- CME’s new Bitcoin Friday futures (BFF) offer weekly expiry and smaller contract sizes for precise Bitcoin exposure management.

- BFF contracts, settling against the BRRNY, aim to improve liquidity and efficiency, attracting institutional and retail traders.

- With record volumes in Bitcoin futures, CME’s BFF innovation enhances trading flexibility, despite competition from Coinbase Derivatives.

The CME Group has said that subject to regulatory permission, it will launch Bitcoin Friday futures (BFF) on September 30th, therefore broadening its range of Bitcoin derivatives offers. A contract size for these new weeklies will be 1/50 of a Bitcoin and will be financially settled to the firm’s CME CF Bitcoin Reference Rate New York Variant. Finalization of contracts takes place every Friday at 4:00 p.m. New York Time while new contracts will be listed every Thursday at 6:00 p.m.

Read CRYPTONEWSLAND on

google news

Benefits for Institutional and Retail Traders

Giving traders a more precise tool to manage their exposure to Bitcoin is the aim of this invention. Market players can exchange contracts for the next two Fridays at any time.

As a result, these contracts are made to closely track the current Bitcoin spot price and lessen the effects of weekly price swings. Consequently, this could appeal to both institutional and sophisticated retail traders.

Giovanni Vicioso, CME Group’s Global Head of Cryptocurrency Products, emphasized that the weekly expiry and smaller contract size will enable investors to fine-tune their Bitcoin positions more effectively.

Furthermore, by settling against the BRRNY, which is also used by major Bitcoin ETFs, traders can benefit from increased liquidity and enhanced market efficiency during U.S. trading hours.

Positive Industry Reactions and Market Impact

Industry reactions to the BFF contracts have been positive. Steve Sanders, EVP at Interactive Brokers, highlighted that these futures provide a cost-effective method for managing Bitcoin exposure. Similarly, Elad Even-Chen, Group CFO of Plus500, noted that the contracts cater to a broad range of investors, offering a fresh approach to cryptocurrency portfolio management.

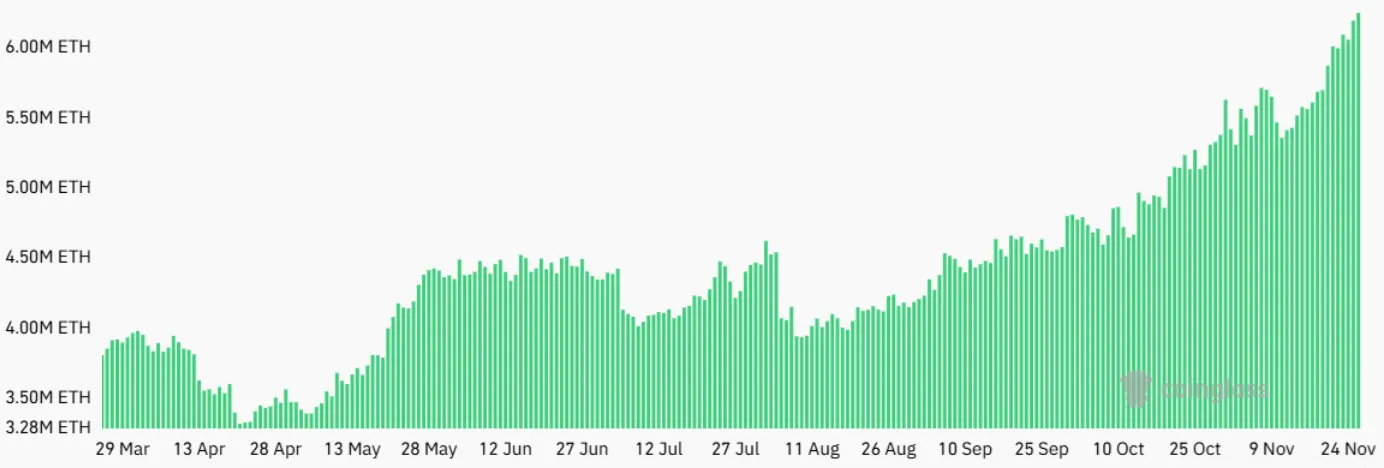

This new offering will join CME Group’s existing suite of Bitcoin futures, which have already seen record volumes in 2024. With 27,900 contracts of open interest, the average daily trading for Bitcoin futures has reached 14,554 contracts. Furthermore, Micro Bitcoin futures have performed well, averaging 37,000 contracts per day with 28,000 contracts accessible for trade.

Crypto News Land, also abbreviated as “CNL”, is an independent media entity – we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.