- Smart money strategized on WIF’s dip to accumulate before the timing waned.

- However, this could also be a double-edged sword for WIF.

Dogwifhat [WIF] began September bearish, consolidating after an August rally to $2. At $1.553 now, it is on its third straight green candle, hinting at recovery. Optimism builds around the expected Fed rate cut, already pushing BTC past $60K.

Interestingly, when BTC hit its ATH in March, WIF surged above $4. Since then, both have declined, with WIF experiencing a sharper drop.

Analysts now suggest that this decline may have marked WIF’s bottom, with several key catalysts aligning for a potential breakout.

Smart money strategized on WIF dip

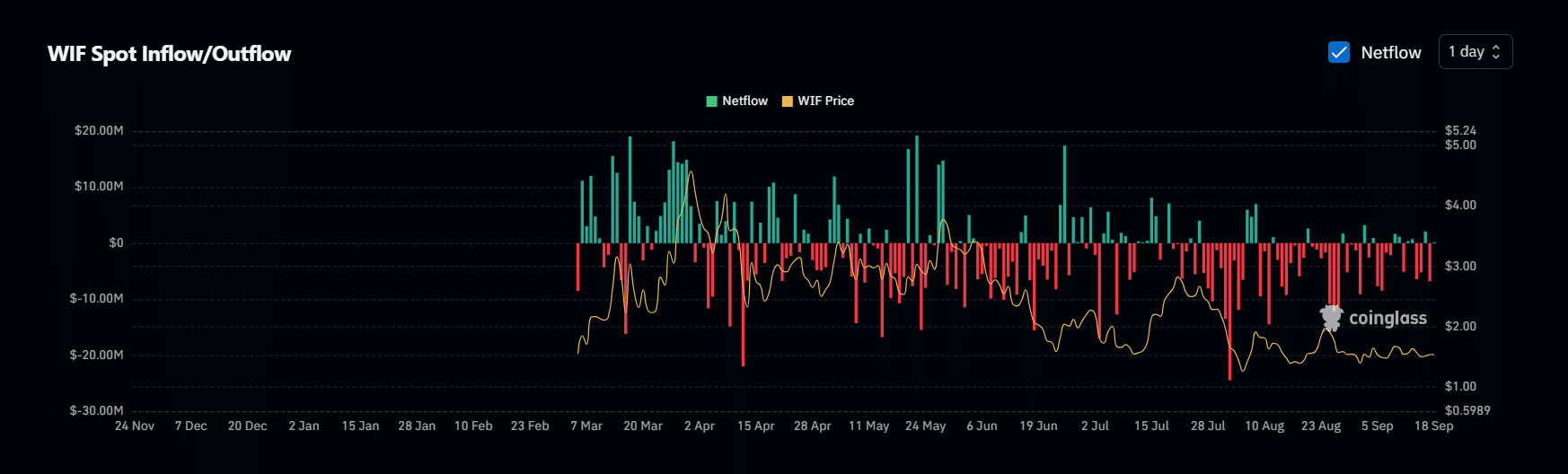

On the day WIF tested the $4 ceiling, it was followed by a spike in positive net flow, reaching up to $19M. This typically aligns with day-trading strategies, where stakeholders cash in on gains before momentum fades.

Surprisingly, despite the high outflows that followed, WIF continued its retracement, eventually dropping to $1.

According to AMBCrypto’s analysis, this anomaly may indicate a hidden pattern. While WIF’s price declined in tandem with Bitcoin’s downward swing, the high withdrawals suggest it was part of an accumulation phase, hinting at smart money positioning for a future rally.

In essence, savvy investors likely used WIF’s low to absorb selling pressure and prepare for the token’s eventual market peak.

With the market rebounding after a consolidation break, could this accumulation push WIF to $2 before it heads back to its original ATH?

