- Analyst predicts a 500% surge for Dogecoin, with RSI showing a potential breakout.

- Despite market downturns, Dogecoin’s bullish signals and strong holder support indicate a possible rally.

Dogecoin [DOGE] has maintained a relatively stable price over the past month despite the wider crypto market’s downturn.

However, according to market analyst Javon Marks, the situation could change dramatically for Dogecoin in the coming months, with potential gains of over 500% on the horizon.

Hidden bullish signals, including a positive divergence between Dogecoin’s RSI and price action, are emerging, indicating that a major upward move could be imminent.

Potential for a 500% price surge

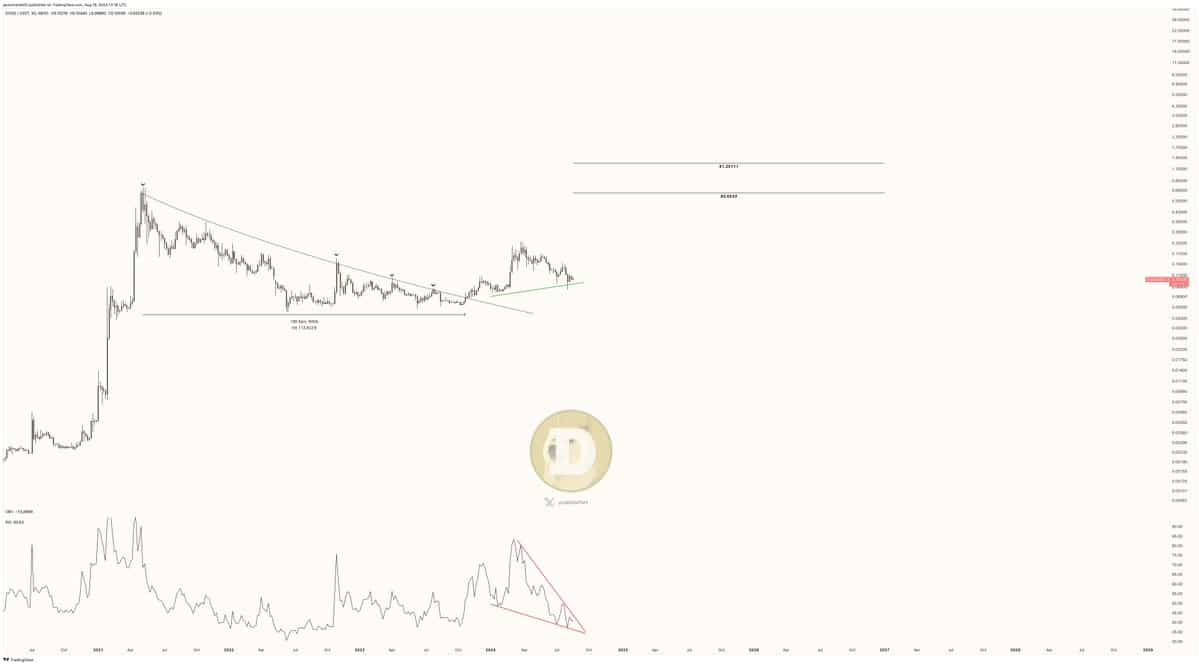

Javon Marks pointed out that Dogecoin’s Relative Strength Index (RSI) is nearing a breakout point, and this divergence could lead to a significant bull run.

Javon said,

“DOGE’s RSI is nearing a breakout point and diverging (Hidden Bull) with Prices, a major bull move could be on the way!.”

According to this analysis, if Dogecoin’s price manages to break and hold above current resistance levels, it could trigger a climb of over 513%, bringing the price to the $0.6533 mark.

This projection is based on previous price behavior and technical patterns. In early 2021, Dogecoin reached an all-time high of $0.73, followed by a prolonged downtrend and a period of consolidation in late 2021 and throughout 2022.

Although Dogecoin showed some signs of recovery in 2023, the momentum was not sustained.

The current analysis suggests that the upcoming bullish move could push Dogecoin back towards its previous highs, with targets of $0.24 and $0.36 already identified by analysts.

Price action and market sentiment

Dogecoin’s price has recently broken out of key resistance levels, according to the analysis. As of press time, Dogecoin was trading at $0.1051, representing a 5.04% increase over the last 24 hours and a 0.13% increase over the past week.

This recent price movement has further fueled speculation that a major bullish move could be on the way.

Javon Marks previously noted a similar pattern in July, stating that the recent pullback in Dogecoin’s price might have been a shakeout, with the token gearing up for a continuation toward $0.6533.

