Bitcoin’s price spiked close to the $65,000 threshold on Monday, August 26, registering a 5% increase over just four days. This recent price surge aligns with growing optimism among BTC traders, especially as speculation rises that the U.S. Federal Reserve might cut interest rates in September 2024.

Bitcoin Tests $65K Again Following August Market Drop

August began with Bitcoin’s price plummeting to a three-month low of $49,111 on August 5, triggering over $500 million in liquidations across crypto markets. However, as the month progressed, the market sentiment shifted. By the second half of August, major cryptocurrencies like Bitcoin, Ethereum, and XRP recorded double-digit gains.

The Bitcoin Price Analysis chart highlights how bullish traders gained control of BTC markets in late August. Bitcoin’s price surged by 15.8% within ten days, from $56,150 on August 15 to nearly $65,000 on August 25. Although bears managed to stall the rally, preventing a breakout above $65,000, Bitcoin retraced to $62,000 on August 27, marking a 5% decline from its recent peak.

Yet, beyond this short-term price movement, on-chain data trends indicate that Bitcoin might be poised for continued growth, making the recent correction appear temporary.

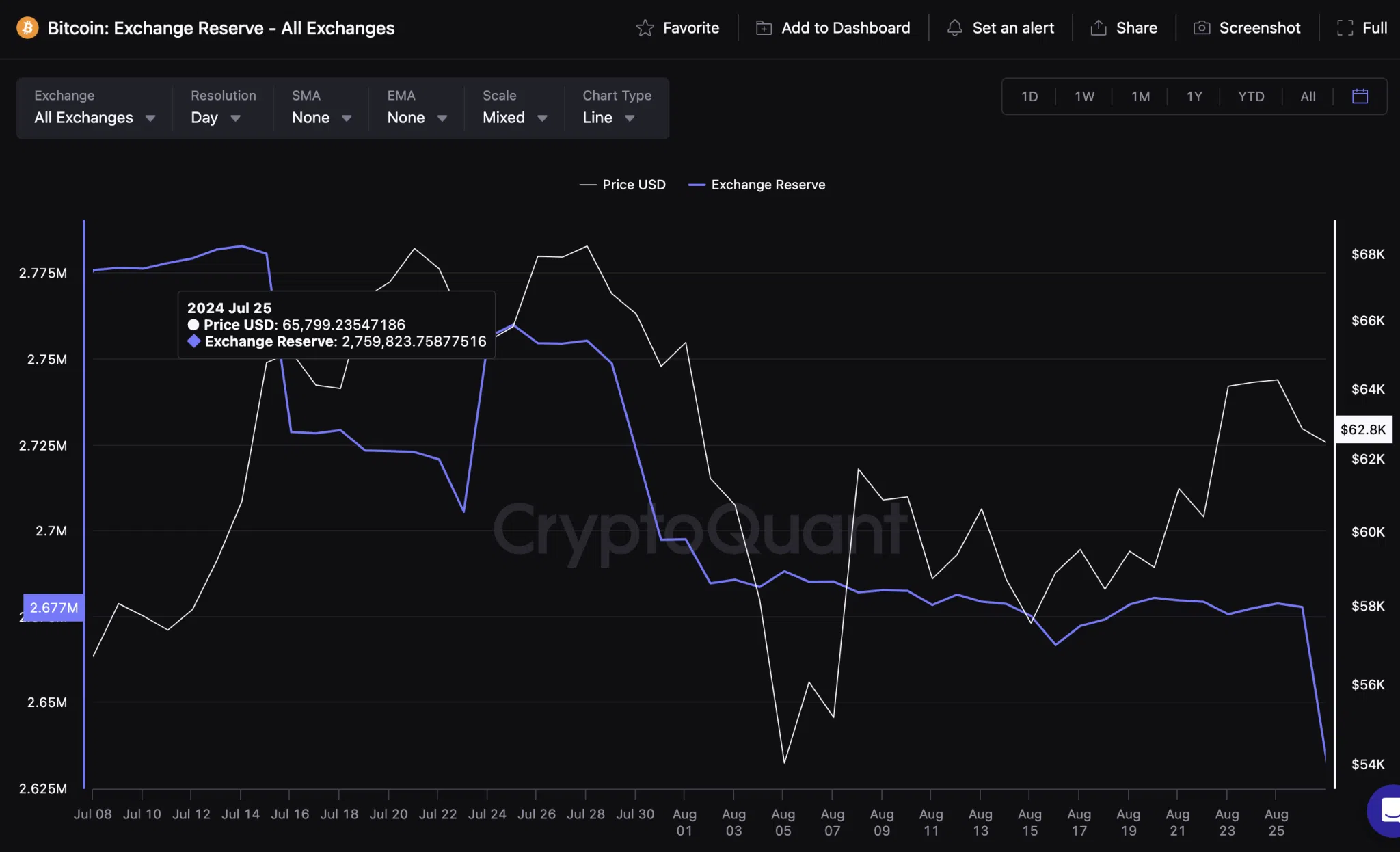

Investors Transfer $5 Billion in BTC to Cold Storage

In the past 30 days, Bitcoin traders have increasingly opted to move their assets into long-term storage. This shift likely anticipates long-term gains, especially with the U.S. Fed’s potential rate cut in September 2024.

