Key Points

- Historical data suggests that Bitcoin’s price could be bearish in September.

- However, 2024 might be different due to various factors.

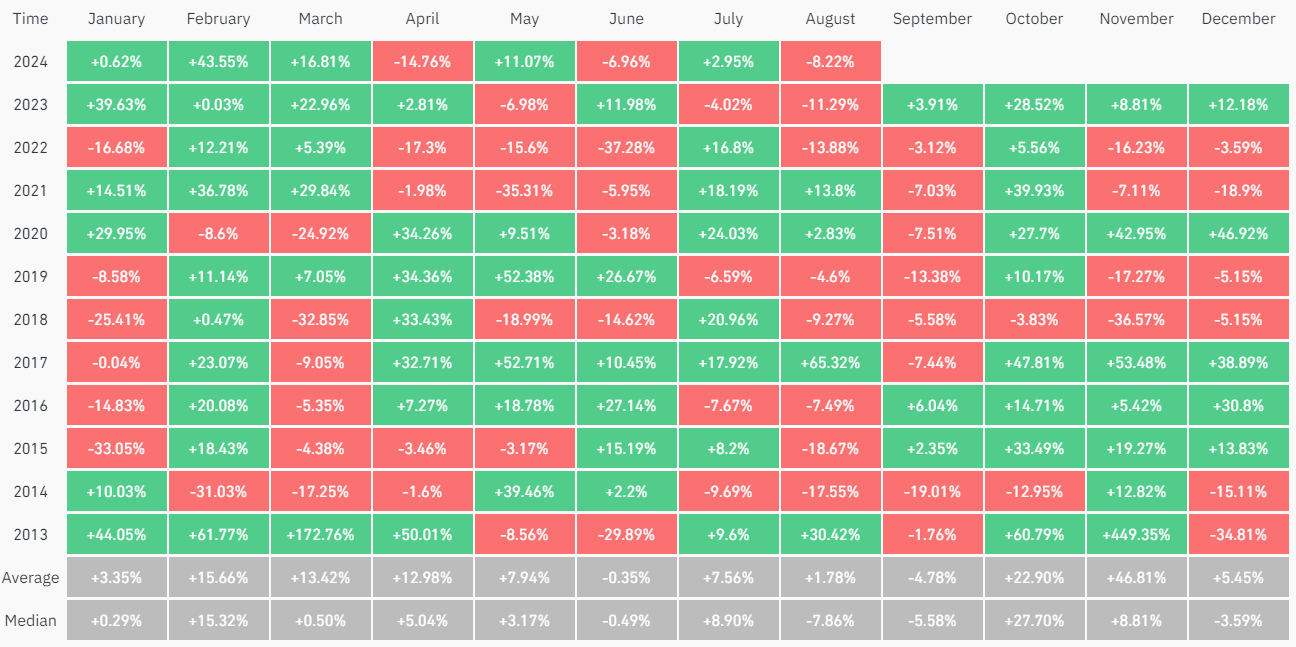

According to historical data, September has mostly been pessimistic for Bitcoin’s price.

Since 2013, previous numbers show a bearish price movement for the most important digital asset, with a few exceptions.

Historical Data – September, the Worst Month for Bitcoin

History has shown that this is the worst-performing month for Bitcoin. If in 2023, BTC saw price drops of a little under 2%, 2014 was the worst year as BTC recorded its most significant price drop in September of over 19%.

However, 2015, 2016, and 2023 data show that Bitcoin’s price was able to see surges in September as well, of 2%, 6%, and almost 4% respectively.

As revealed by the historical price moves of Bitcoin, from 2013 until 2023, September was bearish for BTC, apart from the three exceptions mentioned above.

Even if, overall, BTC’s seasonality shows that this month has been the worst for the digital asset, history might not necessarily repeat itself.

Potential Factors Affecting Bitcoin’s 2024 September Price Moves

Despite Bitcoin’s seasonality, 2024 could see changes in its price trajectory due to multiple factors.

1. Politics – US 2024 Elections

On September 10, the US will witness the main Presidential debate between Kamala Harris and Donald Trump, as CNN reports.

As 2024 is an election year, this is extremely important since Bitcoin and crypto have already become a vital subject debated by political parties.

Without a doubt, the former US President, Donald Trump, has shown that he is a strong supporter of the crypto industry.

Throughout 2024, Trump has made it very clear that his efforts target making the US, the crypto capital of the planet, highlighting on various occasions that the country should stop selling its BTC reserves.

He also revealed World Liberty Financial, the Telegram group run by Trump’s sons, Eric and Don Jr. The group is a rebranding of “The DeFiant Ones,” a reference to the crypto-based concept of decentralized finance (DeFi).

2. Important Macro Data and Potential US Rate Cuts

Also, this month, the US is set to receive important economic data that has usually affected Bitcoin’s price, according to the latest historical info.

The US CPI and PPI data is set to be released this month, along with the important FOMC meeting that will take place on September 18. As noted by Forbes, fixed-income markets expect the Federal Open Market Committee to cut interest rates during the meeting.

So far, there are a lot of hints at a potential rate cut this month, as stated by the Fed Chair Jerome Powell himself.

During the Jackson Hole Economic Symposium speech, Powell said that the time has come for policy to adjust.

According to him, the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

3. Binance’s Changpeng Zhao’s Release

This month, the crypto industry will see another important event – Binance’s Changpeng Zhao’s release from prison.

Last month, the founder of Binance became the subject of premature celebrations on X, as users mistakenly believed that he had been released from prison.

In reality, he is still under US government custody and he’s scheduled to be officially released on September 29, according to official data from the US Bureau of Prisons.

4. US Bitcoin ETFs and Institutional Adoption

2024 is the year that saw the launch of innovative crypto products in the US – the Bitcoin ETFs. 11 BTC ETFs were launched in the country on January 11, and they have been facilitating increased institutional investment in Bitcoin ever since.

This year, Bitcoin and crypto have witnessed enhanced institutional adoption as important names including Goldman Sachs, JP Morgan, pension investment funds and other financial entities have disclosed their positions in Bitcoin ETFs.

Bitcoin ETFs have been important tools triggering accelerated crypto adoption this year.

All these factors mentioned above, along with other developments in the Bitcoin ecosystem, favor 2024’s September as a potential exception to historical Bitcoin seasonality that showed bearish price movements for the month.