In the latest development in the U.S. SEC lawsuit against Binance, Binance.US, and co-founder Changpeng Zhao, the government agency requested the court to amend its complaint. The filing came in response to a district court order denying crypto exchange Kraken’s motion to dismiss in SEC v. Payward case. The agency regrets using crypto asset securities in the case and agrees that 10 tokens are not securities in themselves.

US SEC Files to Modify Complaint in Binance Case

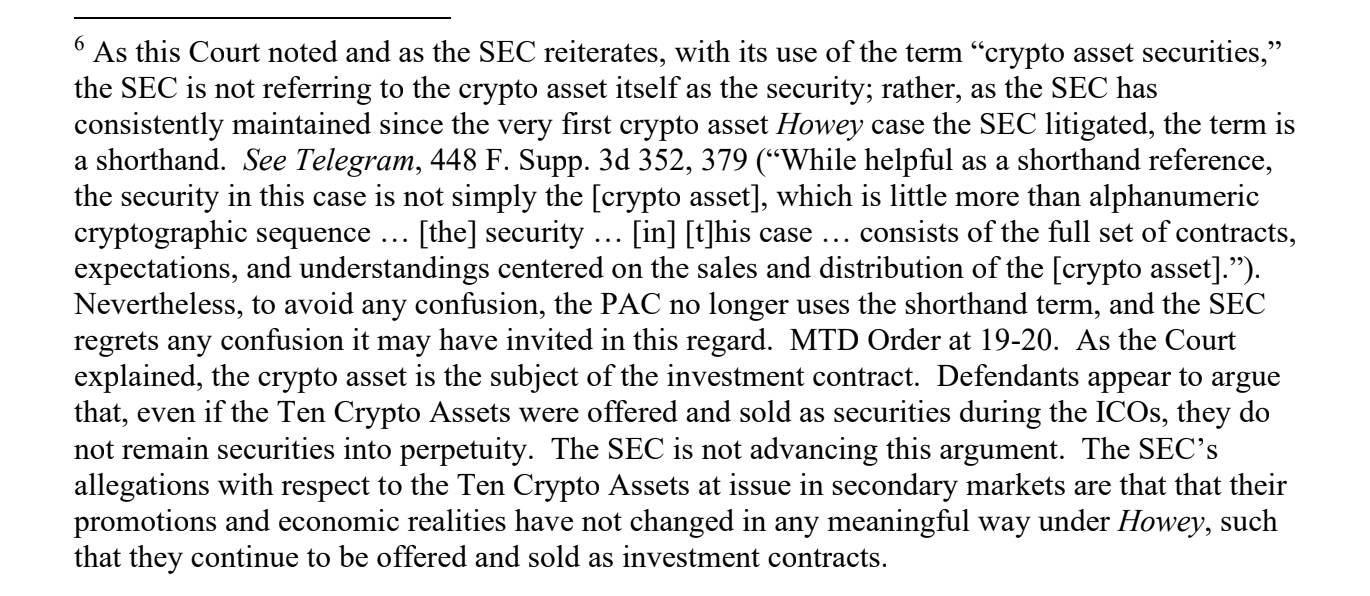

In the latest District Court of Columbia filing in SEC vs Binance, the plaintiff the U.S. Securities and Exchange Commission filed a motion for leave to amend the original complaint regarding “crypto asset securities.”

The regulator has submitted the proposed amended complaint (PAC), a redline comparing the PAC to the original complaint, and, for the court’s reference because it is not yet published on widely available legal databases, the order denying defendants’ motion to dismiss in Kraken vs SEC lawsuit.

Binance is required to file either an opposition or notice of their consent to the SEC’s request by October 11 this year. The agency will continue its regulation by enforcement approach to assert control over the crypto industry.

Coinbase CLO Paul Grewal Reacts to SEC Filing

Coinbase chief legal officer (CLO) Paul Grewal took to X and shared a footnote in the proposed amended complaint by the SEC against Binance. He pointed out that “The SEC regrets any confusion it may have invited” by falsely and repeatedly stating that 10 tokens including SOL, ADA, MATIC are securities in themselves.

He mentioned Ripple CLO Stuart Alderoty in the post citing a notable shift in the SEC’s approach or clarification on its stance regarding the use of the term “crypto asset securities.” Recently, Ripple CLO challenged the thinking of regulators against crypto regarding money laundering.

He further added that ETH has somehow come out of the SEC’s scrutiny but the 10 tokens have failed to avoid the regulator’s nuanced approach towards crypto. The agency will continue to allege the 10 crypto assets at issue in secondary markets and also that they are sold as investment contracts.

Last point of the night:

That @SECGov absolutely “maintained” that tokens themselves are securities is clear from the long record of their regulation by enforcement campaign. Why mislead the Court?— paulgrewal.eth (@iampaulgrewal) September 13, 2024

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: