Six days ago, Ripple’s (XRP) price was $0.63. However, an 11.11% decrease over that period has dragged the cryptocurrency’s value down to $0.56.

As a result, many XRP holders who thought that the initial price increase was a stepping stone to further heights have been left disappointed. But how has this affected the broader XRP holder status at large?

Ripple Takes Its Holders Out of the Money

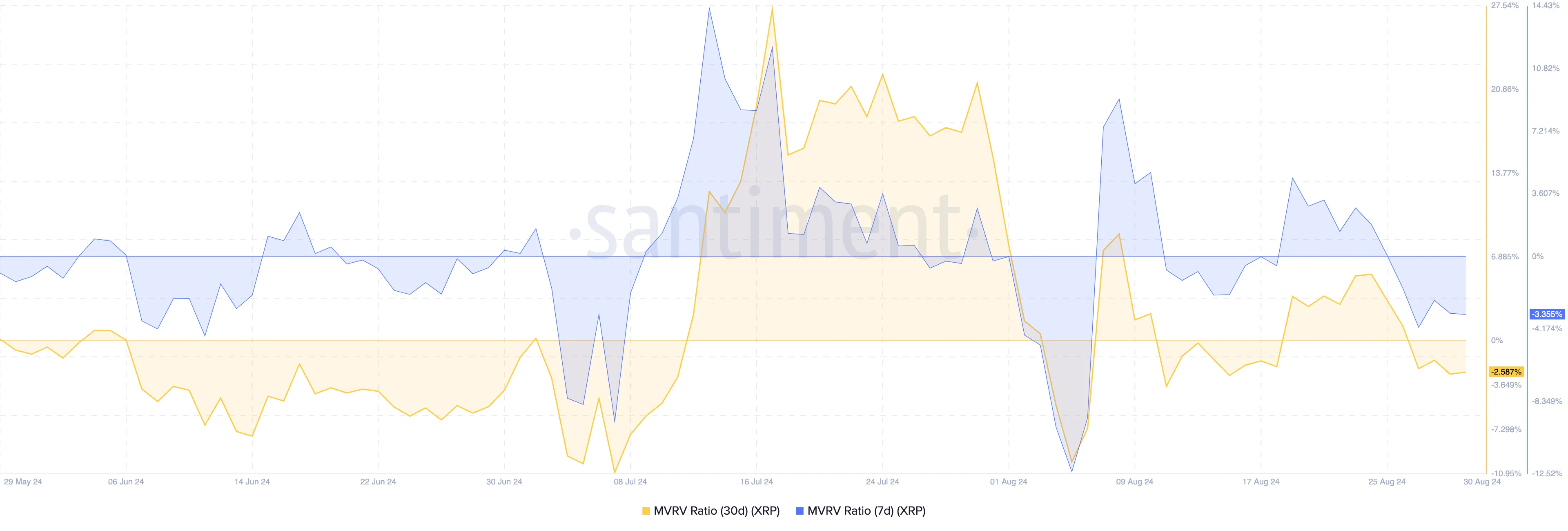

On August 29, BeInCrypto reported that XRP’s price action had recently turned profits for some market participants. However, the situation has since shifted, as indicated by the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio is an on-chain metric that assesses the market’s profitability, helping to identify when an asset might be overvalued (near a peak) or undervalued (near a bottom).

As of August 24, XRP’s 30-day MVRV ratio stood at 5.57%. This suggests that if every holder were to sell, the cryptocurrency would yield approximately 6% in gains. On the same date, the seven-day MVRV ratio was 10.65%, indicating that a higher percentage of XRP holders were sitting on unrealized gains.

Read more: How To Buy XRP and Everything You Need To Know

However, both metrics have recently slipped into negative territory due to XRP’s price performance. This decline means that the average XRP holder now faces the risk of a negative return on investment.

