Bitcoin market performance has been underwhelming since its peak above $73,000 in March 2024. Instead of building on this rally, the top crypto has faced continued consolidation coupled with a series of declines, frustrating many investors.

Currently, Bitcoin is down 22.7% from its March high, raising concerns over whether this signals the start of a deeper bear market. The decline has shaken confidence, with market analysts now questioning the near-term outlook for the digital asset.

Related Reading

Bitcoin Price Continous To Struggle, Why?

Analysts from IntoTheBlock, a market intelligence platform, have recently shared insights on X, reflecting the changing sentiment. In a post uploaded earlier today, the analyst noted:

Bitcoin’s price remains under pressure, with no significant upward momentum. The market, once hopeful for a rally, now faces growing uncertainty as both retail and institutional interest appear to be dwindling.

The analysts asked, “is this just a quiet phase or the start of a prolonged bear market?”

To answer this question, IntoTheBlock first assessed Bitcoin price struggles and the factors contributing to the lackluster price movement.

Mentioning “macro landscape,” the market intelligence platform disclosed that the possibility of a global recession looms large, creating a cautious outlook for risk assets like Bitcoin.

They noted that although many expect rate cuts soon, these measures may take time to affect Bitcoin and other cryptocurrencies positively. Meanwhile, until that happens, the broader macro environment will likely continue to pressure market sentiment and investor confidence.

