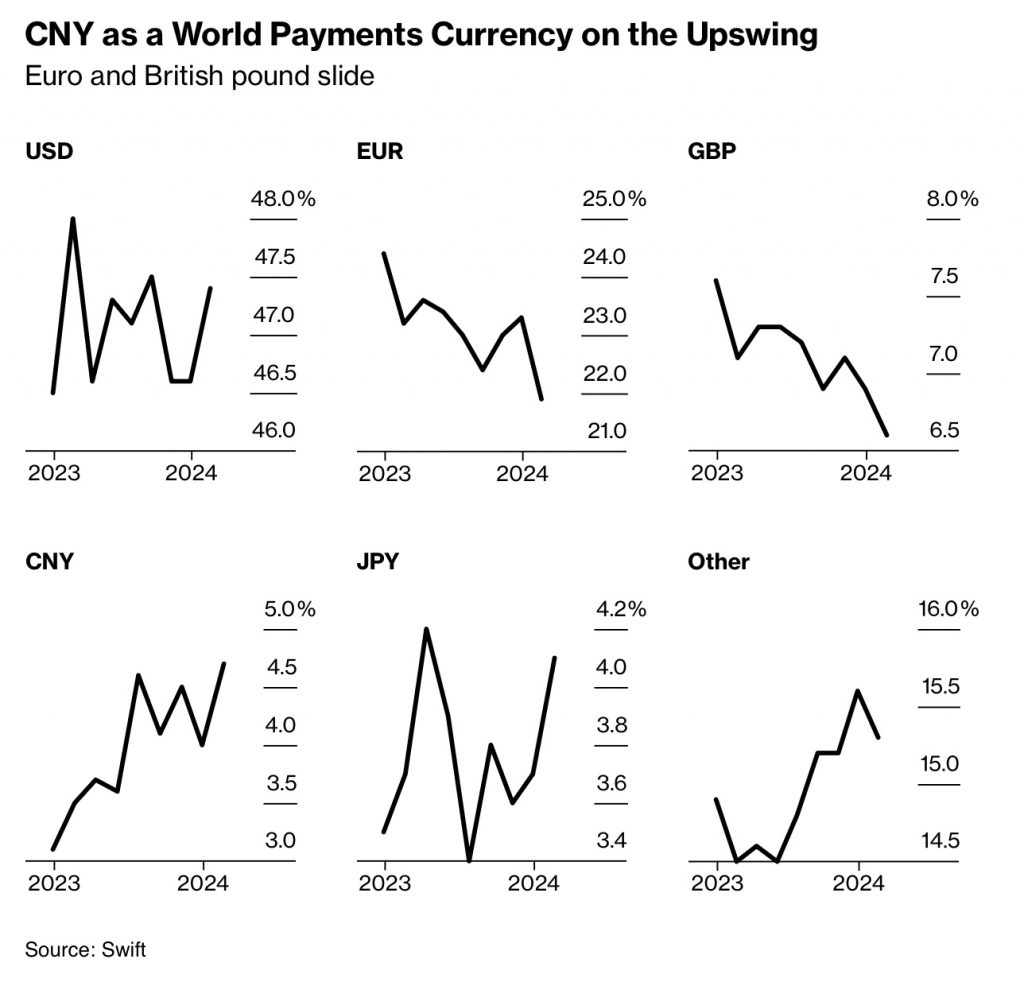

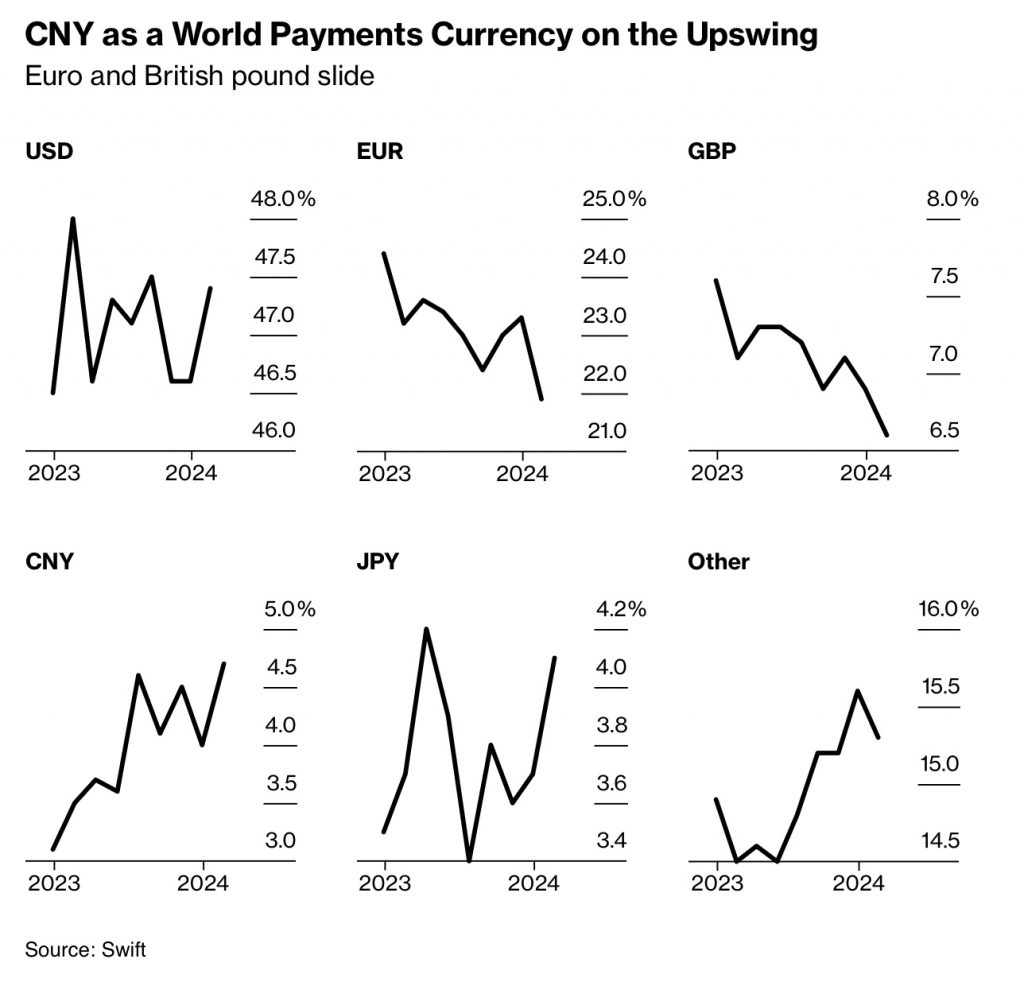

The United States dollar (USD) has been the world’s reserve currency for the longest time. Several governments have previously challenged the dollar. But the United States only grew stronger, forcing a number of nations to jointly roll out a currency to uphold de-dollarization.

Amidst this, China has been keeping at it, as the Chinese yuan is emerging as a prominent contender in the reserve currency race.

Also Read: Can ASEAN Countries Make The Chinese Yuan An International Currency?

The Rise Of The Chinese Yuan In The Global Economy

Earlier this month, data from Bloomberg revealed that in April 2024, the Chinese yuan did better than the Euro. According to the most recent statistics available from the payment messaging system SWIFT, the value of the Chinese yuan was close to 6% in April 2024.

Growth In Trade Payments

June saw a 13.37% growth in trade payments in the Chinese yuan. The asset was right behind the dollar. However, it should be noted that 88% of foreign currency transactions utilize dollars, while fewer than 7% use yuan.

Impact Of U.S. Sanctions On Russia

While the dollar remains strong, the Chinese yuan is gaining momentum. This is due to the increased sanctions the U.S. imposed on Russia in February 2022 following its invasion of Ukraine.

Also Read: Dogecoin Sister Token Rallies 17,348%: Can It Continue?

China’s Strategic Moves

China clearly capitalized on this circumstance to promote the Chinese yuan and the de-dollarization goal globally. Currently, the yuan is among the most used currencies in Russia.

Expert Insights

Speaking about the same topic, Maia Nikoladze, associate director at the Atlantic Council think tank’s GeoEconomics Center, said:

“Trading in yuan is convenient for both Russia and China. Russia does not have too many other currency alternatives, while China benefits from exerting more economic influence over Moscow, and also makes progress towards internationalizing the yuan.”

Also Read: Sui Bullish Breakout: Is $1.50 the Next Target?

Future Prospects

While it will take longer than expected for the Chinese yuan to dethrone the dollar, it seems to be moving at the right pace. In addition, the efforts of the BRICS nations could also bring down the dollar.