Popcat price (POPCAT) recorded a double bottom pattern breakout, soaring over 100% last week. Volume displayed a similar jump, indicating strong indicator optimism.

The token extended last week’s higher high pattern into this week, it could rise nearly 40% over the next seven days. With a 20% retracement over the last five sessions, POPCAT price reached the 20 day EMA support zone. However, the volume change during this retracement was insignificant, indicating that it’s a weak fall.

Yesterday, OKX announced the listing of perpetual futures for POPCAT crypto. This news will improve investor confidence and could extend the bullish rally.

POPCAT Price Primed For Surge to the $0.8000 Mark

After last week’s price surge of over 100%, which was supported by strong buying volume, investors are eyeing the $0.8000 mark. With the volume surge of over 230% last week, investors have added fresh longs. 0.8000 is well within POPCAT’s reach.

Currently, POPCAT price is at $0.6299 with an intraday drop of over 9.20%, indicating profit-booking. While the trading volume surged only by 5% to $126.60 Million.

A 5% surge is relatively insignificant, thus, this week’s 20% retracement is unlikely to dent the overall bullish trend. Today, the POPCAT price retested the 20-day EMA mark and inched closer to the upward trendline support zone of $0.6100. The token could lap up gains in the rising channel and consolidate the bullish trend.

During the second week of August, a double bottom pattern was confirmed near the demand zone of $0.3700 , and POPCAT crypto surged over 80% from that level.

Its Daily RSI curve is still above the midline region, at 54, though it got a slight push from the top, highlighting weak bearish pressure.

POPCAT Crypto by TheCoinRepublic on TradingView.com

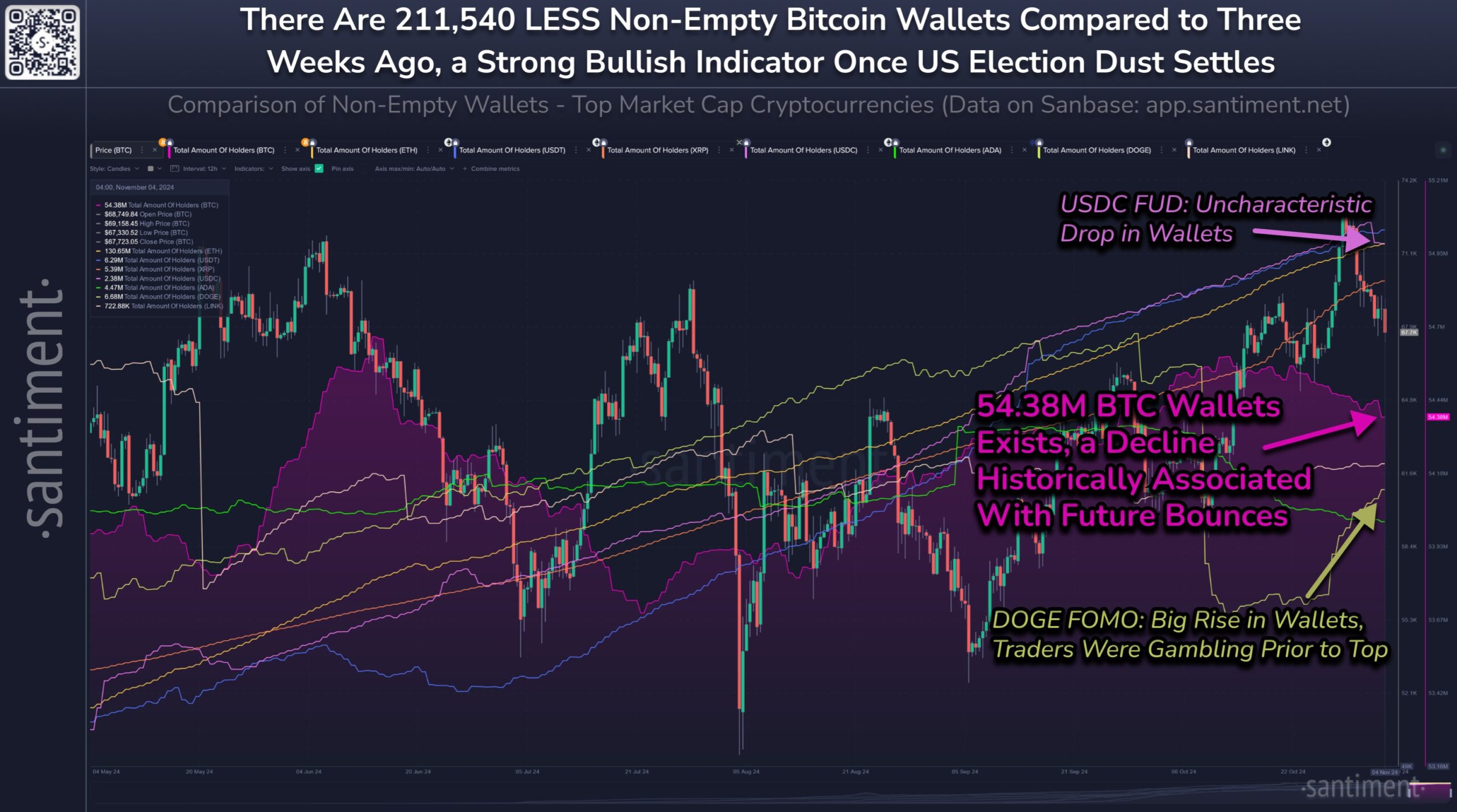

POPCAT Price Chart Source: Santiment

Technical indicators suggest that the higher tops and higher bottoms could extend and the memecoin may revisit its 50% Fib level $0.8000 mark in the coming sessions. Crypto Analyst @AltcoinSherpa highlighted that POPCAT price revisited its strong support zone of $0.6100 and may continue the rise.

Tweet by AltcoinSherpa Source:X

Weighted Sentiment Data Confirms Positive Outlook

Along with the price surge, weighted sentiment data supported the positive price action outlook, as it stayed above the zero line.

Weighthed Sentiment Data Source: Santiment

However, the social dominance data saw a decremental move, as the curve fell below the midine to 0.207.

Futures Open Interest (OI) shed over 9.89% to $51.56 Million, reflecting a long unwinding move in the last 24 hours.

If the token bounces from the 20-day EMA, it may form another higher high and approach the resistance mark of $0.6500, followed by $0.7000. On the other hand, if the token fails to settle near the $0.6100 mark, an immediate fall to $0.5800, followed by $0.5500, is likely.