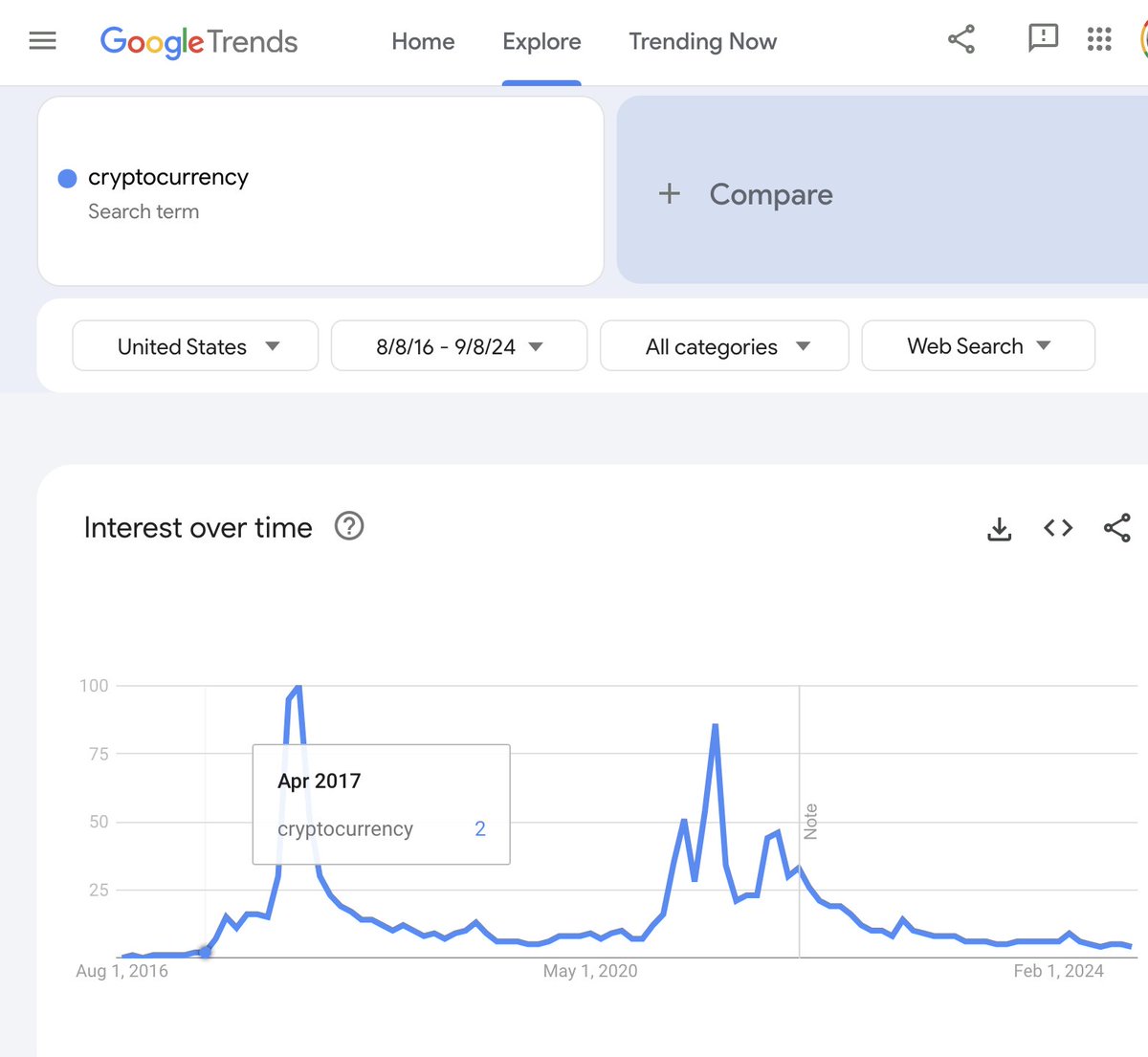

Furthermore, IntoTheBlock touched on the interest in cryptocurrencies, which has also been declining sharply in recent months.

According to the market intelligence platform, search trends related to Bitcoin and other digital assets have significantly decreased, reflecting a drop in public interest.

Even app rankings for major crypto exchanges like Coinbase have fallen, suggesting fewer users engage with the market. This trend has extended to on-chain metrics, where the number of new Bitcoin addresses remains low, indicating a slowdown in market participation.

Should You Panic?

While the current downturn has raised concerns, analysts from IntoTheBlock see potential parallels to Bitcoin’s price action in 2019. They noted:

Historical Bitcoin halving cycles suggest it could be a post-halving dip, something we’ve seen before. Parallels to 2019: Interestingly, many analysts point out the current phase mirrors 2019, where the market also slowed down after a (local) high. Back then, the market experienced a prolonged consolidation before turning bullish again. Could we be on the same path?

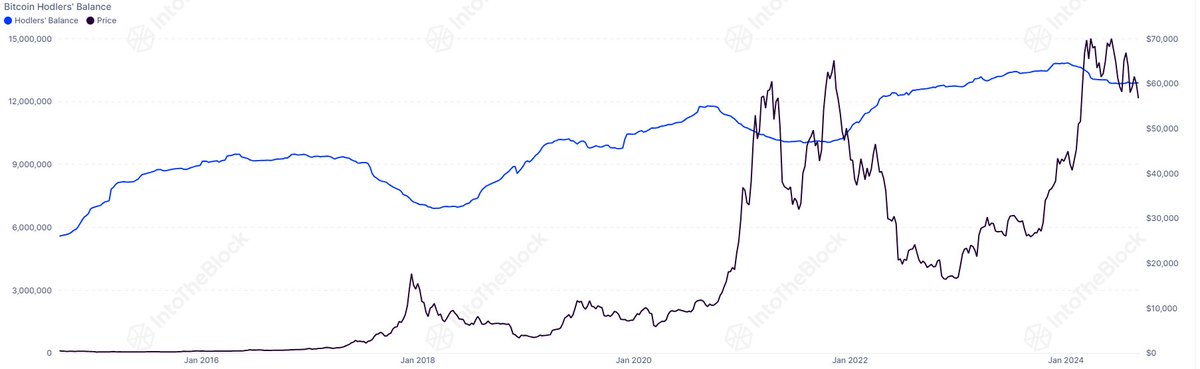

IntoTheBlock further highlighted that “other cycle data tells a different story.” The market intelligence platform noted that in recent weeks, the balances of long-term Bitcoin holders have hit new lows, echoing post-peak trends from previous market cycles.

According to IntoTheBlock, this could signal a “prolonged cooldown” phase for Bitcoin, potentially delaying any significant price recovery.

Related Reading

The analysts noted that while the market faces uncertainties, there are no definitive answers. They concluded:

There are no clear-cut answers, but by considering past cycles and current data, we can stay open to possibilities Keep track of both on-chain data and macro factors—they will be critical in determining what comes next

Featured image created with DALL-E, Chart from TradingView