Key Points

- Options data shows a significant decline in IVs across all major terms.

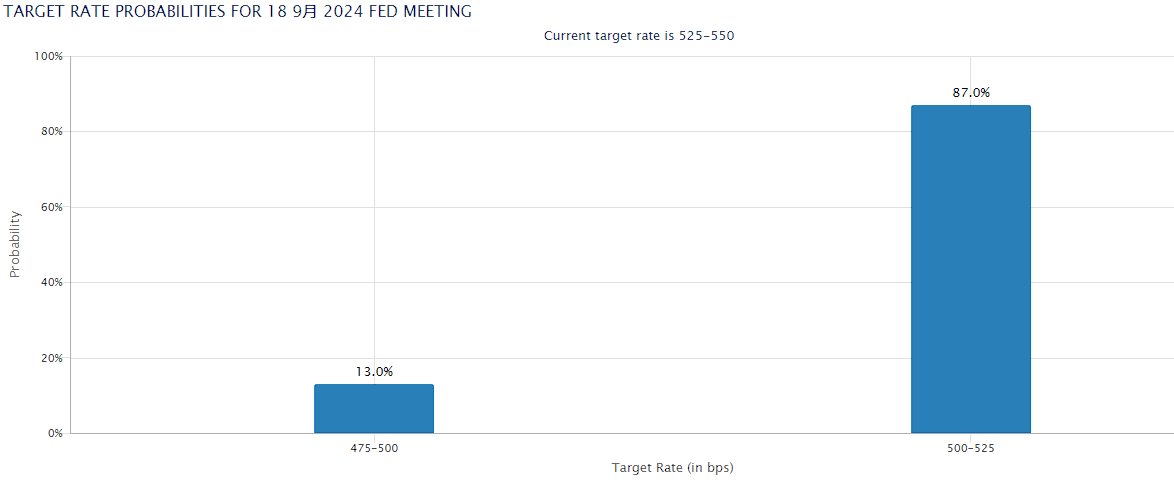

- The probability of next week’s rate cut in the US is 87% for 25 bps and 13% for 50 bps.

According to the latest reports provided by Greeks.live, options data shows important info, ahead of next week’s US interest rate cuts.

Significant Decline in IVs Across All Major Terms

In a new post via X shared today, Greeks.live notes that options data is showing a significant decline in IVs across all major terms.

According to them, the market volatility expectations are falling short, and the market theme for September is still oscillating.

Implied volatility is essentially a measure of how much the market believes the price of the underlying asset will move in the future.

30-day IV shows a volatility metric of 61.31%, the 3-month IV shows over 68% and the 6-month IV shows over 71%, according to their graph.

The crypto market did not see significant volatility during this week and was filled with important economic data and political events.

The UC CPI results came in showing eased numbers for August, there was a Presidential debate between former US President Donald Trump and Kamala Harris, and yesterday, the US commemorated 9/11.

After the price of Bitcoin dropped close to $55,000 yesterday, today the digital asset made a comeback above $58,000. At the moment of writing this article, BTC is trading above $58,000 up by over 2% in the past 24 hours, while ETH is trading above $2,300, up by 1% in the past day.

Bitcoin’s price is expected to be affected by next week’s decision by the US Fed regarding potential rate cuts.

The Probability of a Rate Cut of 25 Bps Reaches 87%

Greeks.live also noted in their post that this week is coming to a smooth end, and the US presidential debate, along with other macro data released this week, didn’t bring significant volatility in the crypto market.

Accoridng to their notes, the US Fed rate cut expectations are gradually converging. The team mentioned the interest rate trading data provided by the CME which shows that the probability of next week’s rate cut of 25 bps in now 87% for the upcoming FOMC meeting.

The probability of a rate cut of 50 bps is only 13% according to their notes.

A new report from Reuters notes that the US Fed will lower interest rates by 25 basis points at each of the US central bank’s three remaining policy meetings in 2024. They cited a majority of economists in a Reuters poll.

The Fed’s meeting will take place next week, on September 18.