🚀 Stay Ahead with AltcoinDaily.co! 🌐

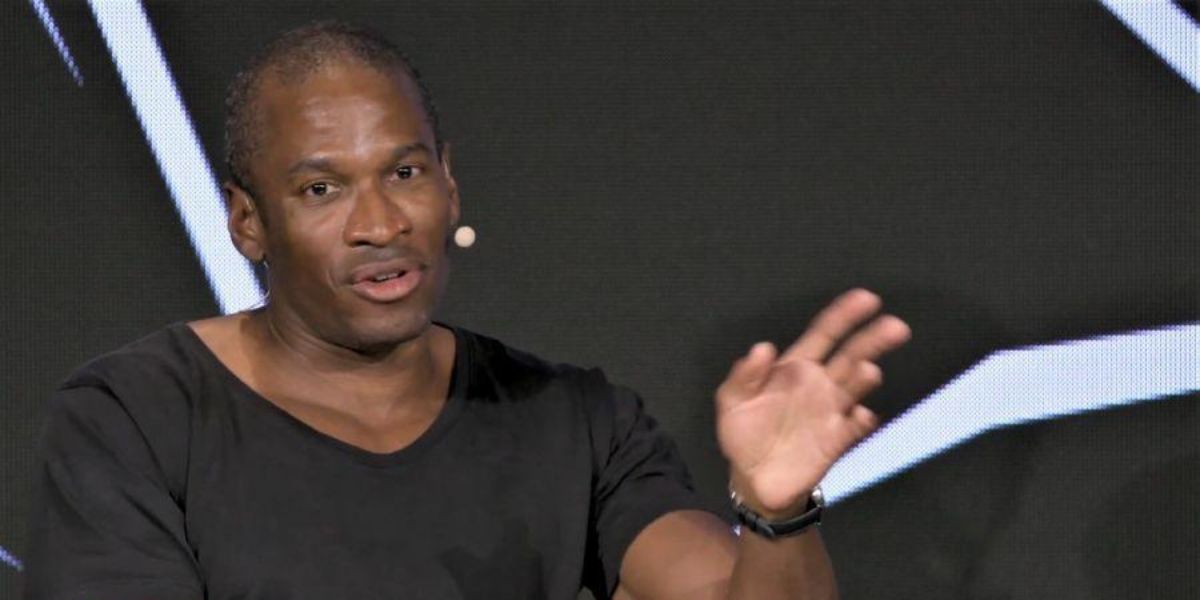

The price of Bitcoin experienced significant turbulence on Friday, plunging from $57,000 to just below $53,000 in a matter of hours. This rapid drop shook the market, with some investors, including prominent figures like BitMEX co-founder Arthur Hayes, seizing the opportunity to short the cryptocurrency. Hayes has predicted a potential upward momentum in the days ahead.

Friday’s Flash Crash

Bitcoin’s sharp decline followed the release of the U.S. August jobs report, which initially seemed like a positive trigger for the market. The report revealed a slight drop in unemployment rates, prompting a brief surge in Bitcoin’s value, spiking $1,500 to hit $57,000.

However, the optimism was short-lived, as bears took control and drove the price down by over $4,000, pushing the cryptocurrency to a monthly low of under $53,000.

🌟 Unlock Crypto Insights with AltcoinDaily.co! 💰

Arthur Hayes, a well-known Bitcoin bull, saw this as an opportunity to open a short position, setting his sights on a further drop below $50,000 over the weekend. Given Bitcoin’s erratic price behavior, this move was not unexpected. However, Hayes closed his short position with a modest 3% profit, suggesting that Bitcoin’s price may rebound soon.

Yellen’s Speech: A Potential Catalyst?

Hayes cited an upcoming speech by the U.S. Treasury Secretary Janet Yellen as a possible reason for Bitcoin to rally. His decision to close his short position indicates that he believes market sentiment could shift, especially if Yellen’s speech has a significant impact on the economic outlook, monetary policy, or inflation.

With Bitcoin’s history of reacting strongly to macroeconomic events, Hayes opted to take profits early rather than risk a sudden price surge.

🦂 AltcoinDaily.co is your trusted source for the latest in crypto news and insights. 🚀

Hayes’ Long-Term Belief in BTC

This isn’t the first time Hayes has made bold predictions about Bitcoin. In May, he expressed confidence that Bitcoin had reached a local bottom and would see gradual growth. While that prediction initially seemed accurate, the market faced setbacks, including large-scale sell-offs by the German government and repayments from the Mt.Gox creditors.

Hayes’ Maelstrom Fund also announced a new Bitcoin grant program in July, aimed at supporting the development of Bitcoin’s technical infrastructure. The initiative highlights Hayes’ long-term belief in Bitcoin, even amid short-term volatility.

As of writing, Bitcoin is trading at around $54,500, down 6.5% over the past week. According to the data by CoinMarketCap, it currently boasts a market capitalization of $1.07 trillion.