- Solana has been consolidating between $120 and $210 for over 180 days, suggesting a significant move ahead.

- Analysts predicted a potential breakout that could see Solana’s price surge to $500-$1,000 or higher.

Solana [SOL] has seen mixed price actions recently, with the asset experiencing a slight decline of 2.2% in the past day. However, it remained up by more than 6% over the past week, trading above the $150 mark at the time of writing.

This price movement has drawn attention, particularly due to the broader implications of Solana’s ongoing consolidation within a defined range.

The cryptocurrency has been oscillating between $120 and $210 for over 180 days, a pattern that some analysts believe could be setting the stage for a significant price breakout.

Technical outlook on Solana

Renowned crypto analyst Curb has weighed in on Solana’s current price dynamics, emphasizing the potential for a major upward movement once this consolidation phase concludes.

In a detailed analysis, Curb pointed out that such prolonged consolidation periods often precede substantial price moves.

According to him, once Solana breaks out of this range, it could see a swift climb to the $400-$500 range, potentially paving the way for even further gains toward $800-$1,000 or higher.

Curb’s prediction is based on the historical performance of assets that experience extended periods of consolidation, which typically serve as a springboard for dramatic price advances.

He also noted that the current market conditions, combined with Solana’s strong fundamentals, make such a scenario increasingly likely.

Curb further elaborated that Solana’s consistent bouncing between its monthly support and resistance levels indicates that the market is accumulating strength for a decisive move.

He believed that this accumulation phase is crucial for Solana, as it helped build the momentum needed to break through significant resistance levels.

Once these levels are surpassed, the move could be rapid and substantial, driven by both technical factors and increased investor interest.

Is a SOL breakout imminent?

While Curb’s outlook is optimistic, it is worth assessing Solana’s underlying fundamentals to determine whether such a breakout is feasible in the near future.

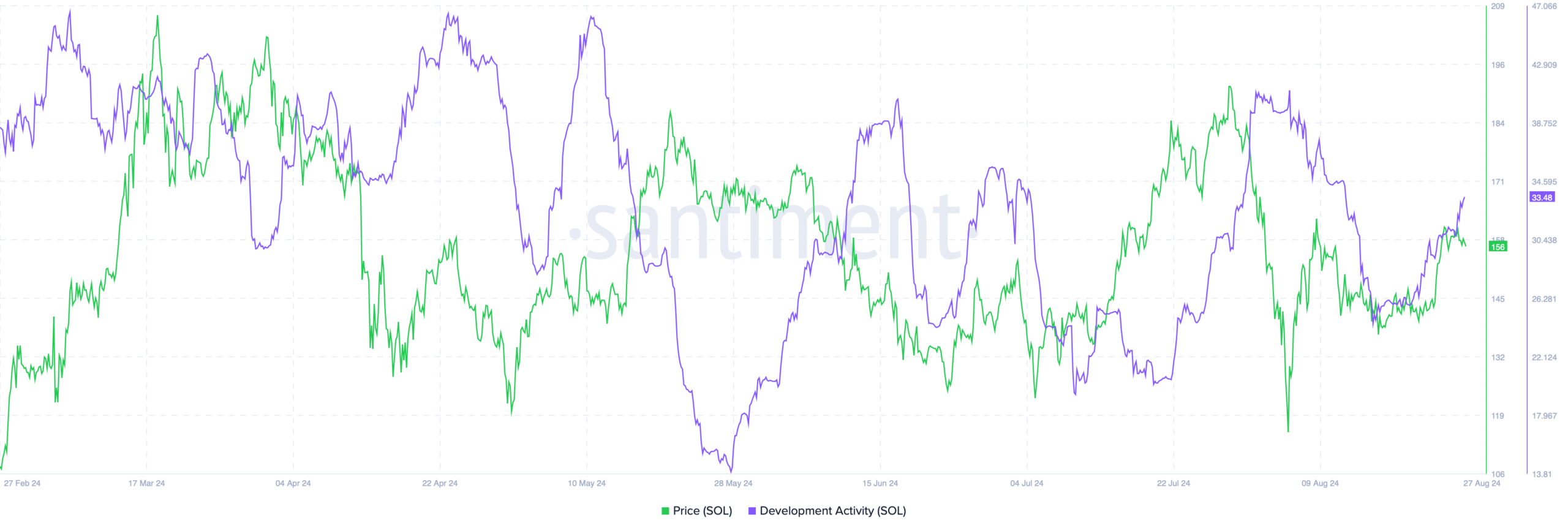

One such example was the network’s development activity, which serves as an indicator of the ongoing interest and innovation within the Solana ecosystem.

