- BNB made a bullish crossover after the 50-day MA moved above the 100-day MA.

- If BNB breaks above $600 with high buying volumes, it could ignite a rally to $700.

Binance Coin [BNB] has been tracking Bitcoin [BTC] over the past month. Like most altcoins, BNB has made a solid recovery, with its 30-day gains at 9%.

BNB traded at $595 at press time after facing rejection, yet again, above the $600 price level. As BNB gets ready for another leg up above this resistance, several bullish signs are lining up, hinting towards a strong uptrend.

BNB price outlook

BNB’s failure to break above $600 suggests that sellers are booking profits at this price.

However, the formation of a bullish crossover on the one-day chart after the 50-day Exponential Moving Average (EMA) crossed above the 100-day EMA indicates that a breakout could be possible.

This crossover usually suggests that the short-term momentum is gaining strength compared to the long-term momentum.

This move could attract buyers looking for a buy signal on BNB, which could consequently drive prices higher.

Buying activity is already being seen in the volume histogram bars, suggesting that buying volumes are higher than selling volumes.

Furthermore, the Chaikin Money Flow shows a reading of 0.30 indicating that buyers are active. The CMF has also made a strong move north, suggesting that the buying momentum is not weakening.

If these high buying volumes continue, BNB could be on the verge of a major rally that could see it break above the 100% Fibonacci level ($700).

These buying volumes are likely to come this week due to the release of former Binance CEO, Changpeng Zhao, from prison on the 29th of September.

Before this event, BNB might continue following the broader market’s movements. Choppy price moves could see support at the 0.786 Fib level ($585) retested.

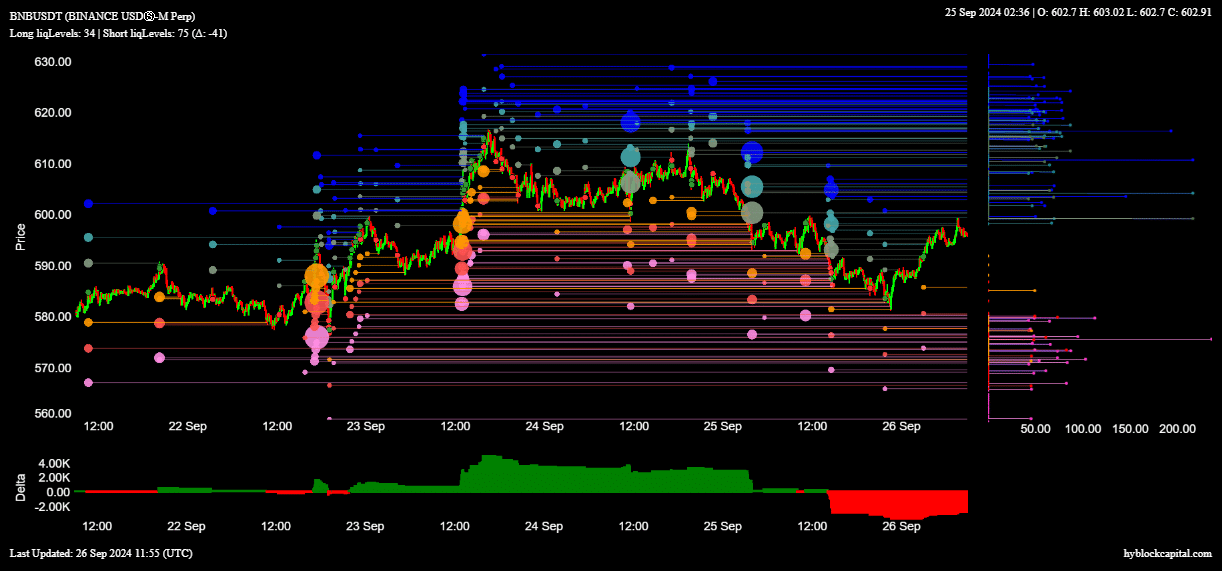

Liquidation data shows THIS

A look at the BNB liquidity heatmap on Hyblock Capital shows an influx of liquidation levels between $600 and $630.

If BNB price starts to rise and approaches these liquidation levels, it could cause a short squeeze where short traders are forced to close their positions by buying BNB. This situation could stir further gains.

These possible liquidations also show that $600-$630 is a strong resistance zone. Therefore, if BNB manages to break above these levels, it could signal a strong shift in market sentiment in favor of bulls.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

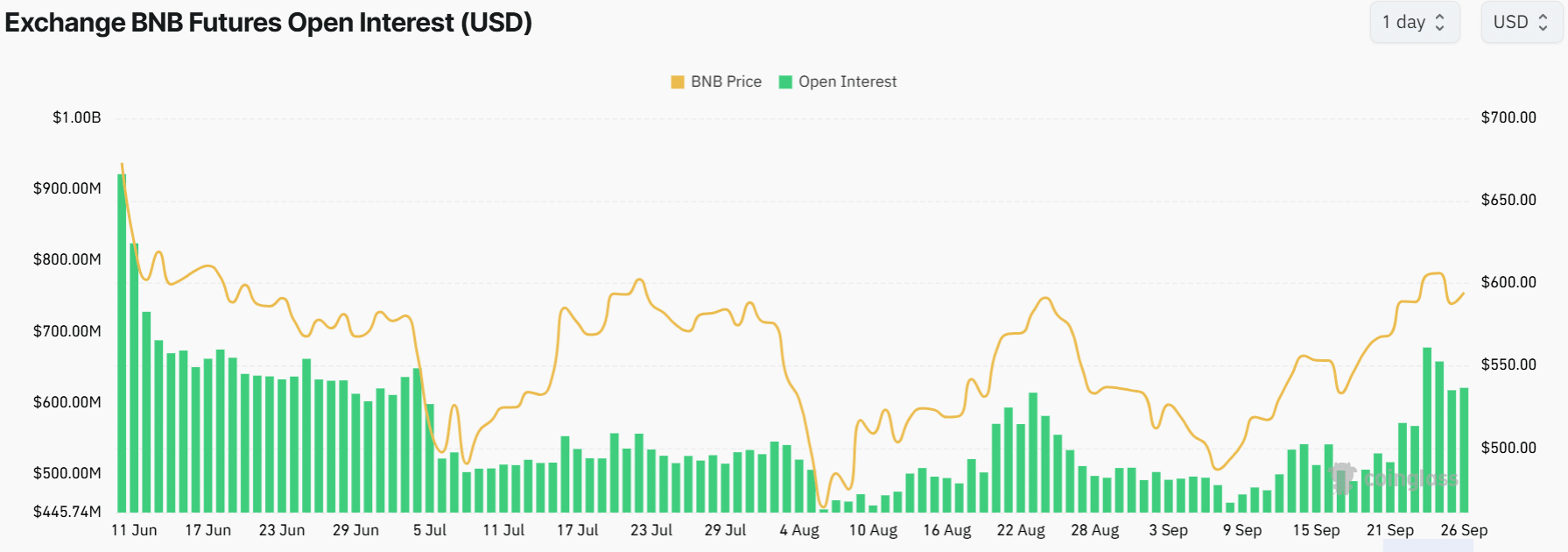

In the Futures market, BNB continued to attract interest, with Open Interest standing at $620M at press time per Coinglass.

However, this has dropped slightly after reaching a three-month high of $677M on the 24th of September.