The value of Telegram-linked Toncoin (TON) dropped after the arrest of the platform’s CEO, Pavel Durov. This dip created a buying opportunity for large holders, or whales, who quickly took advantage by accumulating more TON.

As the altcoin begins to recover, these whales are now positioned to profit from the rebound, signaling a potential upward trend in the coming days.

Toncoin Whales Make Their Presence Known

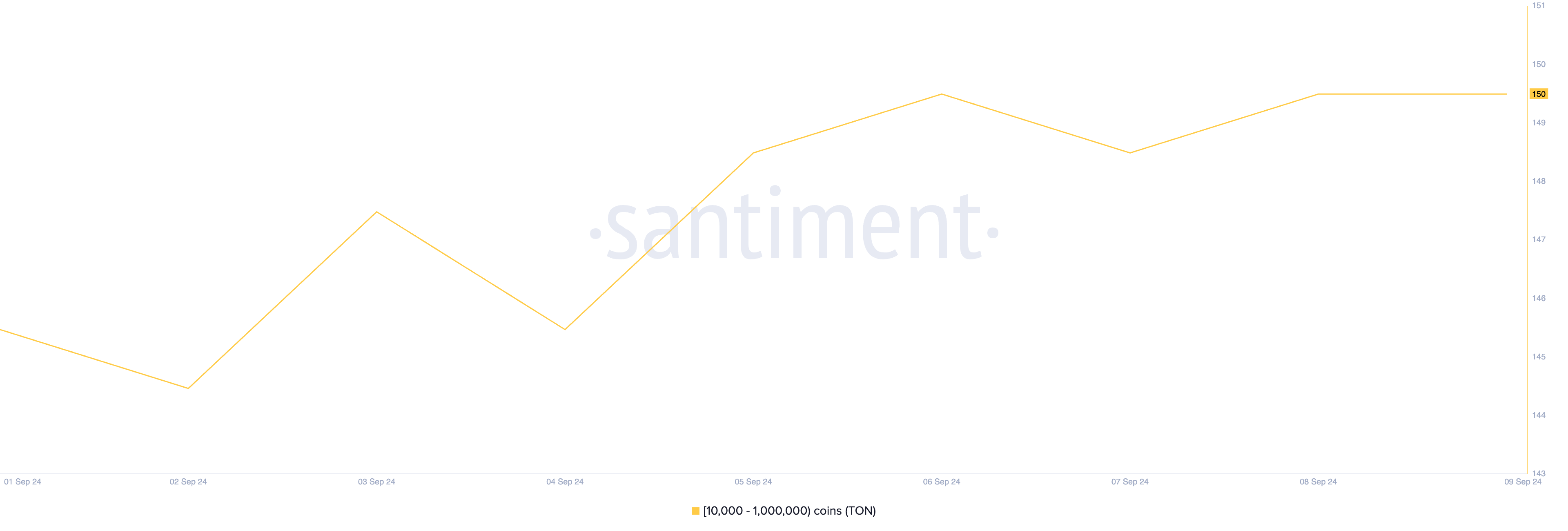

Santiment’s data shows a notable increase in TON whale count over the past few days. According to the on-chain data provider, addresses holding between 10,000 and 1,000,000 TON have risen by 3% in the last week.

For context, when French authorities arrested Telegram CEO Pavel Durov on August 24, this group of investors offloaded a significant portion of their holdings, causing the whale count to drop to a 30-day low of 131 addresses. This mass selling contributed to a sharp double-digit decline in TON’s price within 24 hours.

However, as the market stabilizes, these whales have returned, accumulating more TON. Currently, they control 53.17% of the altcoin’s circulating supply.

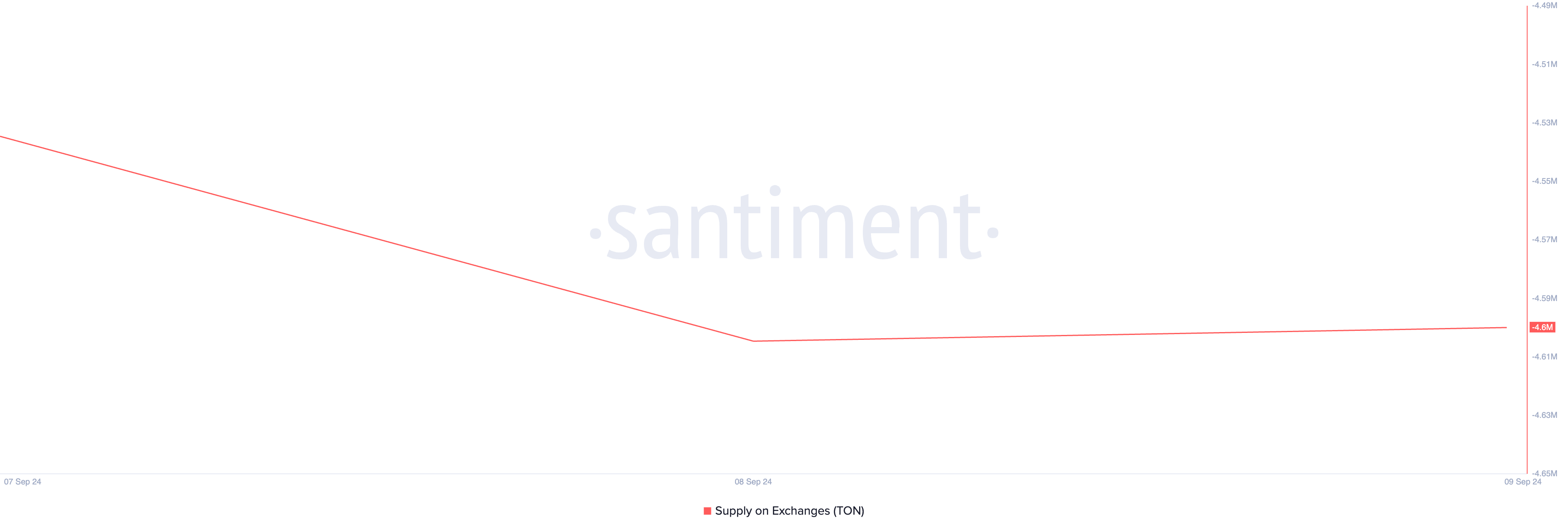

In addition to the rise in whale activity, there’s been a decline in selloffs among TON holders. Santiment reports a 5% drop in TON tokens held on exchanges since September 4, suggesting that holders are moving their assets to private wallets, indicating a long-term holding strategy.

Read more: 10 Best Altcoin Exchanges In 2024

This reduction in supply on exchanges could lessen selling pressure, potentially driving up TON’s price if demand remains stable.

TON Price Prediction: Market Shifts Toward Accumulation

Readings from Toncoin’s moving average convergence/divergence (MACD) indicator on the one-day chart confirm rising demand in recent days. Currently, the MACD line (blue) is positioned to cross above the signal line (orange), a setup that traders often see as a bullish signal. This crossover suggests a shift in market momentum toward upward price movement, potentially signaling a buying opportunity and encouraging traders to exit short positions and take long positions.

If demand for TON continues to grow, this bullish momentum could push the token toward $5.32, where it would test a critical support level. A successful breakthrough could set the next price target at $5.95.

Read more: 6 Best Toncoin (TON) Wallets in 2024

However, if profit-taking intensifies, these bullish projections may be invalidated. Increased selling pressure could drive Toncoin’s price down to $4.51.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.