- The Fear and Greed Index reached lows not seen in a year.

- The decline in Social Volume and positive engagement outlined the market despondence.

The Crypto Fear and Greed index stood at 29 at press time.

It showed fear was prevalent in the market, but was still better than the previous month when heavy price corrections affected the market-wide sentiment, worse than the recent drop below $60k.

Source: Alternative.me

The overwhelmingly negative sentiment in the market saw a week-long, hefty torrent of outflows from the Bitcoin [BTC] spot ETFs. On the other hand, El Salvador continued to buy 1 BTC a day.

The weakest sentiment in a year

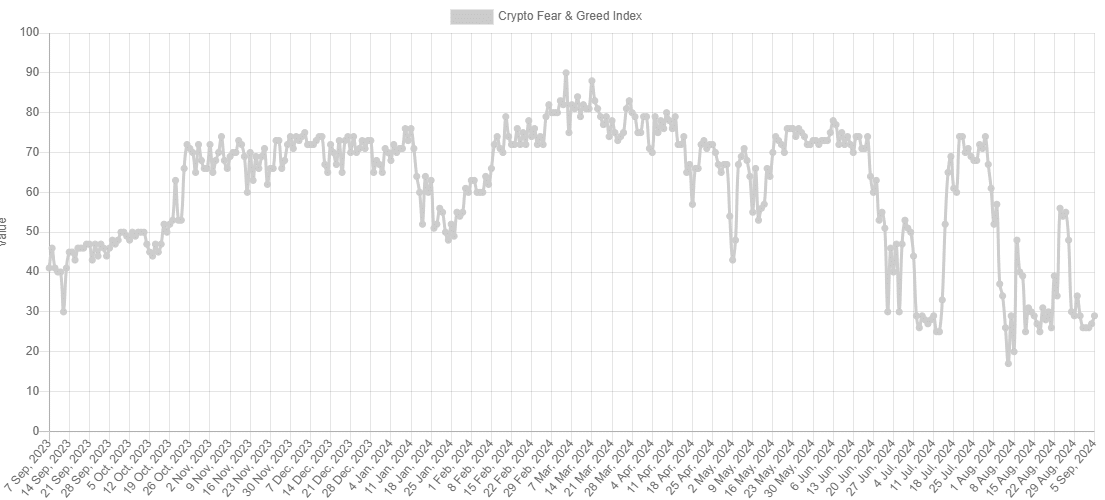

The Fear and Greed Index is a useful tool that gives investors an idea of when to buy and when to sell. Extreme fear readings are generally a good buy opportunity in crypto, while euphoric markets tend to mark price tops.

The Index values are calculated based on the behavior of Bitcoin, since the king coin largely dictates the crypto market behavior. This includes volatility, market momentum, and social media engagement.

Source: Alternative.me

The Crypto Fear and Greed Index had been quite hopeful in May, but the sentiment has soured since then.

The promised bull run after the halving event in April did not take off immediately, but the continued downtrend since March has crypto investors very worried.

In July and again in early August, the Index values reached lows below 30 that were not seen for a year.

At press time, the value of 29 was also a significantly low one, but it might be a buying opportunity for the next 6–12 months.

