potentially driving LUNC’s price upwards. A breakout above the $0.000090 level could unlock further gains, with the possibility of reaching $0.000094. This upward movement might even pave the way for a retest of the $0.00011 level, suggesting a promising future for LUNC’s value.

However, the path forward remains uncertain. If the resistance at $0.00008411 holds firm, LUNC could face a retreat towards the June low of $0.0000714, as it searches for a new support base.

Important: Please note that this article is only meant to provide information and should not be taken as legal, tax, investment, financial, or any other type of advice.

Join Cryptos Headlines Community

Follow Cryptos Headlines on Google News