The Bitcoin Exchange Reserves metric, which measures the total BTC held on exchanges, has dropped from 2,759,823 BTC on July 25 to 2,677,614 BTC by August 25.

This represents a transfer of 82,209 BTC—valued at approximately $5 billion at current prices—into cold storage.

This significant decline in exchange reserves suggests that a large number of investors are withdrawing Bitcoin from short-term market circulation, potentially reducing selling pressure. Historically, such declines in exchange reserves have preceded bullish trends in Bitcoin’s price as investors prepare for long-term gains.

This trend could indicate that rather than liquidating their holdings, investors are preparing for a potential surge in BTC price, particularly if the Fed moves forward with the anticipated rate cut.

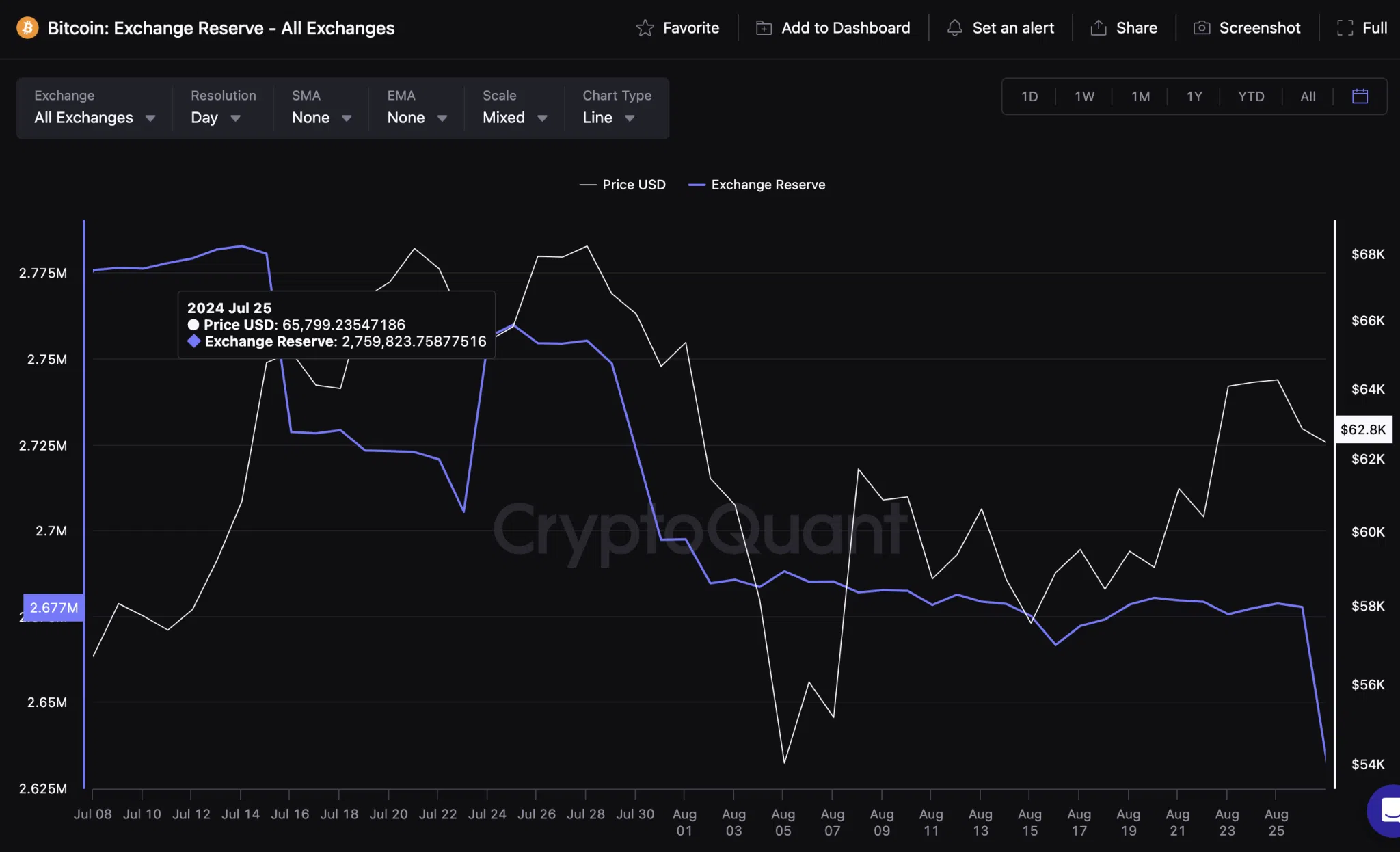

Bitcoin Price Forecast: Bulls Eyeing $70K Breakout

Given the current technical indicators, Bitcoin’s price could soon test the $70,000 mark. The BTCUSD Price Analysis chart below shows the price nearing the upper band of the Keltner Channel, a bullish signal that typically suggests further upward movement.

The recent price activity suggests that $66,000 serves as the next critical resistance level.

Should Bitcoin break through this level, $70,000 could quickly become the new target. On the downside, the $61,000 level is crucial support and, if breached, could lead to a retest of the $56,000 range.

With on-chain data supporting a bullish narrative and technical indicators pointing toward continued upward momentum, Bitcoin appears well-positioned to break new ground as we move into September. Investors should keep a close eye on the $66,000 resistance level, as its breach could signal the start of a new bullish phase, potentially pushing Bitcoin toward the coveted $70,000 mark.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.