- Solana (SOL) drops 25% in a month, falling below key moving averages.

- Technical indicators suggest continued bearish pressure and low buying interest.

- Price targets: potential drop to $133.64 or $110, with $148.27 as bullish recovery point.

Solana (SOL) finds itself navigating turbulent waters as its value has plummeted by 25% over the past month, recently breaching critical technical support levels.

This decline not only reflects SOL’s ongoing struggle to overcome resistance but also signals a potential erosion of positive market sentiment, potentially paving the way for an extended downward price trajectory.

A closer examination of SOL’s one-day chart reveals a concerning development: on August 27, the cryptocurrency’s price dipped below both its 20-day exponential moving average (EMA) and 50-day simple moving average (SMA).

This occurred following an unsuccessful attempt to stabilize above these key technical indicators. With SOL currently trading at $140, it sits well below its 20-day EMA of $147.72 and 50-day SMA of $155.74.

These moving averages serve as crucial benchmarks for assessing an asset’s price trend. In a downtrend scenario, they often transform into formidable resistance levels, presenting significant hurdles for price appreciation.

SOL’s inability to maintain a position above these averages throughout much of the month underscores the strength of the prevailing bearish sentiment.

Can Solana make a comeback?

A brief surge in buying pressure on August 24 momentarily pushed SOL above these moving averages, offering a glimmer of hope to bulls. However, this rally proved short-lived as profit-taking swiftly brought the price back down, further reinforcing the bearish narrative.

The cryptocurrency’s struggle to sustain momentum above these key levels highlights the lack of robust buying interest necessary to fuel a meaningful recovery.

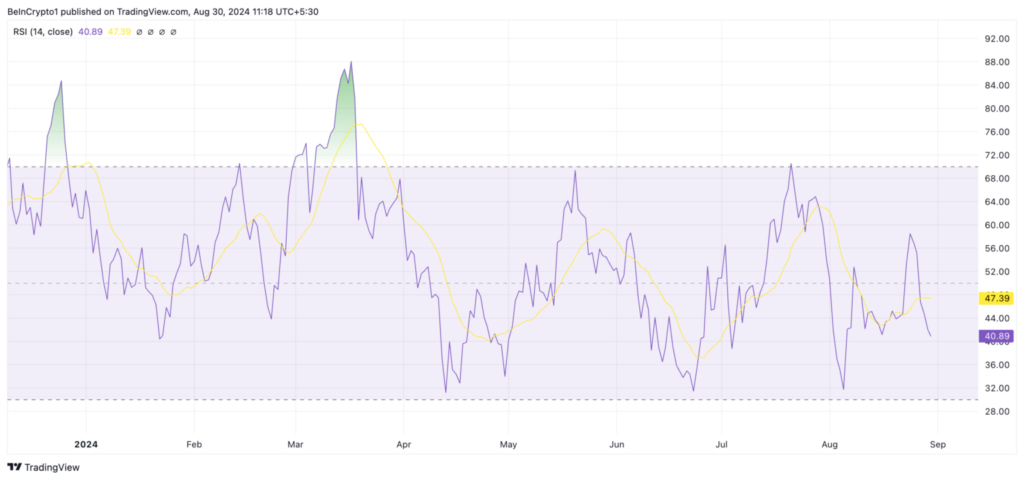

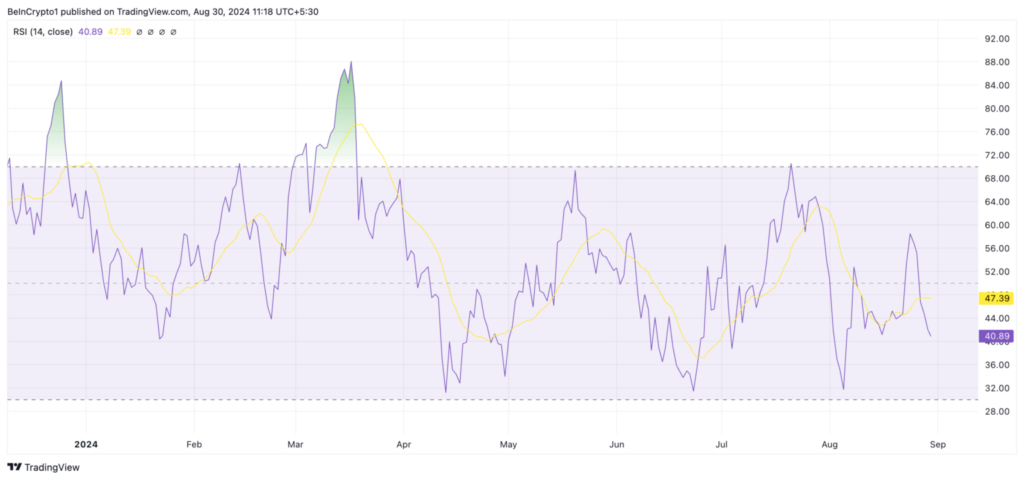

Complementing the bearish signals from moving averages, SOL’s Relative Strength Index (RSI) paints an equally gloomy picture. Currently standing at 40.89 and trending downward, the RSI confirms the dearth of buying pressure in the market.

This technical setup suggests that market participants are more inclined to offload their SOL holdings rather than accumulate, contributing to the persistent downward pressure on price.