- FTX Token (FTT) surged over 110% to reach a nine-month high, with trading volume skyrocketing by 3653%.

- Speculation about FTX’s repayment to its creditors is fueling the rise in FTT’s price.

FTX Token (FTT), linked to the bankrupt crypto exchange FTX, saw a dramatic surge on Sunday, gaining over 110% in just 24 hours. Alongside this price spike, trading volume also saw a jaw-dropping increase of 3653%, bringing FTT back to levels it hadn’t seen since January of this year.

According to data from TradingView, the price of FTT jumped from a low of $1.42 to a high of $2.99. This surge stood in stark contrast to the broader market, where major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) saw a modest decline of 1.67% over the same period. At the time of writing, FTT traded at $2.32 with a daily trading volume of $364 million.

The rally in the FTT Token is fueled by rumors that FTX might start repaying creditors on Monday. Further, tweets from prominent crypto influencers suggested that a $16 billion repayment process could begin this week. However, these claims have been flagged as misleading.

FTX Repayment Speculation vs. Official Confirmation

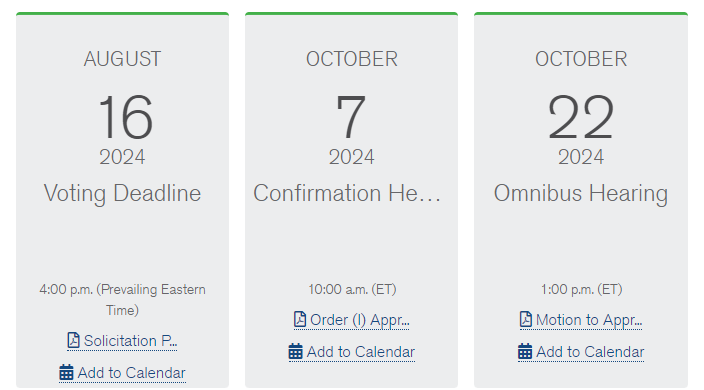

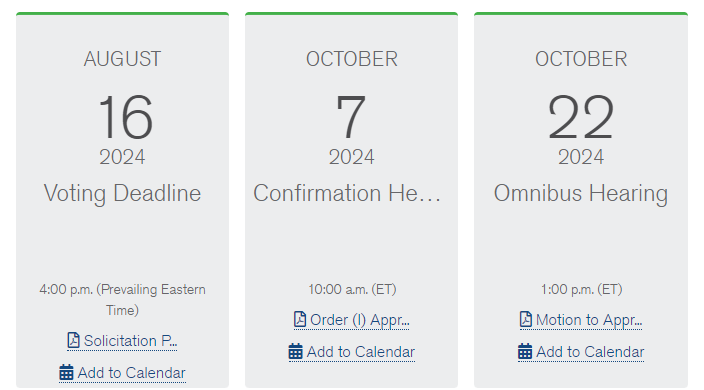

The reality is different. According to official updates, FTX’s repayment process has not started yet. A court hearing scheduled for October 7, 2024, will decide the approval of FTX’s Chapter 11 reorganization plan. If the court approves the plan, repayments for smaller claims (>$50K) may begin within 60 days, while larger claims would start in Q1 2025. But actual payments will follow additional hearings on October 22, November 20, and December 12, 2024.

Further, the newly revised bankruptcy documents indicate FTX creditors are expected to recover only 10–25% of their cryptocurrency holdings. FTX creditor and activist Sunil Kavuri pointed out that reimbursements will be based on the cryptocurrency value from the bankruptcy filing in November 2022, when prices were significantly lower than they are now.

FTX, once the largest crypto exchange, filed for bankruptcy in November 2022 following the exposure of a large-scale fraud led by its former CEO, Sam Bankman-Fried. This scandal sent shockwaves through the crypto community. Leaving thousands of creditors—both individuals and institutions—uncertain about the fate of their funds.

Though the speculation around repayment has fueled FTT’s sudden price surge, there is no official confirmation that the repayments have begun, and the entire process is still under judicial review.

Highlighted Crypto News Today:

Sui Price Rallies 111% in Bullish September Inching Closer to ATH