- Bitcoin’s next price peak could occur in mid-2025, following historical halving cycles & a projected 518 to 546 day rally.

- Re-accumulation after the 2024 halving may precede Bitcoin’s next parabolic rise, similar to past cycles.

- Institutional movements & market sentiment signal upcoming volatility, with Bitcoin maintaining $1.1 trillion market cap.

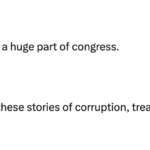

As Bitcoin approaches next halving event in April 2024, historical data indicates that cryptocurrency may see a price peak between mid-Sept and mid-Oct 2025. This prediction is based on past halving cycles, where Bitcoin peaked 518 days after the 2016 halving and 546 days after the 2020 halving.

Notably, Bitcoin’s acceleration in the current cycle, which is approximately 84 days ahead, suggests a shift in its timeline. The longer the consolidation period after the halving, the more it may align with previous cycles.

Pre-Halving Rally and Re-Accumulation Phases

The pre-halving rally has historically set the stage for Bitcoin’s post-halving gains. In the 2016 and 2020 cycles, Bitcoin rallied for 518 and 546 days, respectively, leading to significant price increases. Currently, Bitcoin is following a similar upward trend, with the rally projected to last 74 to 78 bars (around 500 days). This indicates that further price growth may occur leading into the April 2024 halving.

However, after the rally, Bitcoin has typically entered a re-accumulation phase, marked by price consolidation before the next major upward movement. If this trend continues, the post-halving period could see another re-accumulation before Bitcoin’s next parabolic rise.

Institutional Movements and Market Sentiment

Institutional activities continue to play a critical role in shaping Bitcoin’s price dynamics. Recently, Galaxy Digital transferred 1,458 BTC (approximately $78.5 million) to Coinbase, raising questions about upcoming sales.

Read CRYPTONEWSLAND on

google news

This movement occurred amid volatile market conditions, with Bitcoin experiencing notable outflows from ETFs, totaling $706.19 million over the past week. Despite these outflows, the broader market has shown resilience, as both Ethereum and Solana saw slight increases in price. This indicates diversified investor interest across different assets.

Bitcoin’s Current Price and Trading Volume

Bitcoin recently reclaimed the $54,000 level, trading at $54,308.23 with a slight 0.09% increase over the past 24 hours. However, trading volume dropped significantly by 64.20% to $17.4 billion, reflecting current market conditions. Bitcoin’s price movements remain closely watched, particularly as market cap holds at $1.1 trillion, solidifying its position as the leading cryptocurrency.

Crypto News Land, also abbreviated as “CNL”, is an independent media entity – we are not affiliated with any company in the blockchain and cryptocurrency industry. We aim to provide fresh and relevant content that will help build up the crypto space since we believe in its potential to impact the world for the better. All of our news sources are credible and accurate as we know it, although we do not make any warranty as to the validity of their statements as well as their motive behind it. While we make sure to double-check the veracity of information from our sources, we do not make any assurances as to the timeliness and completeness of any information in our website as provided by our sources. Moreover, we disclaim any information on our website as investment or financial advice. We encourage all visitors to do your own research and consult with an expert in the relevant subject before making any investment or trading decision.