According to data from Santiment, Solana’s development activity has seen a notable increase, rising from a low of 13 in late May to over 33 as of today.

This uptick in development activity suggested that the Solana network was actively evolving, with more projects and improvements being implemented.

Such a rise in development activity typically correlates with increased investor confidence, which can contribute to upward price pressure.

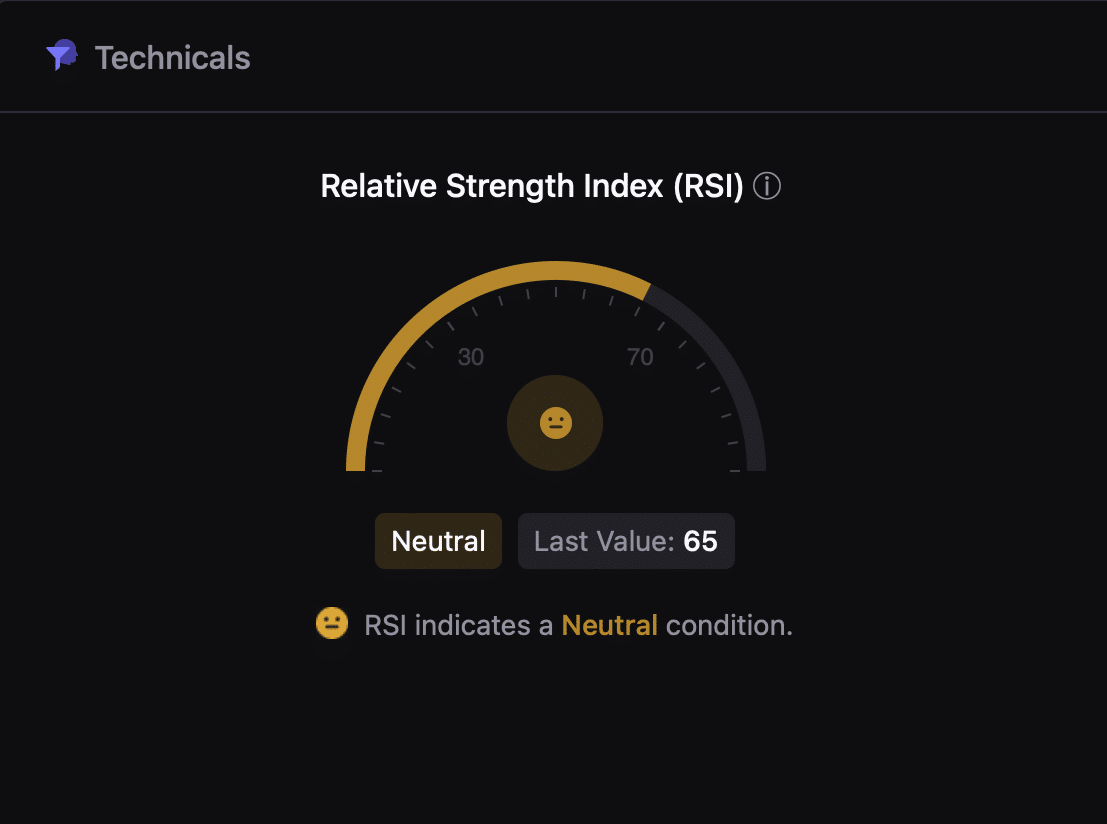

Also, Solana’s Relative Strength Index (RSI), a technical indicator used to assess whether an asset is overbought or oversold, sat at a neutral level of 65 at press time.

Read Solana’s [SOL] Price Prediction 2024–2025

An RSI of 65 suggests that Solana is neither overbought nor oversold, implying that the market was in a balanced state.

This neutral condition could mean that Solana has room to move in either direction, but given the other bullish signals, it may be poised for further gains if market conditions remain favorable.