The Ethereum Foundation recently transferred 35,000 ETH, valued at approximately $96 million, to a wallet associated with the Kraken exchange, according to blockchain data analysis platform Arkham Intelligence. This move has sparked speculation within the crypto community about potential market impacts, given the Foundation’s track record of selling at market peaks.

Why Did the Transfer Occur?

On August 23, this significant transfer was made to Kraken, reminiscent of past moves by the Ethereum Foundation. Notably, the Foundation sold 100,000 ETH in December 2020 before a substantial price surge. These actions raise questions about the Foundation’s market timing and motives behind such large transfers. Access NEWSLINKER to get the latest technology news.

What Does This Mean for Ethereum?

Ethereum Foundation Executive Director Aya Miyaguchi clarified that the recent transfer is part of the Foundation’s routine treasury management. She emphasized that it was executed to balance their financials and not indicative of an imminent sale. Miyaguchi highlighted their annual budget, which includes grants and salaries, with some expenses requiring fiat currency payments.

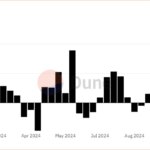

The price of Ethereum has shown slight fluctuations, touching a low of $2,656 on August 24 before stabilizing around $2,743 by August 26. This comes after another substantial transfer of 92,000 ETH to an unidentified wallet a month earlier, further fueling speculation about the Foundation’s strategic moves.

Key Takeaways for Investors

- The Ethereum Foundation’s latest transfer is part of treasury management activities, not a direct sale.

- Past transactions by the Foundation have coincided with significant market movements, suggesting potential market insights.

- Ethereum’s price stability following the transfer may offer a buying opportunity for some investors.

- Monitoring the Foundation’s wallet activities can provide valuable foresight into market trends.

The Ethereum Foundation’s recent financial maneuvers highlight the complexity and strategic management behind large cryptocurrency holdings. Investors and market watchers should stay informed about such activities to better understand potential impacts on market dynamics.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.