The CORE price gained traction and made a strong breakout after a short-term consolidation near the demand zone. The bulls established their presence at the demand, triggering a breakout. Thus, it made short-term traders and investors optimistic.

At the time of writing, Core was trading close to $1.17, adding an impressive 12% intraday. Moreover, short-term bullishness led to a significant change in on-chain metrics: a weighted sentiment curve that may lead to higher prices.

However, despite the recent efforts, the long-term trend outlook still pointed to a bearish side. The price was approaching a trendline resistance, which multiple times emerged as a hurdle for the bulls.

Let’s analyze whether Core may surpass the hurdle and shine higher in the upcoming sessions or suffer from trendline resistance again.

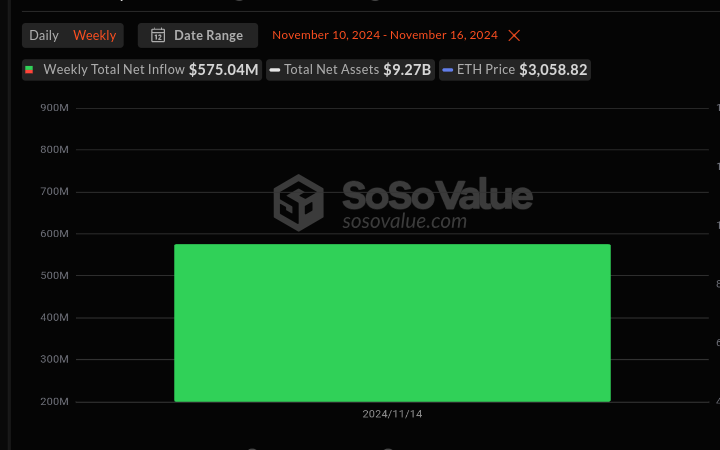

Weighted Sentiment Curve Highlights Bulls Domination

As per the data obtained from Santiment, a significant shift in the traders’ and investors’ sentiment was observed. The positive sentiments have surged amid the recovery in the broader markets.

Source: app.santiment.net

The advancement in the positive sentiment helped the weighted sentiment curve surpass the zero line and claim bullish territory. The weighted sentiment curve has turned positive, indicating the dominance of the investors with a bullish bias.

The sentiment data reflected the current biases of the traders and investors. The positive sentiment highlights bullishness.

At the same time, a negative sentiment indicated a bearish stance. The weighted sentiment curve indicated the combined bias of the traders and investors.

Can Core Token Price Surpass Hurdles and Shine Higher?

Moreover, the daily chart highlighted the formation of a descending triangle pattern since mid-April. It was accompanied by the price correcting following the upper and lower boundaries of the pattern. On the lower side, the $0.85 level is a strong demand.

Source: TradingView

The short-term trend outlook has shifted to bullish after the Core price triggered a breakout after a short-term consolidation. The price has surpassed the 20 and 50-day Exponential moving average, indicating bulls’ domination in the short term.

At the time of writing, CORE was approaching a strong hurdle of 200-day EMA and a trendline resistance. A long-term trend reversal may be validated if the CORE price surpasses the hurdles.

Suppose the price fails to overcome the hurdles and suffers lower. If this happens, the bears may try to regain control over the trend and show more downturns.

Core price surged 12% intraday to $1.17 after a breakout from short-term consolidation. However, the long-term trend still remained bearish, with the price nearing trendline resistance.

As per the on-chain data, the positive sentiment has increased, pushing the weighted sentiment curve into bullish territory.

Moreover, the daily chart shows a descending triangle pattern since mid-April, with $0.85 as strong demand. The short-term trend turned bullish as the price surpassed the 20 and 50-day EMAs.

However, the 200-day EMA and trendline resistance are key hurdles. Failure to overcome these could see bears regain control and lower prices.