Key Points

- Ethereum profitability dropped post-Dencun upgrade.

- However, ETH has successfully scaled and seems ready to onboard the masses.

Even if both Ethereum bears and bulls camps are polarized, both theses have compelling arguments on their sides regarding the future trajectory of Ethereum.

ETH Bear Case

1. Profitability Dropped Post Dencun Upgrade

Profitability has dropped post the Dencun upgrade and it doesn’t look like things will change soon, according to the bears’ thesis about the price trajectory of ETH.

On March 13, 2024, the blockchain underwent a series of nine Ethereum improvement proposals (EIPs) collectively called the Dencun Upgrade. The hard fork was intended to enhance the network’s scalability and efficiency while reducing transaction fees across L2 networks, passing savings to the end user.

Bears believe that L2s will not make ETH deflationary again, but instead:

- L2s will only make ETH deflationary if they saturate both the blob and regular fee markets

- L2s aren’t beholden to a specific bath posting cadence to L1

- The combination of the above means L2s will constantly maneuver around each other to avoid creating a high-fee environment for themselves

The concept of blob space was introduced by Dencun – the expansion of block pace on Ethereum meant for L2s to post their batch data to.

2. L2s Are Becoming Fragmented

L2s are becoming fragmented, which is substantially degrading UX and becoming a significant barrier to widespread adoption. The bear thesis noted that Solana on the other hand, has shown the potential of a monolithic chain and ecosystem.

3. DeFi Utility is Called Into Question

There are various projects which are basically memes with “predatory tokenomics.” and the low-FDV meta is designed to extract as much value from retail into VC pockets. In other words, most of the upside for new tokens is usually captured privately, before the token even exists.

4. ETH ETFs’ Performance Was Low Compared to Bitcoin ETFs

2024 saw the launch of Ethereum ETFs but their performance was not as high as the one of Bitcoin ETFs. The products saw more outflows than inflows, as SoSoValue data shows. As of September 10, the total net assets locked in ETH ETFs is $6.5 billion, compared to the ones in BTC ETFs totaling $52.2 billion.

The ETH ETFs failed to trigger too much interest this year so far and Bitcoin remains the main focus from an institutional and political perspective.

ETH Bull Case

1. Transactions on ETH and L2s Hit ATHs

Transactions on ETH and L2s have hit ATHs with transaction prices close to lows. According to the bull scenario, ETH has successfully scaled following the Dencun upgrade and it’s ready to onboard the masses.

2. Ethereum TVL is 56%

Also, ETH’s TVL surpasses one of its nearest competitors without counting L2s. L2 TVL is still value-locked within the ETH ecosystem, and much of this value should ultimately accrue to ETH holders.

ETH’s TVL is 56.29%, followed by Tron with 10% and Solana with 6%.

3. ETH Remains the Primary Institutional-Grade Chain

Bulls’ scenario also highlights that ETH is still the primary institutional-grade chain, battle-tested over the years, with the highest developer activity.

Also, many of the smartest minds in the space are collaborating on the ETH roadmap, and any institutional onboarding will be done on ETH, whether it’s RWAs and on-chain tokenization, prediction markets, and so on.

4. DeFi Narrative Could Shift

Ethereum’s underperformance in 2024 has coincided with a rotation from DeFi to memes, but this narrative could be shifting.

Also, developments such as Coinbase’s cbBTC and Vitalik Buterin-backed L2 MegaETH may stimulate a new round in DeFi speculation.

Ethereum has continued to find killer apps this year with Polymarket being a great example. Its rising popularity was more than obvious ahead of the US elections.

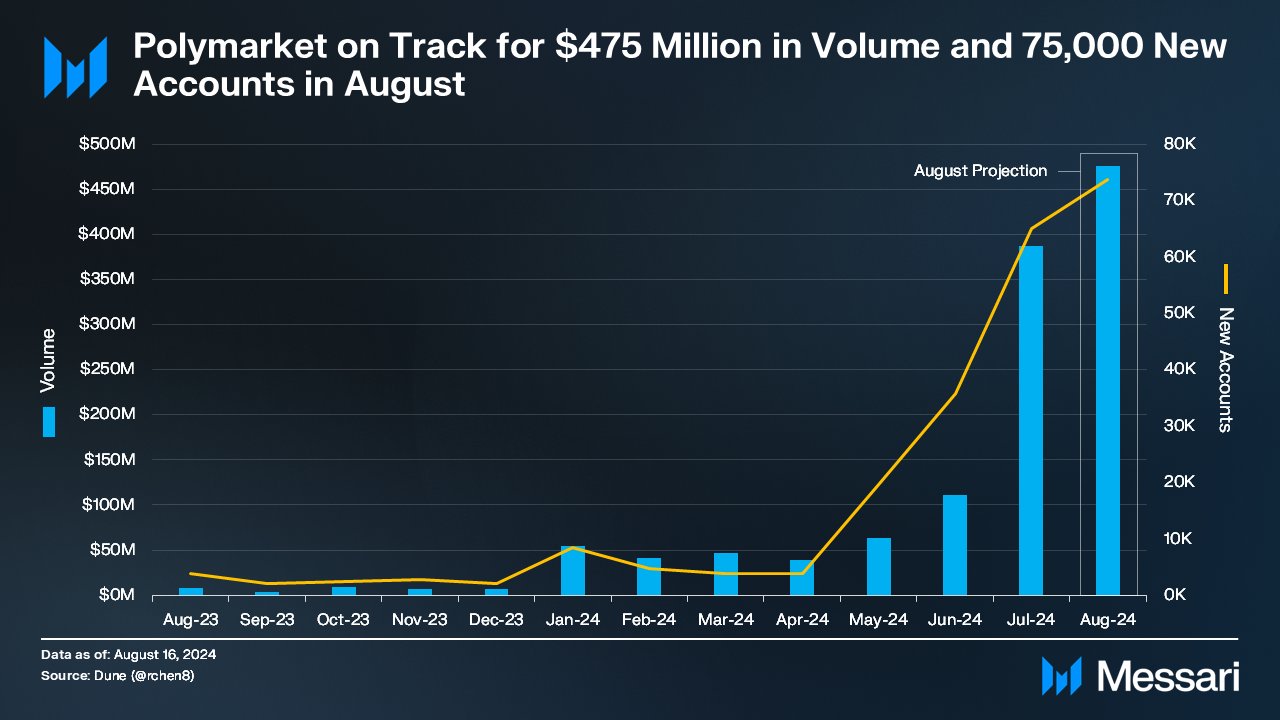

Messari’s Nick Garcia recently said that it’s hard to argue that Polymarket is not the crypto app of the year with 75,000 new accounts only in August.

5. Interoperability Solutions in the Works

There are various interoperability solutions in the works, and in a few years, we may barely need to know what chain we’re connected to. These protocols include:

- LayerZero

- Synapse Protocol

- Omni

- Wormhole

6. Ethereum ETFs

The Ethereum ETFs were launched in very different conditions compared to the Bitcoin ETFs. More than that, they suffered terrible price optics, putting off potential investors – this is the main explanation for their lack of success, compared to the Bitcoin ETFs.

Even if now, the most political and institutional focus is on Bitcoin, as it becomes more accepted, they will begin to ask what’s next and obviously Ethereum is the answer.

Both bear and bull cases have strong arguments regarding the future of Ethereum, but the bulls one definitely looks more compelling in the long term.