- LINK faces bearish pressure despite reduced short-term holder dominance.

- Ichimoku Cloud analysis suggests potential extended bearish conditions.

- Price could consolidate between $10.79 and $12.35, with $13.77 as bullish target.

Chainlink (LINK) finds itself navigating turbulent waters as uncertain market conditions continue to exert bearish pressure on its price, resulting in losses for investors. Despite glimmers of hope for recovery, the broader market environment appears to be constraining LINK’s ability to stage a significant rally.

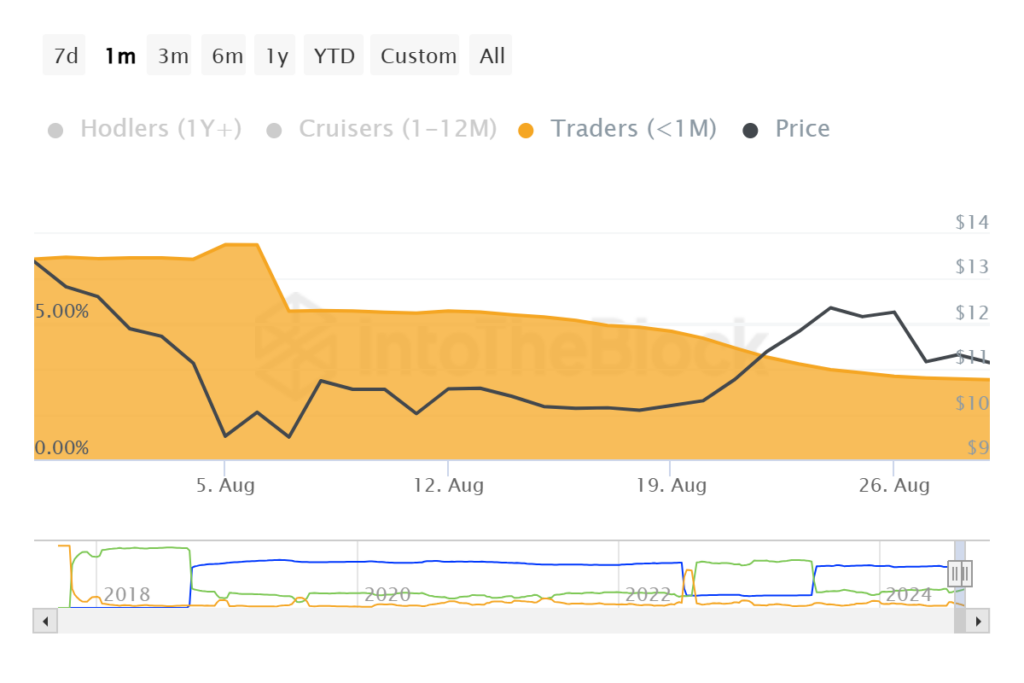

Interestingly, LINK’s price action is unfolding against a backdrop of diminishing influence from short-term holders. This cohort, typically defined as investors holding for less than a month, has seen their dominance plummet from 7.37% to a mere 2.9% over the past four weeks.

Normally, such a reduction in short-term holder presence would be viewed positively, as it suggests a decrease in immediate selling pressure and a potentially more stable investor base.

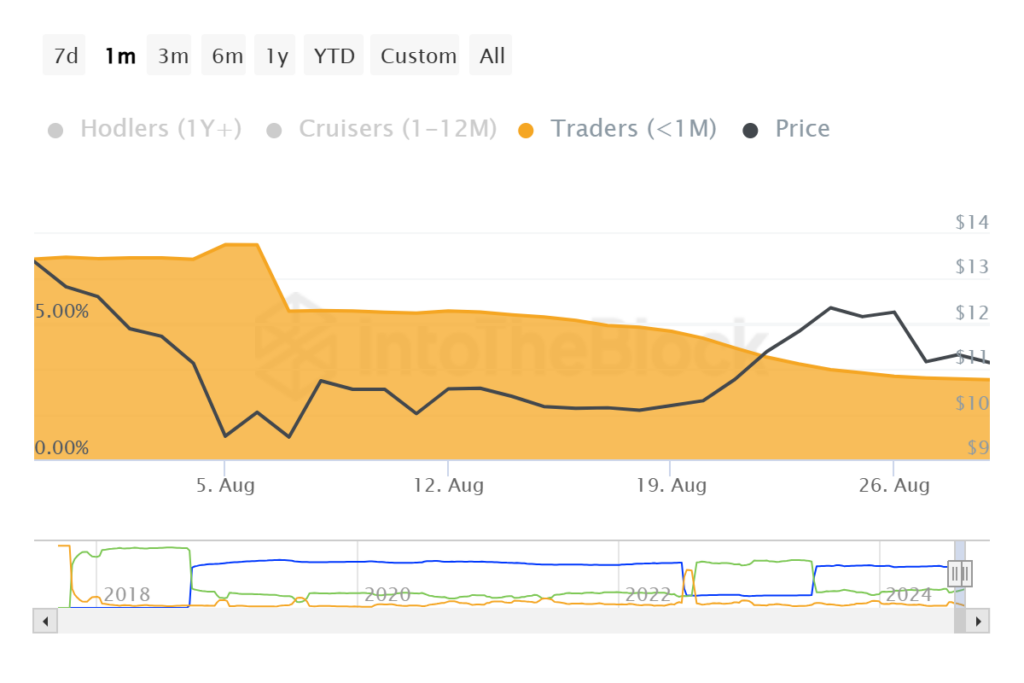

However, this ostensibly bullish development is overshadowed by bearish signals emerging from technical analysis. The Ichimoku Cloud, a comprehensive indicator used to gauge market trends, paints a decidedly pessimistic picture for LINK.

With the cloud persistently positioned above the price candlesticks, the indicator suggests that bearish conditions may persist in the near term.

Chainlink has been extremely volatile recently

LINK’s recent price action has been a rollercoaster of emotions for investors. A brief 30% surge in value nearly triggered a bullish signal, igniting hopes of a sustained recovery. However, this momentum proved short-lived, with prices quickly retracing and extinguishing the potential bullish crossover.

Currently trading at $11.12, LINK finds itself sandwiched between the $12.35 resistance and $10.79 support levels. This price range, while not historically established as a consolidation zone, may become LINK’s new home in the short term, given the conflicting market signals and broader crypto market uncertainty.

Should bearish pressures intensify and breach the $10.79 support, LINK could face a further decline to $9.35, a critical support floor. A drop below this level would effectively erase the recent 30% gains, potentially demoralizing investors and exacerbating selling pressure.