- DOGE has surged by 13.14% over the last 7 days

- Some analysts are eyeing a 102% surge to $0.22

Dogecoin [DOGE], the world’s largest memecoin by market cap, has seen strong upward momentum over the past month. This, despite the fact that much of the crypto-market has been stuck in a vortex of volatility for a while now.

In fact, at the time of writing, DOGE was trading at $0.1062 following a 1.08% hike over the last 24 hours. The memecoin also registered significant gains over the past week, surging by 13.14% on the charts.

The memecoin’s high trading volume underlined DOGE’s resilience. Figures for the same soared by 30.75% to $643.9 million over the last 24 hours. Over the same period, its market cap hiked to $15.4 billion too.

Needless to say, these market conditions have sparked optimism among key market players. Popular crypto analysts like Javon Marks are even predicting a 102% hike, citing a recent breakout.

Could market sentiment be key?

In his analysis, Marks claimed that the breakout from the falling wedge is now confirmed following a breakout retest.

In context, when a breakout is confirmed, it means the price has broken through the upper resistance line of the wedge, suggesting a potential trend reversal. Usually after the breakout, prices often retest the breakout level. The retest is mostly perceived as a confirmation that the breakout is valid and offers a foundation for further uptrend.

Based on this analysis, the breakout positions DOGE for a massive rally, one where it might surge by by 102% to $0.22 in the short run. According to the analyst, there might also be a sustained bull run to hit $0.6533 in the long term.

Therefore, if the current breakout remains valid and DOGE sustains its current momentum, it might see significant gains.

Any answers on DOGE’s charts?

Over the past month, DOGE has recorded a strong upswing, hiking by 3.55%. As noted by Marks’s analysis, the breakout from the descending channel now positions the memecoin for further gains.

Therefore, these prevailing market conditions could set the memecoin for sustained gains on the price charts.

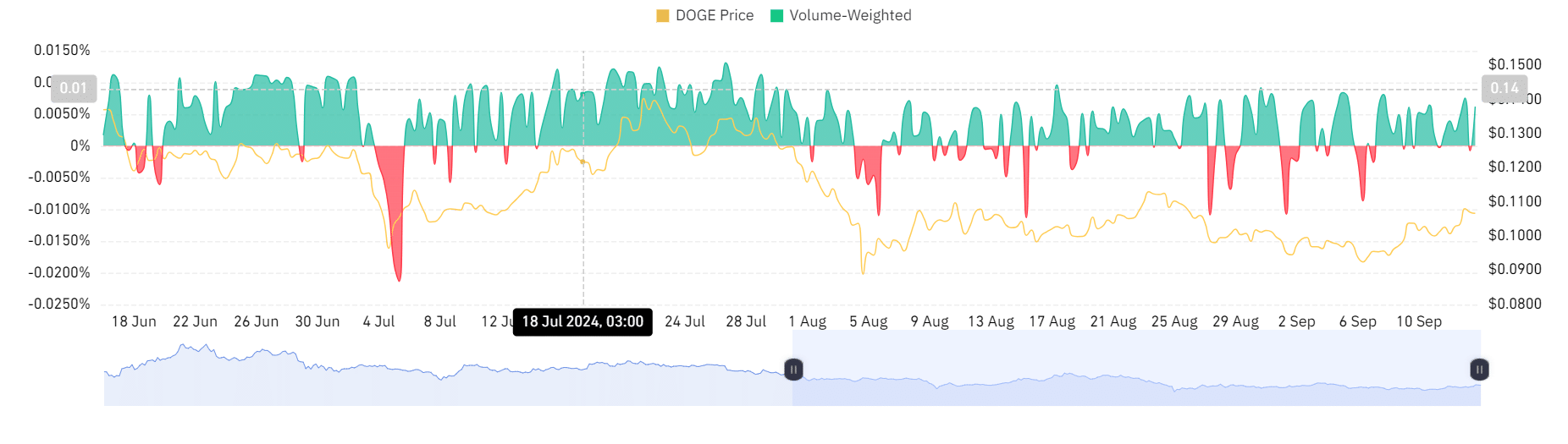

Consider this – At press time, Dogecoin’s funding rate aggregated by exchange was positive at 0.01, with the same remaining largely positive since 8 August.

A positive funding rate aggregated by exchange indicates long position holders pay shorts. This can be interpreted as a sign that the market is bullish as more traders are long than short. Such market behavior represents investor’s confidence and greater buying pressure.

Additionally, this phenomenon can be further supported by a positive OI-weighted funding rate. A positive OI-weighted funding rate means that the demand for long positions outweighs that of short positions. This is another bullish signal.

As DOGE is enjoying favorable market conditions right now, it may be set for further gains. Thus, if the memecoin sustains its momentum, it will hit at least $0.11 in the short term. In a bullish scenario, it can surge to $0.128 too.