Key Points

- Key data this week could affect Bitcoin’s price.

- BTC is trading above $57,000 today.

Important economic data set to be released this week, along with important speeches could affect the price of Bitcoin and the overall trajectory of the crypto market.

These events include unemployment and non-farm payrolls ahead of a key meeting of the US Fed later this month that will decide on potential interest rate cuts.

According to data shared via X by Greeks.live, looking at the current trading data, there is a 70% probability of a 25Bp rate cut and a 30% probability of a 50Bp if there’s more pressure on economic data in September.

Top 6 Events Potentially Affecting Bitcoin’s Price

Here are the heavyweight events of the week, according to data from Greeks.live:

- Bank of Canada will announce the interest rate resolution.

- US initial jobless claims for the week will be revealed.

- The US ADP employment data for August is set to be released.

- The US Fed will release the beige book on economic conditions.

- The US unemployment rate for August will be revealed.

- US Fed official speeches will take place this week.

All the economic data mentioned above can affect the trajectory of Bitcoin’s price.

Bitcoin Trades Above $57,000

At the moment of writing this article, Bitcoin is trading above $57,000, down by almost 1% in the past 24 hours.

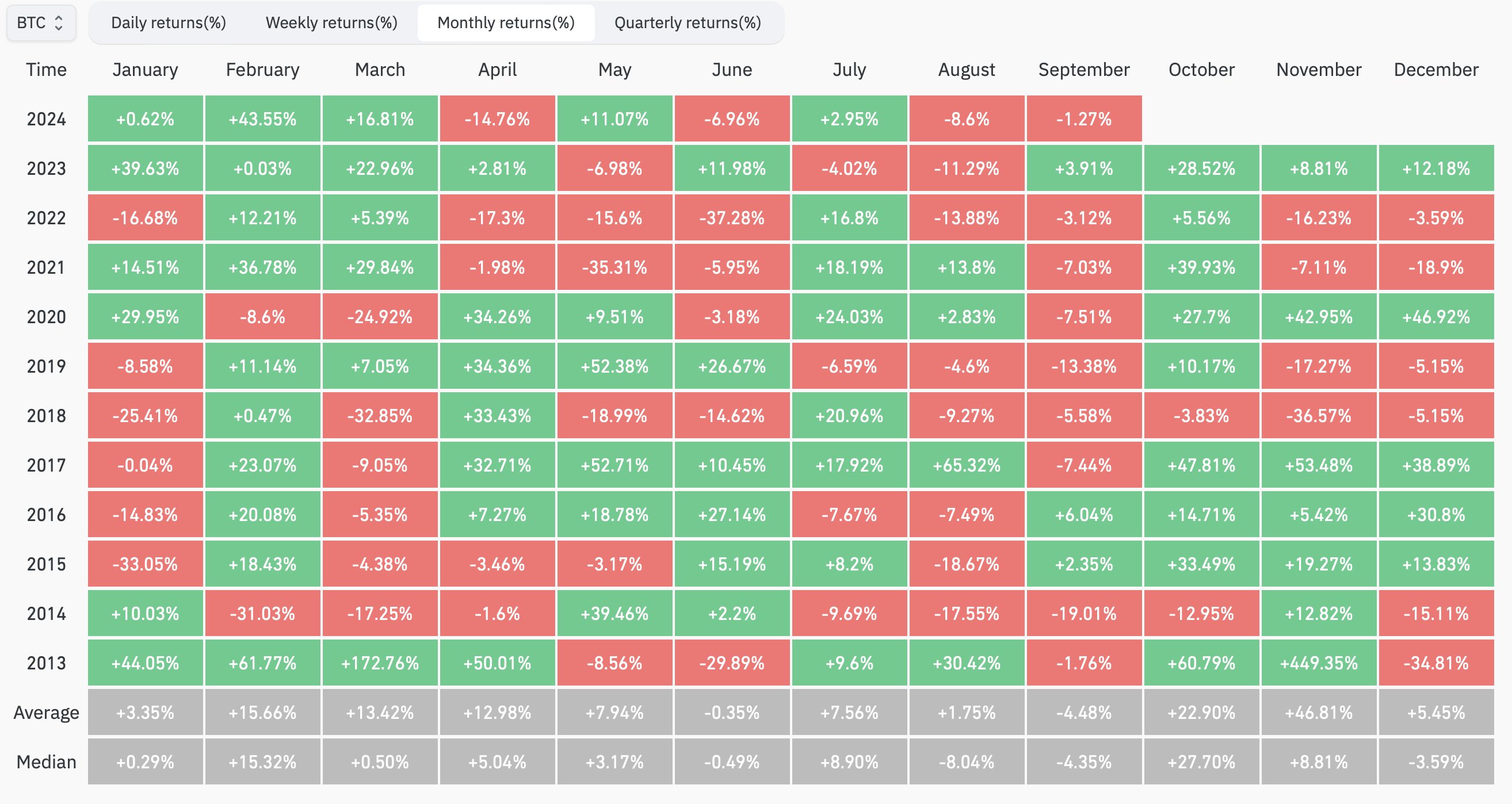

The weak crypto market is not a surprise as, according to previous historical data, September has always been more pessimistic.

Bitcoin recorded price drops between 2% and 19% during previous years.

Now, BTC kicked off September with a 1.27% price drop according to official data.

Crypto Market Outlook

The crypto market is weak at the beginning of this month, and investor confidence is severely low, with IVs relatively stable across all major terms.

Also, mid to long-term IVs continue to fall back slightly and the short-term IVs see a rebound. Options trading moves closer to the US election, with options IV for November 8 expiration significantly higher than other terms.

Regarding the crypto interest rate market, the Bitfinex interest rate market is relatively calm, and the right interest orders can be actively traded.