- Ethereum struggles to stabilize at $3,000 due to weak institutional inflows.

- October expected to bring shift in sentiment, potentially boosting ETH price.

- Technical analysis suggests possible 23% rise to $3,258 if breakout occurs.

Ethereum (ETH) finds itself at a critical juncture as it grapples with the challenge of establishing a firm foothold around the $3,000 mark. The second-largest cryptocurrency by market capitalization has faced headwinds in the form of tepid institutional inflows and wavering investor confidence.

However, market observers anticipate a potential shift in sentiment and price action as October approaches, contingent upon increased institutional participation.

The lackluster performance of spot Ethereum ETFs has been a significant concern for the altcoin’s bullish outlook. Matt Mena, crypto research strategist at 21.co, attributes this weak inflow to various factors, highlighting the need for a change in institutional sentiment to drive ETH’s price momentum.

What can cause Ethereum to pump?

Alvin Kan, COO of Bitget Wallet, outlines several external factors that could propel ETH back to the $3,000 threshold. He emphasizes the importance of technical innovation, particularly in AI, payments, and restaking projects deployed on the Ethereum network.

Additionally, Kan points to potential improvements in macroeconomic liquidity, suggesting that a Federal Reserve rate cut could enhance ETH’s appeal as an income-generating asset.

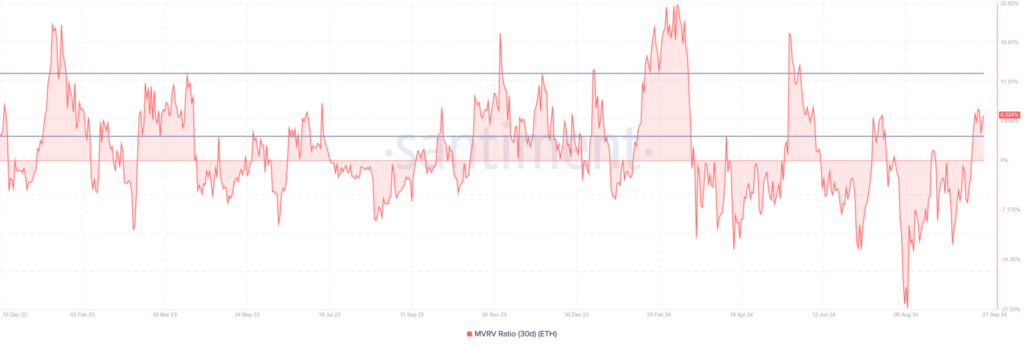

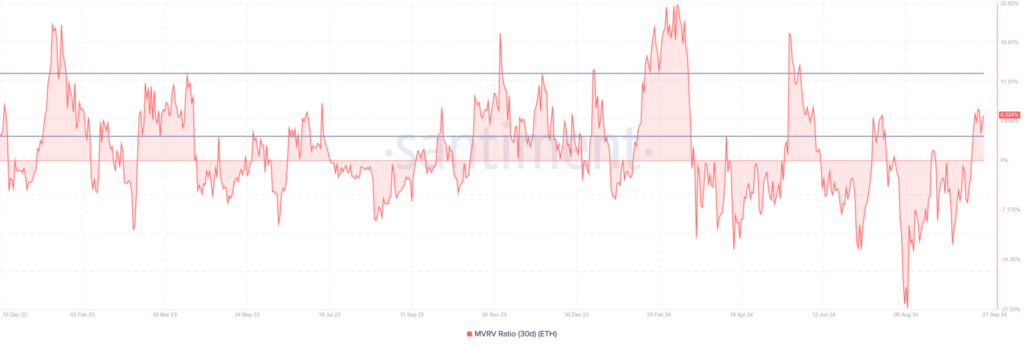

However, bearish signals are emerging from investor behavior. Ethereum’s 30-day Market Value to Realized Value (MVRV) Ratio currently sits at 6.5%, placing it in a precarious “danger zone.” This metric, which measures profits and losses, suggests that investors may be inclined to realize profits by selling their holdings, potentially triggering a correction.

From a technical perspective, Ethereum is on the verge of breaking out of a descending channel pattern that has constrained its price action for the past two months. A successful breakout could potentially catalyze a 23% surge, targeting the $3,258 level. However, this optimistic scenario heavily relies on improved institutional inflows and sustained bullish sentiment.