Uneven distribution may curb the rally

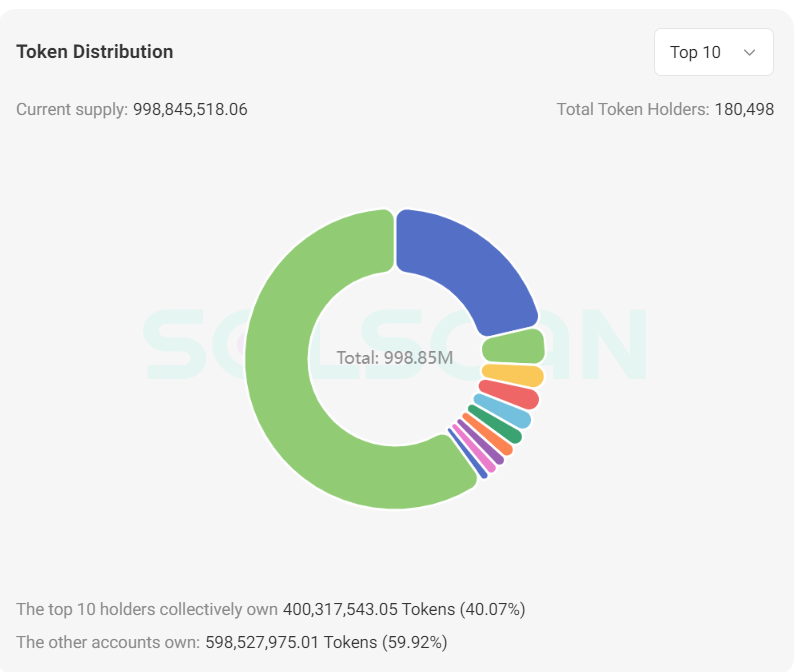

At a market cap of $1.5B, there are approximately 998M WIF in circulation. Data from SolScan indicated a concentrated distribution, with the top 10 holders owning over 40% of the supply.

Consequently, the uneven distribution could be a double-edged sword for WIF. It might stabilize the token during downturns but could also hinder a rally if major holders lose confidence.

However, since smart money targeted WIF’s bottom, they’re likely to stay optimistic about a rally, unless the memecoin tests the $2 ceiling, which may still be within reach.

A crucial road ahead

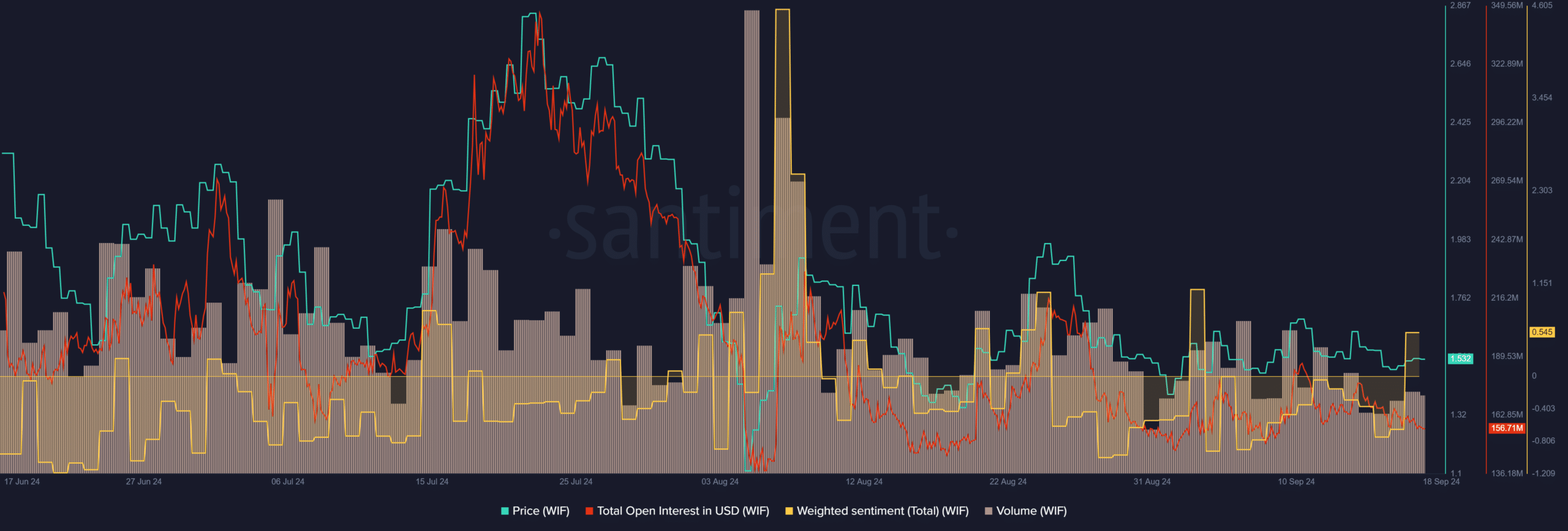

While accumulation prevented WIF from dropping below $1, it might not be enough to drive a full bullish surge, as evidenced by the chart below.

Compared to the mid-July rally, which saw key determinants push WIF above $2, current momentum falls short of that surge. OI in USD is at $156M, well below the $356M seen during the rally.

Realistic or not, here’s WIF’s market cap in BTC’s terms

However, the timing is significant. BTC’s bullish surge has turned sentiment for WIF positive, signaling growing community interest. A doubling in volume could further boost momentum.

Overall, the memecoin’s appeal is rising. If the trend holds and smart buyers remain confident, WIF could approach $2.