The crypto market is stuck in a loop, bouncing between hope and panic like a ping-pong ball. One day it’s all “to the moon,” and the next it’s “run for the hills.” The Fear & Greed Index is doing cartwheels, flipping from extreme fear to greed as if it can’t make up its mind.

You’d think the economic background would offer some direction, but nope. Central banks are acting all dovish, hinting they might cut rates soon. This should be a good thing, right? Risky assets like crypto should be getting a boost from this easy money vibe.

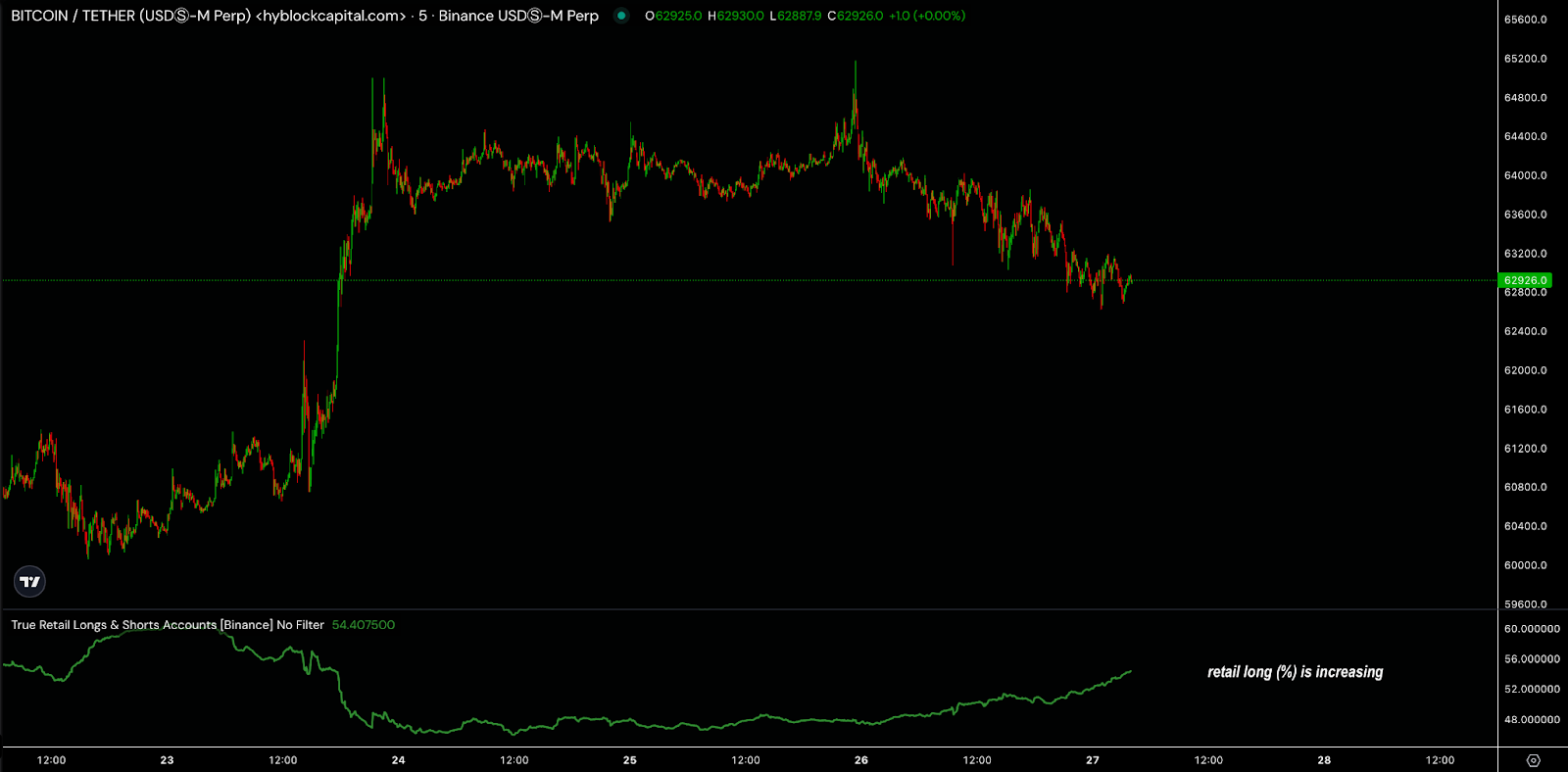

The Jackson Hole symposium even gave it a thumbs up, and we saw Bitcoin ETFs pull in a fat $252 million in net inflows last Friday. Yet here we are, Bitcoin hanging around like it’s got nowhere to be. It jumped from 60K to 64K, then decided to take a nap.

And let’s not even start on the retail investors going long, just waiting for the rug to be pulled out from under them. History tells us when retail goes all in, it usually ends in tears.

Altcoins are also feeling the heat, moving wildly with every headline. Look at what happened with TON after the news broke that Telegram’s Pavel Durov got nabbed. TON’s price tanked, followed by massive liquidations.

But get this, despite the bloodbath, open interest in TON hit new highs. Traders are not backing down; they’re in this game, probably looking to ride the volatility.

Liquidity is the name of the game right now. If you’re not watching those zones, you’re missing the whole plot. For Bitcoin, all eyes are on the spots below $62K and around the mid-$58K range.

If Bitcoin breaks down and heads for these areas, that’s where the drama might kick in. A big drop in open interest could signal we’ve hit a pain point, where the market just can’t take it anymore.

We’ve seen this movie before: price drops, open interest spikes, and then, bam, a quick rebound. Traders know this script well, and they’re ready to pounce if it happens again.