- Dogecoin demonstrated some bullish strength amid signs of accumulation

- DOGE large holder inflows confirmed that bulls have been buying

Dogecoin has been hitting lower lows in its price action lately as part of the larger market’s bearish sentiment. These are outcomes that have been eroding confidence in the market’s most-popular memecoin.

Nevertheless, it attempts a bullish recovery every once in a while. And, recent observations suggest it may already be in such a situation.

Dogecoin kicked off this week with some bullish momentum which was short-lived. Nevertheless, that attempted upside may just be a sign of a potential move in the coming days. The king of memecoins has been moving sideways for the most part over the last 5 weeks.

And yet, despite this, its Money Flow indicator (MFI) implied that a lot of accumulation has been taking place.

The MFI bottomed out at just below 20 on 5 August, with the same recovering to 63.87 at press time. Its RSI flashed a similar observation.

In fact, it recently pushed above its mid-point, while not demonstrating significant sell pressure to push it below that level. Simply put, Dogecoin bulls are building up momentum on the charts.

Are Dogecoin whales accumulating?

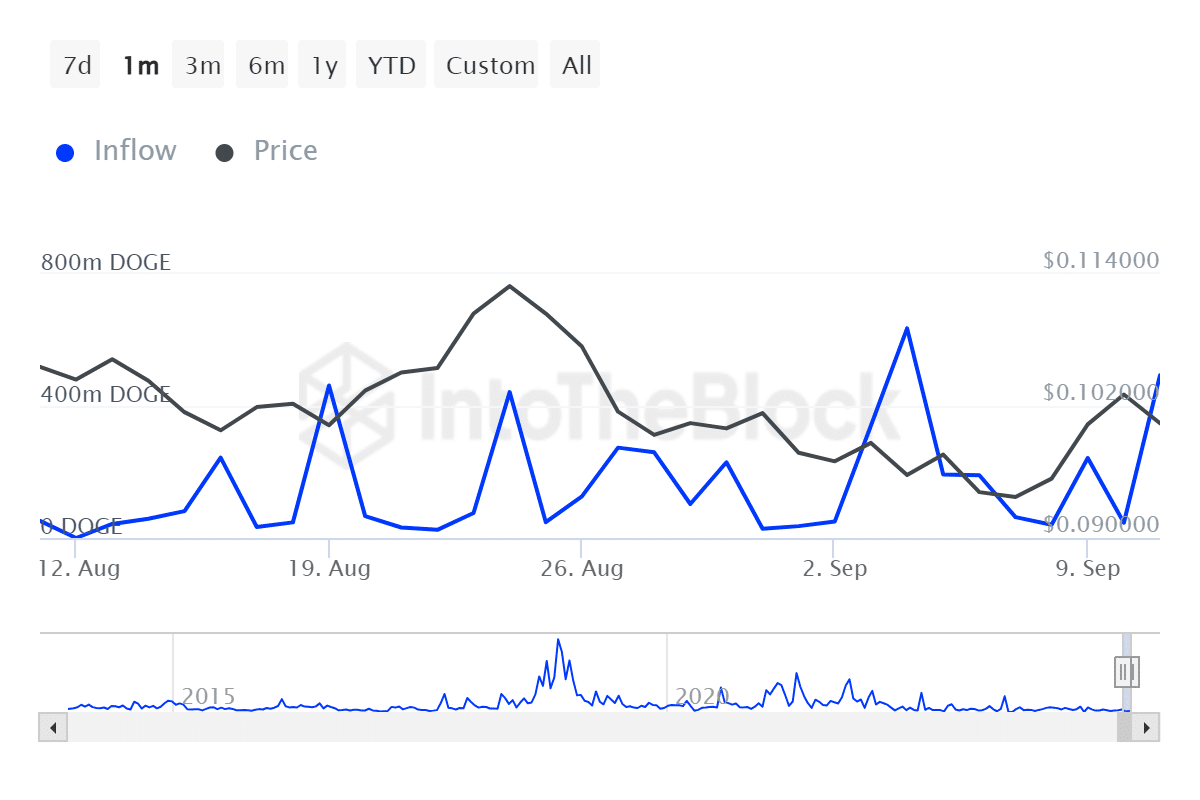

On top of that, on-chain data revealed that whales have been accumulating recently. According to Dogecoin’s large holder inflows metric on IntoTheBlock, whales’ holdings spiked to 493.15 million DOGE in the last 2 days alone.

The spike indicated that large holders added a substantial amount to their balances, confirming a healthy level of accumulation. On the contrary, large holder outflows shifted from 442.12 million DOGE to 78.17 million during the same period.

