Celo recorded a remarkable price spike within an hour after Ethereum’s Vitalik Buterin gave the project a positive endorsement.

Notably, in a post this morning, Buterin highlighted how Celo’s work aligns with Ethereum’s mission to improve access to financial services globally.

His comment came in response to a previous report from Artemis, which confirmed last week that Celo (CELO) overtook Tron in stablecoin usage, specifically in daily active addresses.

This came after Tether announced plans to launch USDT on Celo six months back. Interestingly, the disclosure from Tether came after a similar announcement from Circle to introduce USDC on Celo in January.

Buterin’s latest support led to a spike in Celo’s price this morning, with a 19% surge within an hour pushing the token to a three-month high of $0.6552 before facing rejection. However, the hourly candle still closed with a 13% gain.

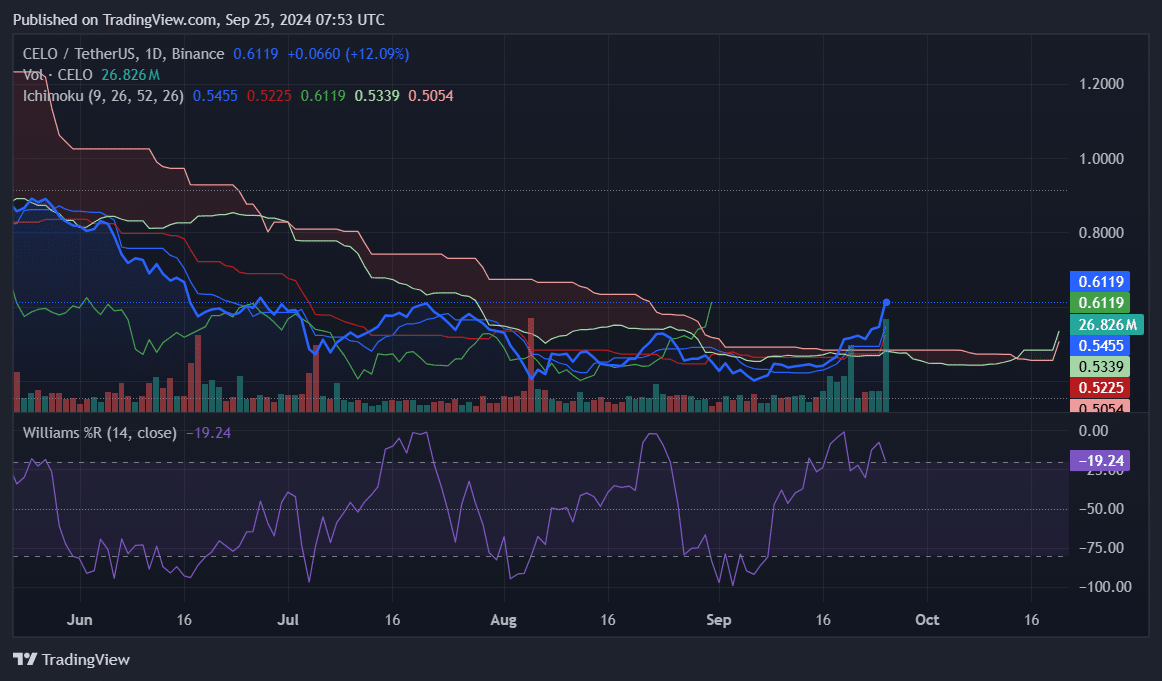

Celo is up 15% in the past 24 hours and is trading at $0.6119 at the time of writing. Its weekly gains currently stand at 34.45%, translating to a surge in market cap to $338.9 million. Celo’s daily trading volume has also skyrocketed by 511% to $99 million.

At the current position, Celo is trading above the Ichimoku Cloud, a classic signal of a bullish trend. In the Ichimoku Cloud, the conversion line (Tenkan-sen) stands at $0.5455, representing a key short-term support level.

Meanwhile, the baseline (Kijun-sen) has risen to $0.5225. The current price above these levels points to ongoing bullish momentum, especially as the lagging span A (Senkou Span A) at $0.5339 is also providing upward support.

However, the Williams % Range dropped to negative 19.24. While this confirms that the bulls have seized control, it suggests that the market is nearing overbought levels but has not quite reached an extreme.

Despite the bullish price action, the rejection from the $0.6552 high shows there is some selling pressure. The key levels to watch will be the support provided by the Ichimoku Cloud and the resistance around the recent peak.