Examining Bitcoin’s metrics

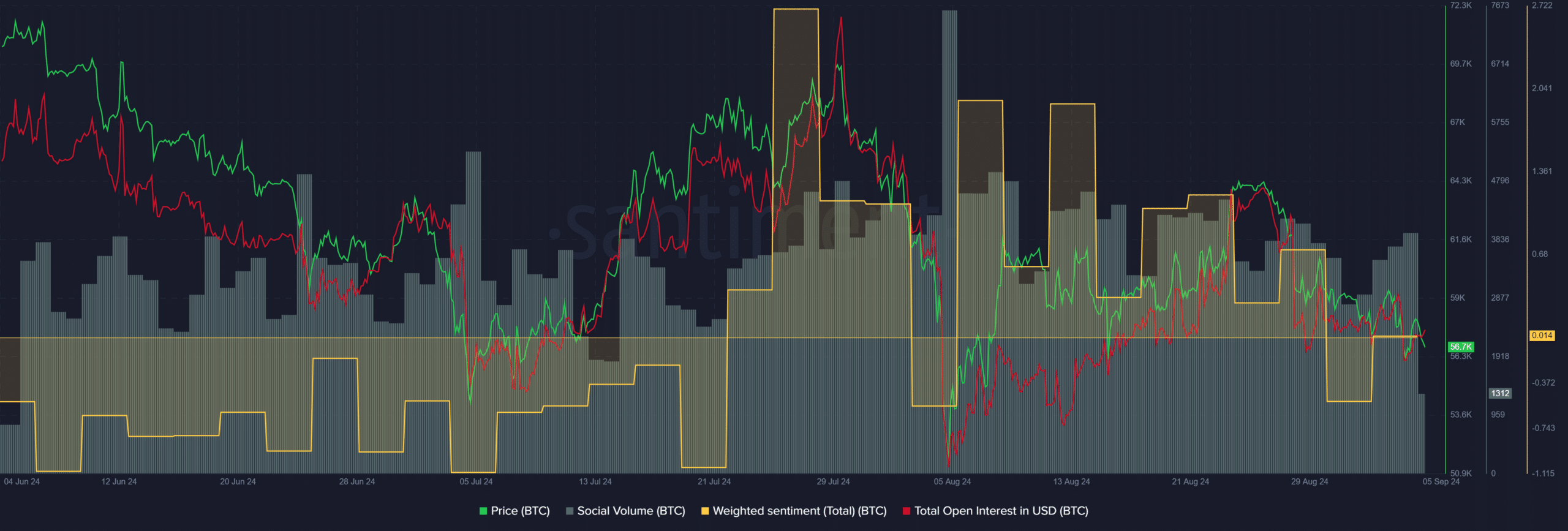

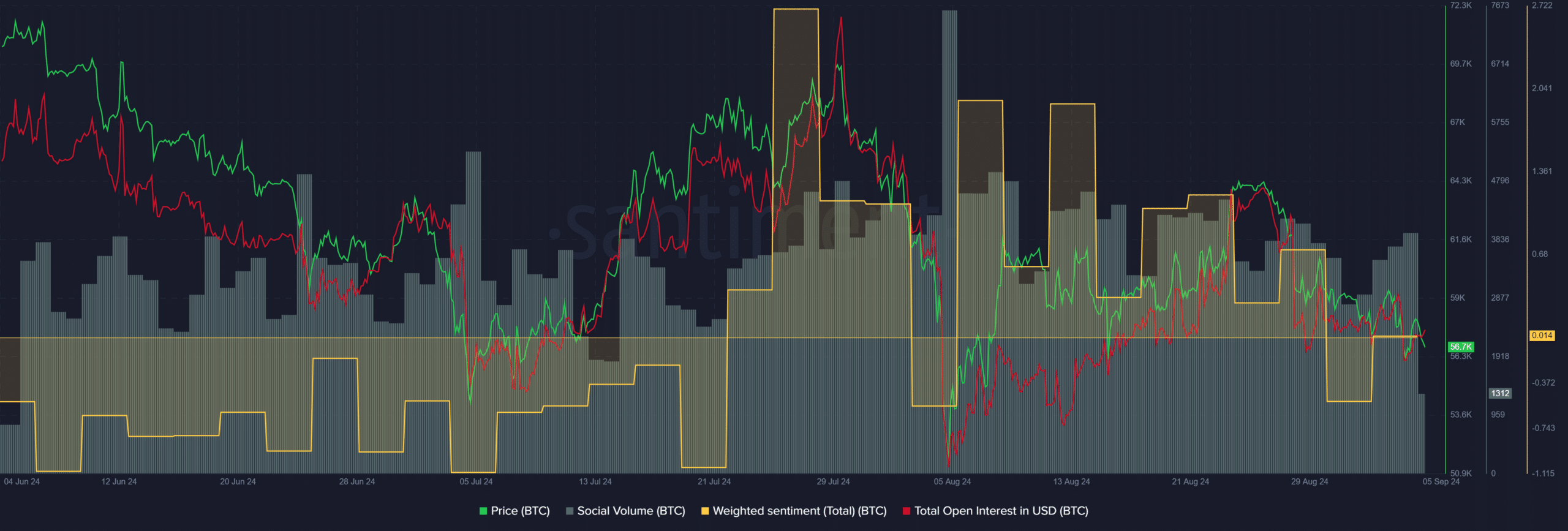

Source: Santiment

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s Social Volume has slowly declined over the past month. The Weighted Sentiment, which had been positive when Bitcoin reclaimed the $60k level in mid-August, began to climb lower in the past three weeks.

The Open Interest also fell swiftly when BTC was rejected at the $64k resistance zone. Overall, the market sentiment was bearish and those looking to buy were in the minority.