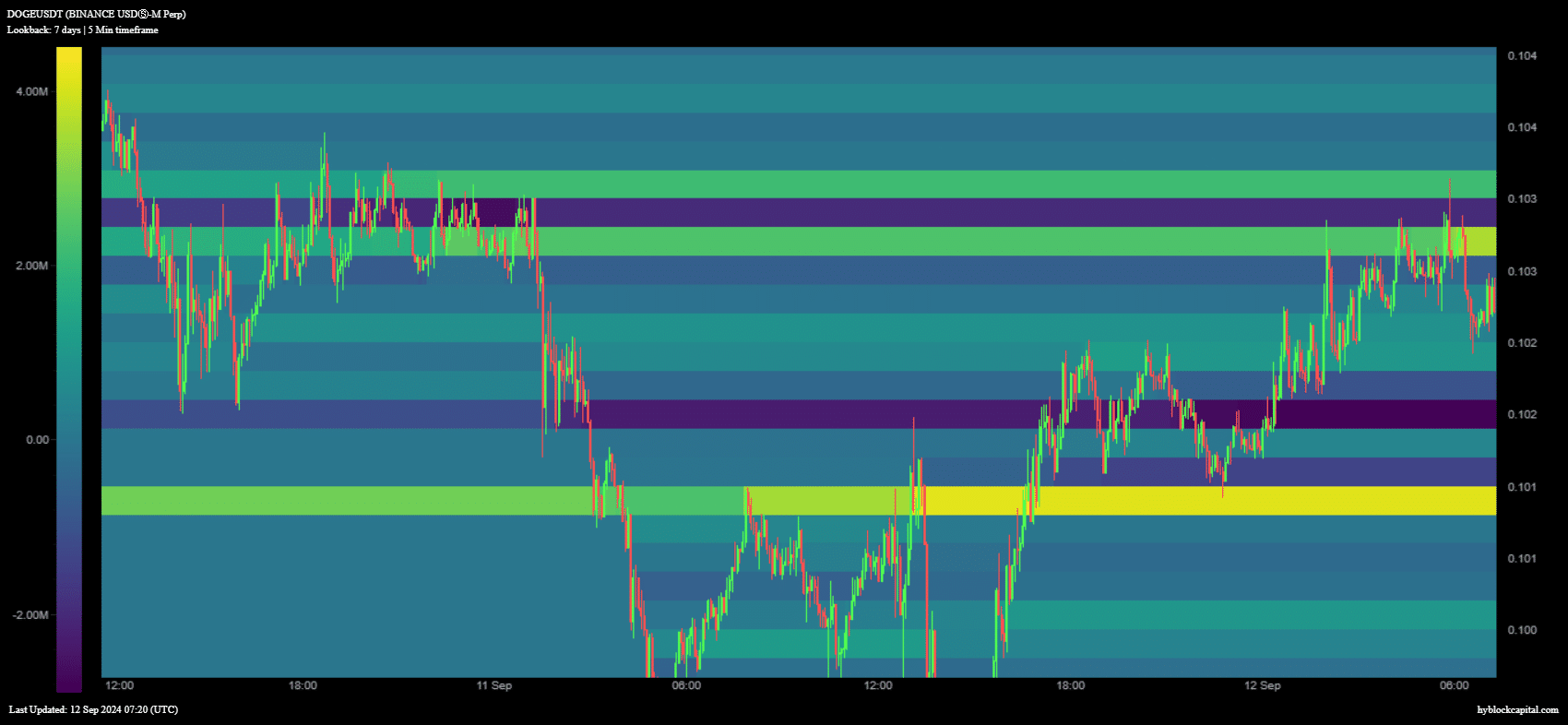

The large holder flows confirmed that whales shifted guard, from contributing to sell pressure, to add to their balances. Meanwhile, Dogecoin’s net longs heatmap highlighted a retest of hot zone where long positions have been flowing in. This seemed to be at the $0.101 price level.

The number of long positions peaked at the aforementioned price zone. In fact, there were roughly 4.154 million long positions at the $0.101 level during its latest retest.

The highest number of net shorts within the same price zone was 1.54 million net shorts. And, the price has since gone up too. To put it simply, the net longs versus net shorts situation confirmed that bullish sentiment was higher, at the time of writing.

Based on the aforementioned observations, Dogecoin could be on the verge of a noteworthy rally in the coming days. This is assuming that there will not be an unexpected FUD event that will trigger an erosion of the growing confidence.