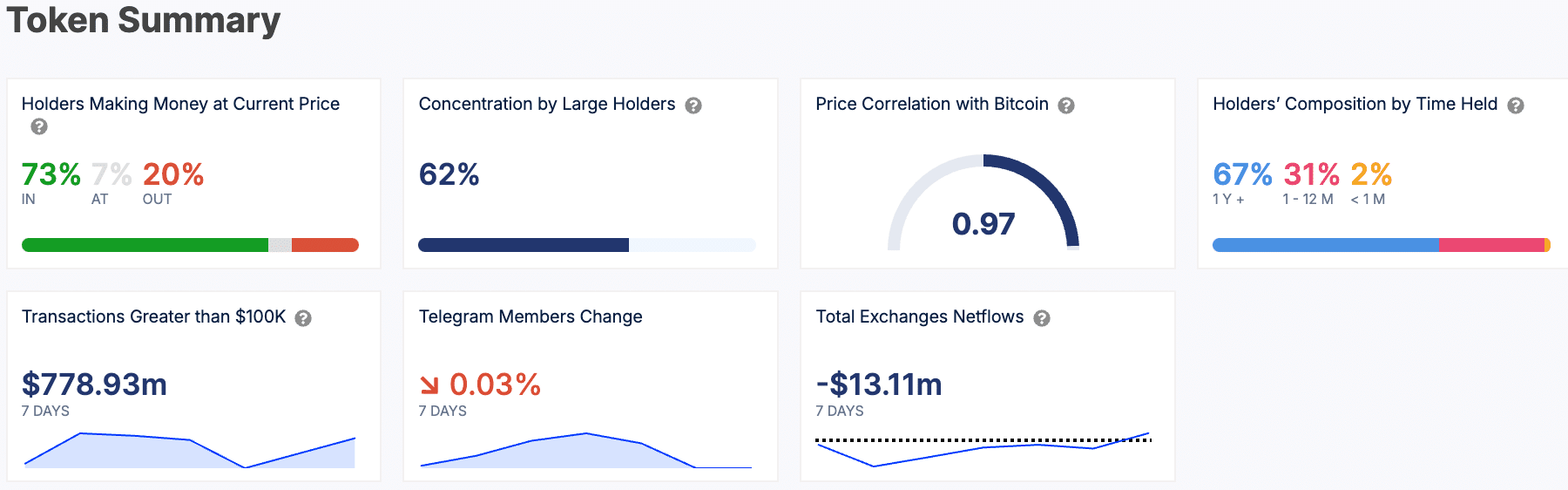

Despite the market’s overall bearish tone, Dogecoin’s active user base remains high. Data shows that 73% of Dogecoin holders are currently in profit, while 20% are at a loss.

Additionally, large holders control 62% of the token’s supply, and 67% of Dogecoin holders have held the token for over a year.

These metrics indicate strong long-term support for Dogecoin, which could contribute to the anticipated price surge.

Dogecoin’s transaction volumes have been substantial, totaling $778.93 million over the past 7 days. This suggests ongoing activity in the market, even as the DOGE price has remained relatively stable.

Dogecoin also maintains a strong price correlation with Bitcoin, currently standing at 0.97.

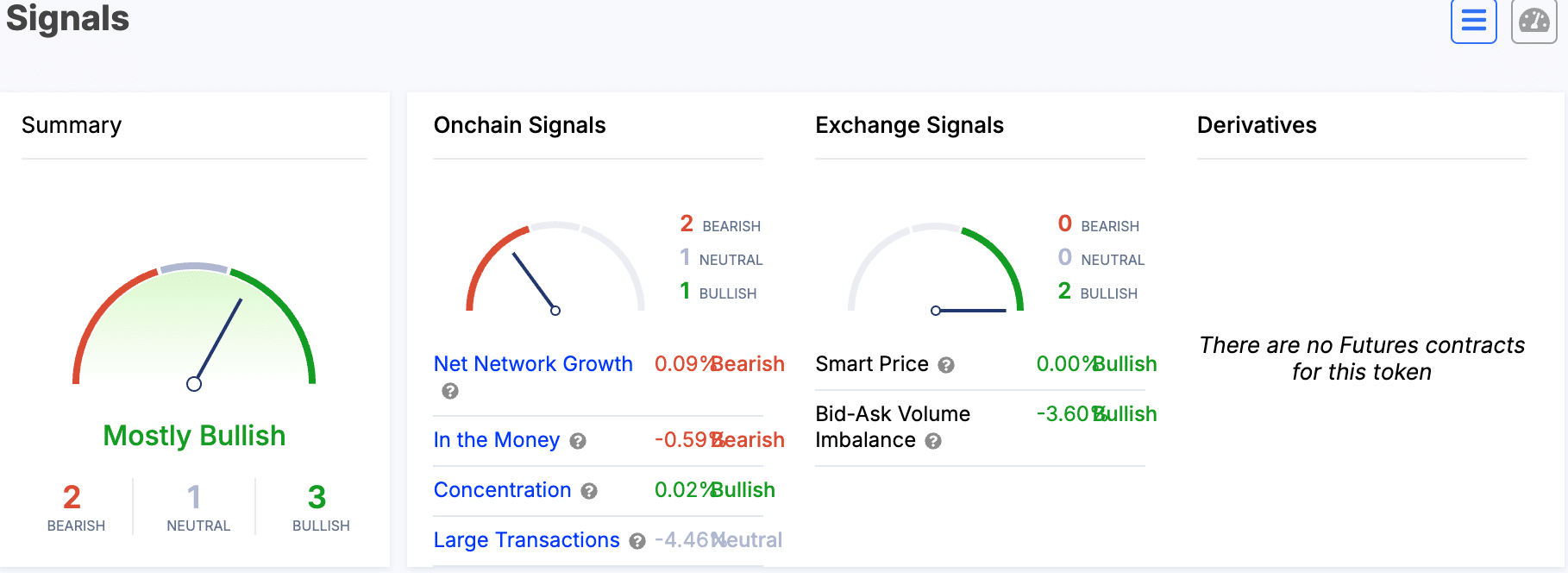

IntoTheBlock data shows that market signals for Dogecoin have shifted towards a mostly bullish outlook. There are now 3 bullish indicators, 1 neutral, and 2 bearish signals.

On-chain signals still reflect some bearish trends, such as net network growth at 0.09% and “In the Money” at -0.59%.

However, exchange signals are showing strength, with a smart price reading of -0.02% (bullish) and a bid-ask volume imbalance of -5.11%, both suggesting positive momentum.

Read Dogecoin’s [DOGE] Price Prediction 2024-2025

According to DefiLlama, Dogecoin’s Total Value Locked (TVL) is currently $3.7 million, with daily fees amounting to $1,824.

This data reflects the activity within the Dogecoin network and its utilization in decentralized finance (DeFi) applications.