MUFG has not disclosed the names of the companies that will be the initial users of its platform. However, a few banks are said to have already chosen a different stablecoin solution

Mitsubishi UFJ Financial Group (MUFG), a major bank in Japan, has introduced its stablecoin issuance platform called “Progmat Coin.” The platform will enable Japanese banks to launch stablecoins pegged to the Yen on various public blockchains.

This development follows new regulations implemented this month, which prompted Japanese banks to express their interest in exploring or creating stablecoins.

In mid-2022, the Japanese government passed a bill that restricted non-banking institutions from issuing stablecoins. The bill officially became effective on June 1, 2023.

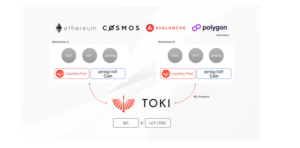

In a recent announcement on June 2, MUFG revealed its plans to utilize Progmat Coin for issuing stablecoins backed by banks. These stablecoins will be available on Ethereum, Polygon, Avalanche, and Cosmos blockchains, and the bank intends to add support for additional networks in the future.

To enhance the functionality of the platform, MUFG’s blockchain technology partners TOKI and Datachain are working on building a bridge. This bridge will enable cross-chain transactions, lending, and swaps between the supported blockchains.

MUFG aims to launch the cross-chain infrastructure in the second quarter of 2022, allowing users to seamlessly interact across different blockchain networks.

Progmat Coin cross-chain interopability. Source: MUFG

MUFG introduced Progmat Coin in February 2022 as a solution aimed at enabling seamless transactions and serving as a universal digital asset payment method. The platform’s purpose is to facilitate the use of stablecoins, various other cryptocurrencies, and potentially even a central digital bank currency (CBDC) based in Japan. The goal is to provide interoperability and a user-friendly experience for digital asset payments.

MUFG has not disclosed the specific banks that will be the first to utilize Progmat Coin. However, during the Progmat Coin announcement last year, MUFG confirmed its own plans to launch a Yen-pegged stablecoin.

Also Read This Related: XDC Price Surges 28% Following Exchange Expansion into Japan

According to a report from Nikkei Asia on June 1, Shikoku Bank, Tokyo Kiraboshi, and Minna Bank have expressed their intentions to issue stablecoins. However, these banks will be using a different stablecoin platform developed by a Tokyo-based startup called G.U. Technologies.

Important: This article is intended solely for informational purposes. It should not be considered or relied upon as legal, tax, investment, financial, or any other form of advice.

Join Cryptos Headlines Community: https://linktr.ee/cryptosheadlines.com