Key Points

- Most cryptocurrencies experienced a midweek rise, reversing an initial dip.

- Ethereum’s strength has been renewed, surpassing Bitcoin in gains, but faces potential pressure from increased issuance.

Following an initial dip at the start of the week, most cryptocurrencies experienced a midweek surge.

Ethereum (ETH), in particular, has demonstrated renewed strength over recent weeks.

Ethereum Outperforms Bitcoin

At the time of writing, Ethereum was trading at $2,689, with bulls aiming for a close above $2,770 – a level not seen since August 24. Ethereum has been outperforming Bitcoin in the latter half of this month, recording gains of 16.34% since September 15. Coinglass data revealed that Ethereum’s price rose by 11.26% last week, while Bitcoin only saw a 7.38% increase.

Despite its recent surge, Ethereum has seen a drop of 20.75% over the past three months. This decline is significant, especially given the anticipation of a rally following the July 23 launch of a U.S spot Ethereum exchange-traded fund (ETF).

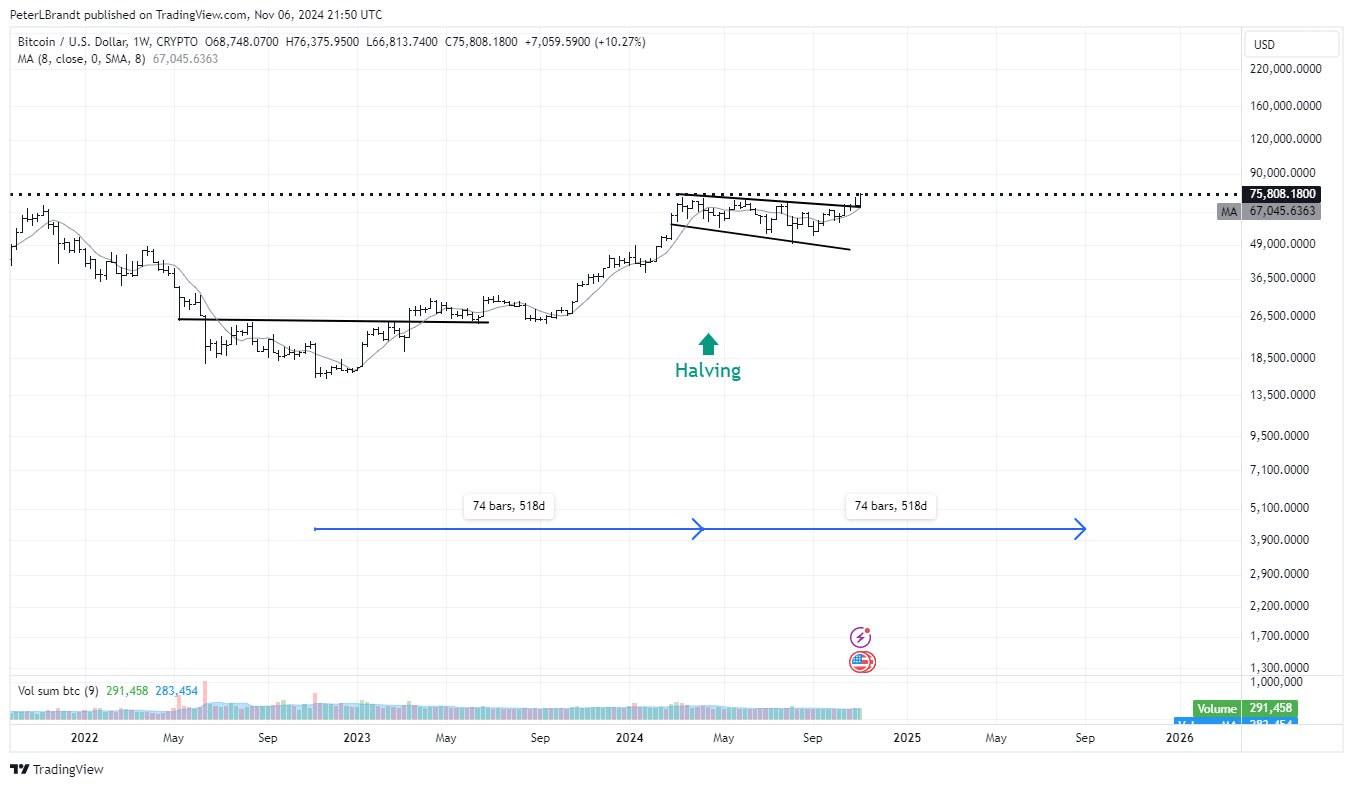

Bitcoin’s Potential Monthly Gains

Bitcoin’s price trajectory could result in double-digit monthly profits if it maintains a price above $65K. In contrast, Ether is projected for a 5.70% gain in September at its current price.

As the weekend approaches, speculators are focusing on the monthly closes for the respective cryptocurrencies. Bitcoin was trading near $66,000, with support established around $62,800. Ethereum, on the other hand, was holding steady above $2,600.

Analysts have set short-term price targets in the $68k to $70k range for Bitcoin and in the $2,760 to $2,820 range for Ethereum. However, a potential pullback could result in caution on long positions. A loss of momentum could allow bears to take control and drive prices down, as happened in July.

Bitcoin’s downside targets include a return below $62,000, with a potential drop as deep as $57,400. Ethereum, meanwhile, saw a rejection at $2,770 on August 24, pulling its price back to $2,430 three days later.

Ethereum’s potential for price growth is also facing pressure from increased Ether issuance, which could impact the spot movement. Data from Ultrasound Money revealed that a total of 54,098.4 ETH has been added to the supply over the last 30 days, which equates to a 0.547% annualized inflation rate.