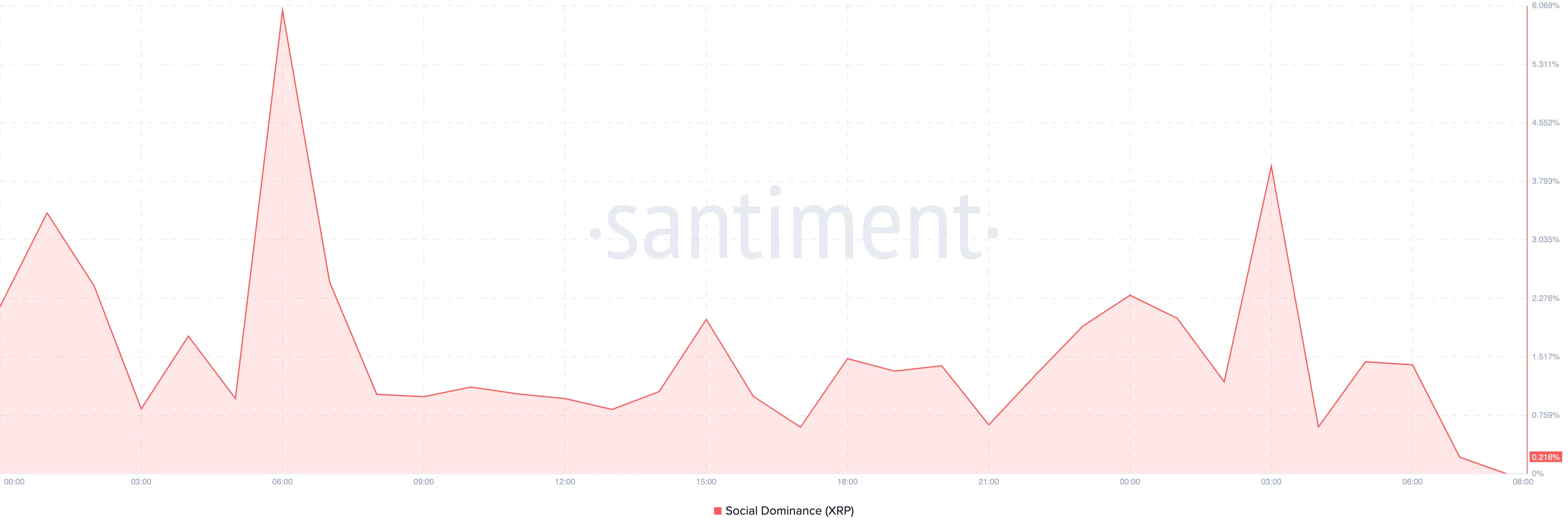

Additionally, data from crypto intelligence platform Santiment shows a decrease in XRP’s social dominance. This metric measures the frequency of discussions around a cryptocurrency relative to others in the top 100 by market capitalization.

A higher social dominance indicates more mentions or posts about a particular cryptocurrency. The decline in XRP’s social dominance suggests that its recent price action has caused many participants to shift their focus from XRP to other cryptocurrencies.

If this trend continues, it could become increasingly difficult for XRP’s price to recover. As a result, more holders may face another round of unrealized losses.

XRP Price Prediction: The Token Could Drop to $0.50

On the daily chart, XRP appears to be following a pattern similar to the one that caused its price to drop to $0.49 in early August. Back then, the token initially traded around $0.62 before quickly crashing.

This time, bulls may need to defend the support level at $0.55 to prevent a similar decline. If they fail to hold this level, XRP could enter a freefall, potentially dropping to $0.50.

Additionally, the Awesome Oscillator (AO), which measures momentum, is currently negative. A positive AO reading indicates bullish momentum and the potential for price increases, while a negative reading suggests that bearish momentum is dominating.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

However, in XRP’s current situation, the negative position of the Awesome Oscillator (AO) could accelerate the downtrend. If this scenario unfolds, the drop to $0.50 might occur within a week or less.

On the other hand, a rebound could be possible if market conditions improve or if market participants start aggressively buying XRP around the $0.56 level. If this buying pressure materializes, XRP could see a jump back to $0.62.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.